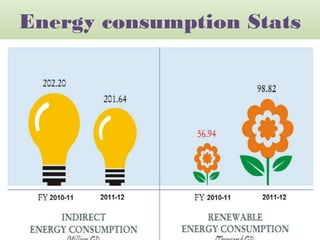

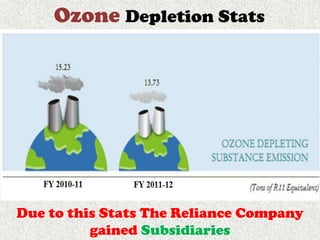

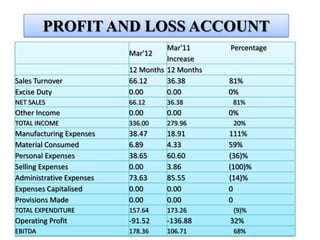

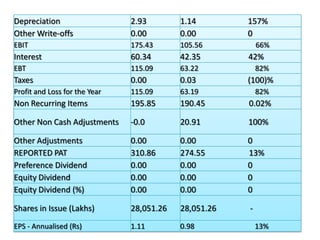

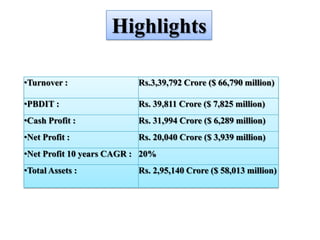

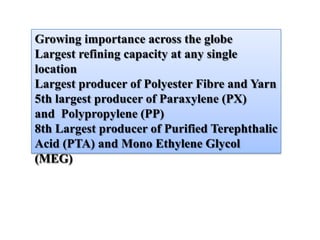

Reliance Industries Limited (RIL) is the largest polyester producer in the world and a major producer of polyester waste. To deal with this waste, RIL developed an effective recycling process that won an award. RIL has a diverse portfolio of petroleum, petrochemicals, and garment products. The company gained subsidiaries due to strong sustainability and environmental protection efforts like waste recycling, energy efficiency initiatives, and social responsibility programs. However, oil leakage issues led to some fines and a small profit ratio decline from recycling investments.