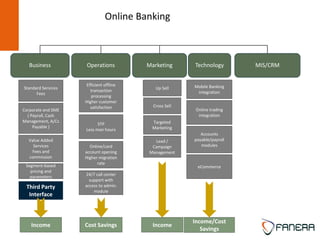

Fanera utilizes industry expertise and technology partnerships to offer practical solutions for optimizing banking channels and enhancing revenue. Their Channel Optimization & Revenue Enhancement program analyzes customer data to define priorities, implements solutions across technology, business, operations, marketing and MIS, and monitors results. The program aims to turn physical and electronic channels into profitable businesses by generating incremental fees, reducing costs through streamlined operations, and increasing cross-selling and up-selling through targeted marketing.