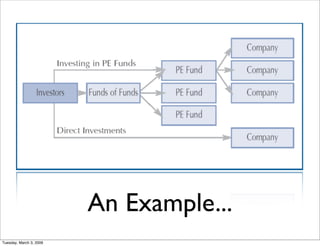

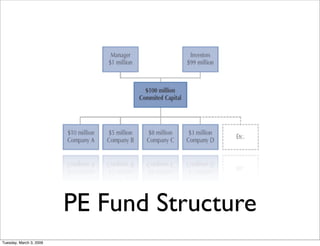

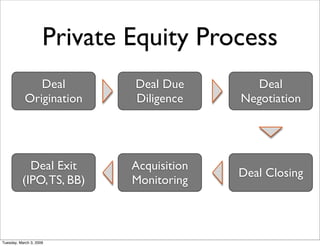

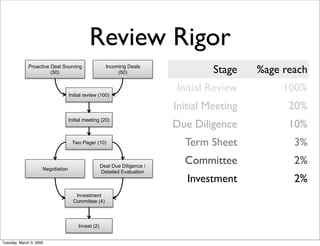

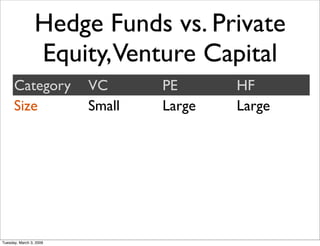

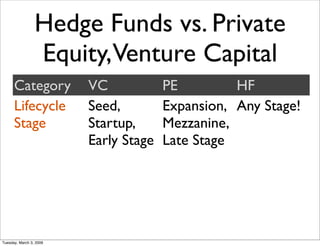

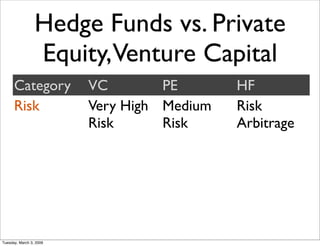

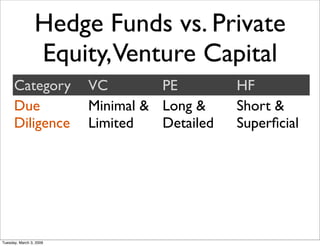

The document is a lecture on private equity presented by Jose Paul Martin. It provides an overview of private equity, including definitions of private equity and venture capital. It discusses private equity fund structures, the investment process, and how private equity creates value for companies. It also compares private equity to hedge funds and discusses how the current economic crisis is affecting private equity deals and fundraising.