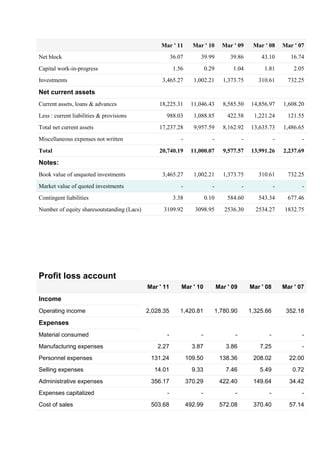

The document provides financial reporting data for a company over several quarters and fiscal years. It includes quarterly results summaries showing sales, operating profit, interest, gross profit and EPS. It also gives more detailed quarterly results breaking down other income, expenses and net profit. The balance sheet, cash flow statement and profit and loss account are presented for several fiscal years showing assets, liabilities, income, expenses and cash flows. Dividend details are also listed for each year.