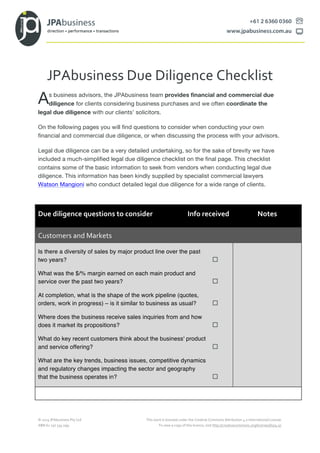

This document provides a due diligence checklist for clients considering purchasing a business. It includes questions to consider regarding customers and markets, inventory and suppliers, people and processes, contracts and agreements, and financial performance of the business. It also includes a simplified legal due diligence checklist of key information to obtain from vendors, such as corporate structure, licenses, contracts, assets, employees and any litigation. The purpose is to help buyers thoroughly evaluate all important aspects of a target business before acquiring it.