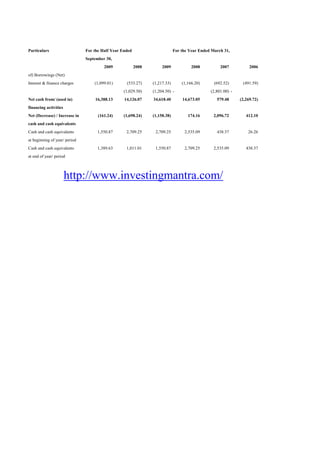

This document summarizes the assets, liabilities, equity, income and expenses of a company over several years:

- Total assets have increased substantially from Rs. 59,613 million in FY2008 to Rs. 1,15,331 million in the first half of FY2010, mainly due to increases in capital work in progress.

- Borrowings make up the majority of liabilities, growing from Rs. 38,275 million to Rs. 75,757 million over the same period.

- Net profit has increased from Rs. 1,359 million in the first half of FY2008 to Rs. 2,695 million in the first half of FY2010.

![CONSOLIDATED RESTATED STATEMENT OF ASSETS & LIABILITIES

(Rs. Million)

Particulars As at September 30, As at March 31,

2009 2008 2009 2008 2007 2006

Goodwill on Consolidation 171.19 171.12 171.82 172.08 171.36 0.03

Gross Block (at cost) 29,642.15 11,327.91 11,518.89 11,143.85 10,865.17 10,730.73

Less: Depreciation 5,821.97 5,042.97 5,349.19 4,742.10 4,152.19 3,567.04

23,820.18 6,284.94 6,169.70 6,401.75 6,712.98 7,163.69

Capital Work in Progress (including 79,874.31 48,786.82 79,189.89 27,419.79 2,728.78 116.13

capital advance)

1,03,694.49 55,071.76 85,359.59 33,821.54 9,441.76 7,279.82

1,994.72 218.44 1,704.73 207.32 3,675.07 3,454.91

Current Assets, Loans and

1,368.48 337.66 322.70 300.50 231.25 214.50

Sundry Debtors 3,474.37 1,247.53 1,409.43 693.00 3,899.23 4,675.03

Cash & bank balances 1,589.63 1,211.01 1,750.98 2,949.40 2,745.09 448.37

Loans and advances 3,038.65 1,355.95 1,957.70 1,091.81 1,034.69 249.42

9,471.13 4,152.15 5,440.81 5,034.71 7,910.26 5,587.32

Total Assets (A+B+C+D) 1,15,331.53 59,613.47 92,676.95 39,235.65 21,198.45 16,322.08

Liabilities & Provisions

Advance towards Share Capital - 94.20 - 90.00 - -

Minority Interest 152.18 0.18 152.19 800.13 800.29 0.25

75,756.85 38,275.36 59,265.85 22,720.90 6,045.10 4,383.10

Unsecured Loans 1,005.78 5.78 5.78 5.78 1,025.78 5.78

Deferred Tax Liability 953.95 748.14 814.49 685.02 559.24 442.93

Current Liabilities & Provisions

19,915.23 7,286.23 17,637.24 3,811.40 1,142.37 369.56

71.72 203.05 23.73 1,208.31 424.65 1,295.85

97,855.71 46,612.94 77,899.28 29,321.54 9,997.43 6,497.47

Net worth [(A+B+C+D) - E] 17,475.82 13,000.53 14,777.67 9,914.11 11,201.02 9,824.61

Represented by:

13,664.28 5,377.21 5,465.70 5,147.56 3,468.00 2,890.00

Reserves & Surplus 3,811.54 7,623.32 9,311.97 4,766.55 7,733.02 6,934.61

17,475.82 13,000.53 14,777.67 9,914.11 11,201.02 9,824.61](https://image.slidesharecdn.com/jswipo-091207080942-phpapp01/75/Jsw-Ipo-1-2048.jpg)