Oz Metals 20150111

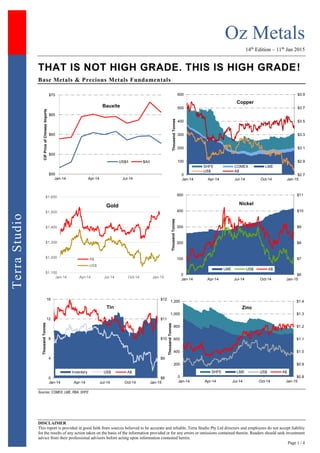

- 1. Oz Metals 14th Edition – 11th Jan 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 1 / 4 TerraStudio THAT IS NOT HIGH GRADE. THIS IS HIGH GRADE! Base Metals & Precious Metals Fundamentals Sources: COMEX, LME, RBA, SHFE $50 $55 $60 $65 $70 Jan-14 Apr-14 Jul-14 CIFPriceofChineseImports Bauxite US$/t $A/t $2.7 $2.9 $3.1 $3.3 $3.5 $3.7 $3.9 0 100 200 300 400 500 600 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 ThousandTonnes Copper SHFE COMEX LME US$ A$ $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Gold A$ US$ $6 $7 $8 $9 $10 $11 0 100 200 300 400 500 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 ThousandTonnes Nickel LME US$ A$ $8 $9 $10 $11 $12 0 4 8 12 16 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 ThousandTonnes Tin Inventory US$ A$ $0.8 $0.9 $1.0 $1.1 $1.2 $1.3 $1.4 0 200 400 600 800 1,000 1,200 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 ThousandTonnes Zinc SHFE LME US$ A$

- 2. Oz Metals 14th Edition – 11th Jan 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 2 / 4 TerraStudio Discoveries This is not a discovery sensu stricto, but still deserves to be mentioned. Beadell Resources reported exceptional drilling results from RC drilling at the Duckhead Main Lode beneath the current open pit limits. Gold results include: FVM514 28 m @ 267 g/t incl. 1 m @ 6,845 g/t FVM515 53 m @ 47 g/t incl. 1 m @ 1,219 g/t FVM511 16 m @ 58 g/t incl. 7 m @ 127 g/t FVM510 23 m @ 37 g/t incl. 4 m @ 198 g/t FVM508 14 m @ 26 g/t incl. 1 m @ 295 g/t Markets & Majors SNL - A new law took effect in China on Jan. 1, which is expected to lift environmental standards for domestic miners and speed up progress of a campaign to spread environmentally friendly mining practices across the country. The campaign was jointly launched by the National Development and Reform Commission and the Ministry of Land and Resources in 2009. Among its provisions, the new environmental protection law introduces, for the first time in China, a national standard for the discharge of industrial pollutants from mining and processing operations. This is expected to help crack down on illegal discharge of pollutants in the country. Analysts also argue that in the longer term, the new law will also serve to accelerate the country's efforts to make its environmentally damaging mining industry more "green." Green — or environmental friendly — mining, as defined by the Ministry of Land and Resources, requires producers to apply advanced technology to reduce pollution during the mining process, undertake land reclamation after a mine's life ends and expand afforested areas to cover 80% of the mining and producing area, according to a guideline issued in 2010. Metal Bulletin - The supply of scrap copper in China will remain tight in 2015 "because the peak obsolescence time of developed countries has ended and global supply of copper scrap has been declining in recent years," said China Metal Recycling Association Vice Secretary General Zhang Xizhong. Thomson Reuters - China has introduced a new export tax rebate for some copper products and increased the export rebate for another, according to a statement from the Ministry of Finance, in a move expected to increase copper product shipments by as much as tenfold. Jiangxi Copper, China's top integrated copper producer and its biggest maker of copper rods with one million tonnes of capacity a year, said it would take advantage of the new tax rebate if domestic prices were lower than the international market. Wu Yuneng, vice president of Jiangxi Copper, also said the new rebate would drive up domestic demand for refined copper to make the products, with China's refined copper consumption rising at least 6% in 2015 from last year. The Ministry of Finance said China has put in place an export tax rebate of 9% for copper bars, rods and profiles at the beginning of 2015, while increasing the export tax rebate for copper foils to 17% from 13%. Thomson Reuters - China canceled its export quotas on rare earth metals following a World Trade Organization ruling in March 2014 that the policy broke its rules. Under the latest commodities export guideline issued by the Ministry of Commerce on Dec. 31, 2014, export permits for rare earth metals would be granted based on trade contracts. China has scrapped a quota system aimed at restricting exports of rare earths, a group of 17 metals used in high tech sectors, as it moves to comply with a World Trade Organisation ruling last year. The Ministry of Commerce issued a notice at the end of December that abolished export quotas for rare earth, as well as tungsten, molybdenum and fluorspar. Export permits for rare earth metals would now be granted based on trade contracts instead of authorities' approval starting Jan.1. China is responsible for more than 90% of global rare earth production, giving it a chokehold over the supply of a group of elements used in sectors such as defense and renewable energy. It raised tariffs and imposed strict quotas in 2010, saying that cheap prices on the global market were not enough to cover the huge environmental costs of production, but importers in Japan, Europe and the United States complained that the move breached trade rules. Thomson Reuters - Brazil's government plans to rework parts of the country's new mining code currently stalled in Congress, the new Mines and Energy Minister Eduardo Braga said on Thursday. "All this delay in voting the bill gives us more time to rework some parts of the mining code in light of the new international background," Braga told reporters before the presidential inauguration without giving any details. Mining is a vital part of Brazil's economy, accounting for about a third of exports. In recent years, Brazil's giant miner Vale and foreign peers have struggled with falling iron ore prices as China's economy slows down. The saga over the new mining code, a flagship policy of President Dilma Rousseff first announced in 2009, has meant miners have had projects delayed, others have rushed to lock in current terms, and some have avoided the country altogether. Thomson Reuters - CME Group planned Asian gold kilo bar contract will begin trading in Hong Kong on Jan. 26, a new entrant in the regional race to provide a price benchmark. Bourses in Singapore and top consumer China also recently launched gold contracts in a bid to establish a price reference in the top consuming region and better reflect Asian demand. CME's U.S. COMEX contract - the most liquid gold contract - already sets the benchmark for bullion futures globally. "As demand for gold grows rapidly in China and the Far East markets, and physical bullion moves eastward, the world increasingly looks at market conditions and price signals in the biggest bullion trading hub in the region, Hong Kong," said CME's executive director of precious metals. The 1 kg physically settled Asian contract will complement the benchmark 100-ounce COMEX contract, and help meet hedging demand. Codelco copper production increased by 8% in 2014 from the prior year, but its pre-tax profit fell. Output for state-owned Codelco in 2014 was 1.78 million tonnes. Pre-tax profit for 2014 was more than $3 billion, a decline of $760 million from the 2013 level. Codelco is battling falling ore grades at its decades-old flagship mines as well as high energy costs. CuDeco Ltd. is seeking a second listing on the main board of the Hong Kong Stock Exchange. The dual listing will allow the

- 3. Oz Metals 14th Edition – 11th Jan 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 3 / 4 TerraStudio company to pursue future opportunities in Australia and elsewhere as it moves to become a major mining house. North West Star - Glencore is reviewing the potential of an open cut copper pit within its Mount Isa operations in Queensland, Australia, if the copper smelter receives a four- year extension. Minister for Environment and Heritage Protection Andrew Powell has said he expects a development proposal from the company "shortly." Metal Bulletin - The supply of lead in the spot market will tighten this year as producers sold more on long-term contracts and given the continued threat of battery scrap tightness on secondary supply. Transactions, Mergers & Acquisitions Azure Minerals signed a binding agreement with Teck Resources under which Azure can acquire full ownership of the Alacrán copper project in Mexico's Sonora state. Benagerie Gold Pty Ltd a wholly owned subsidiary of Havilah Resources has executed a mining contract with Consolidated Mining & Civil Pty Ltd for the Portia gold project in South Australia. Under the agreement, revenue will be shared on a 50/50 basis for all gravity-recoverable gold mined from the Portia deposit. Timpetra Resources has sold off its entire shareholding in fellow ASX-listed company Saracen Mineral Holdings for A$16.1 million. Timpetra sold 80% of its shareholding, or 28,322,027 shares, in late July 2014 for about A$13.5 million. The company originally acquired its 5% interest in Saracen for roughly A$6.5 million. Bauxite Sector Source: Bloomberg, SNL Lithium-Tantalum Sector Source: SNL Copper Producers Source: SNL Copper Developers & Explorers Source: SNL Nickel Sector Source: SNL Tin Sector Source: SNL Zinc & Poly-metallic Sector Source: SNL Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ABX Australian Bauxite 0.285 ▼ (2%) (7%) 36 2 35 BAU Bauxite Resources 0.098 ▲ 3% 0% 23 31 (8) MLM Metallica Minerals 0.060 ▲ 9% 9% 10 1 9 MMI Metro Mining 0.027 — 0% 0% 8 8 1 QBL Queensland Bauxite 0.020 ▼ (9%) (5%) 10 4 6 Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AJM Altura Mining 0.056 ▼ (7%) (14%) 26 3 41 GXY Galaxy Resources 0.028 ▲ 8% 12% 30 3 97 ORE Orocobre 2.90 ▲ 9% 4% 383 26 358 PLS Pilbara Minerals Ltd. 0.047 ▲ 7% 12% 29 3 26 RDR Reed Resources 0.033 ▼ (8%) (13%) 16 7 11 Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA ABY Aditya Birla Minerals 0.20 ▲ 3% 3% 63 137 (42) NA AOH Altona Mining 0.24 — 0% (2%) 126 18 111 3.1x HGO Hillgrove Resources 0.43 ▼ (3%) (4%) 64 16 78 1.9x KBL KBL Mining 0.029 ▼ (12%) (3%) 11 7 27 1.7x MWE Mawson West 0.051 — 0% 0% 11 54 39 NM OZL OZ Minerals 3.71 ▲ 5% 7% 1,126 364 971 5.3x PNA PanAust 1.43 ▼ (1%) 1% 907 146 1,140 NA SFR Sandfire Resources 4.65 — 0% 2% 725 58 828 3.8x SRQ Straits Resources 0.004 ▼ (20%) (20%) 5 13 128 17.3x TGS Tiger Resources 0.16 — 0% 19% 177 42 316 NA 985 CST Mining 0.007 — 0% 2% 192 146 20 0.3x 1208 MMG 0.40 ▲ 2% 5% 2,099 154 4,135 4.3x 3993 China Molybdenum 0.78 ▲ 7% 10% 8,357 347 8,999 NA Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ARE Argonaut Resources 0.014 ▼ (13%) (13%) 6 2 3 AVB Avanco Resources 0.079 ▲ 5% 4% 131 32 99 AVI Avalon Minerals 0.029 ▲ 38% 45% 4 1 4 AZS Azure Minerals 0.018 ▼ (25%) (25%) 15 1 14 CDU CuDeco 1.65 ▼ (15%) (15%) 401 9 392 CVV Caravel Minerals 0.009 ▲ 13% 13% 7 1 6 ENR Encounter Resources 0.13 — 0% 0% 17 4 14 ERM Emmerson Resources 0.029 ▼ (6%) (6%) 11 2 9 FND Finders Resources 0.15 ▼ (3%) (3%) 96 8 80 GCR Golden Cross Resources 0.075 — 0% 7% 7 2 5 GPR Geopacific Resources 0.060 ▲ 15% 15% 20 3 20 HAV Havilah Resources 0.145 ▲ 4% 4% 23 1 21 HCH Hot Chili 0.17 ▲ 3% 3% 57 13 55 HMX Hammer Metals 0.081 — 0% (1%) 7 1 6 IAU Intrepid Mines 0.15 ▲ 7% 7% 54 11 (90) IRN Indophil Resources 0.30 — 0% 0% 355 215 146 KDR Kidman Resources 0.063 ▼ (9%) (6%) 8 3 5 KGL KGL Resources 0.19 ▼ (12%) (18%) 26 7 12 MEP Minotaur Exploration 0.14 — 0% (3%) 25 5 21 MNC Metminco 0.008 — 0% 0% 15 8 11 MTH Mithril Resources 0.006 — 0% (14%) 3 2 1 PEX Peel Mining 0.070 ▲ 6% 1% 9 3 6 RDM Red Metal 0.08 ▼ (2%) (1%) 14 2 12 RER Regal Resources 0.040 ▼ (13%) (13%) 8 2 4 RXM Rex Minerals 0.13 ▲ 19% 14% 28 3 25 SMD Syndicated Metals 0.029 ▼ (9%) (9%) 8 2 6 SRI Sipa Resources 0.038 ▲ 3% 3% 23 4 19 SUH Southern Hemisphere 0.043 — 0% 0% 11 2 8 THX Thundelarra Resources 0.125 ▲ 19% 14% 40 7 33 XAM Xanadu Mines 0.125 ▲ 25% 25% 45 4 46 Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA IGO Independence Group 4.60 ▲ 3% 4% 1,078 57 1,049 7.5x MBN Mirabella Nickel 0.029 — 0% 0% 27 34 64 NA MCR Mincor Resources 0.58 ▼ (2%) (2%) 108 26 86 2.8x PAN Panoramic Resources 0.40 ▼ (8%) (5%) 129 64 73 1.5x WSA Western Areas 4.20 ▲ 9% 12% 977 231 964 6.7x AVQ Axiom Mining 0.015 ▼ (6%) 0% 50 2 48 NM CAV Carnavale Resources 0.012 ▼ (14%) (29%) 2 3 (1) NA CZI Cassini Resources 0.15 ▲ 26% 21% 17 8 9 NM LEG Legend Mining 0.007 — 0% 0% 14 5 10 NA MAT Matsa Resources 0.180 ▲ 6% 6% 26 3 23 NM MLM Metallica Minerals 0.060 ▲ 9% 9% 10 1 9 NM PIO Pioneer Resources 0.016 ▲ 23% 23% 10 1 8 NM POS Poseidon Nickel 0.12 — 0% 0% 82 4 112 NM SEG Segue Resources 0.005 — 0% 0% 10 1 9 NM SGQ St George Mining 0.070 — 0% 11% 8 1 7 NA SIR Sirius Resources 2.71 ▲ 5% 6% 925 59 867 NM TLM Talisman Mining 0.16 ▲ 3% 3% 21 16 5 NM WIN Winward Resources 0.16 ▼ (3%) (3%) 14 6 8 NM Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) CSD Consolidated Tin Mines 0.043 ▲ 5% 5% 12 0 13 ELT Elementos 0.010 — 0% 25% 8 1 7 KAS Kasbah Resources Limited 0.050 ▼ (15%) (7%) 23 4 17 MLX Metals X Limited 0.84 ▼ (1%) 7% 348 57 291 MOO Monto Minerals 0.003 ▲ 50% 50% 4 1 3 SRZ Stellar Resources Limited 0.024 ▼ (14%) (17%) 7 4 3 VMS Venture Minerals Limited 0.039 ▲ 26% 26% 11 7 5 Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AQR Aeon Metals 0.086 ▼ (14%) (14%) 26 5 33 DGR DGR Global 0.033 ▼ (3%) 3% 14 0 14 HRR Heron Resources 0.13 — 0% 0% 45 33 14 IBG Ironbark Zinc 0.087 — 0% 9% 38 2 36 IPT Impact Minerals 0.026 ▲ 24% 8% 15 1 14 IVR Investigator Resources 0.019 ▲ 12% 19% 9 3 6 MRP MacPhersons Resources 0.115 ▲ 5% (8%) 36 7 29 MTA Metals of Africa 0.05 ▼ (2%) (2%) 7 8 (1) RDM Red Metal 0.08 ▼ (2%) (1%) 14 8 6 RVR Red River Resources 0.16 ▲ 19% 41% 27 9 18 RXL Rox Resources 0.029 ▼ (3%) 4% 25 3 22 TZN Terramin Australia 0.140 ▲ 27% 27% 197 5 246 VXR Venturex Resources 0.005 — 0% 0% 8 1 7

- 4. Oz Metals 14th Edition – 11th Jan 2015 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 4 / 4 TerraStudio Gold Producers Source: SNL Gold Developers & Explorers Source: SNL For further information, please contact: J-François Bertincourt m +61 406 998 779 jf@terrastudio.biz Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA AGD Austral Gold 0.10 ▼ (23%) (23%) 48 NA 113 8.8x ALK Alkane Resources 0.21 ▼ (9%) (5%) 87 16 71 10.6x AMI Aurelia Metals 0.25 — 0% 4% 86 22 171 NM BDR Beadell Resources 0.29 ▲ 14% 29% 232 10 294 NA DRM Doray Minerals 0.53 ▲ 10% 10% 89 16 88 2.7x EVN Evolution Mining 0.80 ▲ 22% 24% 572 32 702 3.4x IGO Independence Group 4.60 ▲ 3% 4% 1,078 57 1,049 7.5x KCN Kingsgate Consolidated 0.75 ▲ 10% 14% 168 54 268 NM KRM Kingsrose Mining 0.30 ▲ 15% 18% 108 7 113 NM LSA Lachlan Star 0.025 ▲ 14% 25% 4 2 22 NA MIZ Minera Gold 0.003 — 0% 0% 8 0 13 NM MLX Metals X 0.84 ▼ (1%) 7% 348 57 291 4.1x MML Medusa Mining 0.80 ▲ 12% 22% 165 14 161 2.7x MOY Millennium Minerals 0.039 ▲ 5% 5% 8 2 47 NA NCM Newcrest Mining 12.18 ▲ 11% 12% 9,336 141 13,397 NM NGF Norton Gold Fields 0.14 ▲ 8% 12% 130 38 231 NA NST Northern Star Resources 1.70 ▲ 13% 14% 1,007 82 930 11.1x OGC OceanaGold Corp. 2.48 ▲ 13% 19% 747 28 876 4.6x PGI PanTerra Gold 0.017 — 0% (6%) 14 6 86 NA PRU Perseus Mining 0.29 ▲ 12% 10% 150 37 114 4.9x RMS Ramelius Resources 0.077 ▲ 45% 51% 36 12 26 NM RRL Regis Resources 2.14 ▲ 10% 11% 1,070 7 1,103 NM RSG Resolute Mining 0.33 ▲ 20% 23% 208 19 240 2.3x SAR Saracen Mineral Holdings 0.31 ▲ 19% 22% 246 36 224 5.4x SBM St Barbara 0.14 ▲ 23% 29% 67 79 327 NM SLR Silver Lake Resources 0.24 ▲ 23% 23% 121 24 110 NM TBR Tribune Resources 2.94 ▲ 9% 11% 147 11 162 9.4x TRY Troy Resources 0.55 ▲ 15% 20% 107 43 104 NM UML Unity Mining 0.008 ▲ 14% 14% 9 7 3 NM Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ABU ABM Resources 0.32 ▲ 9% 9% 86 10 76 AWV Anova Metals 0.035 ▲ 30% 30% 9 1 7 AZM Azumah Resources 0.026 ▲ 30% 30% 10 4 8 BLK Blackham Resources 0.075 ▲ 44% 47% 11 1 10 BOK Black Oak Minerals 0.28 ▲ 6% 4% 12 3 15 BSR Bassari Resources 0.014 ▲ 8% 17% 17 - 16 CHN Chalice Gold Mines 0.11 — 0% 0% 30 44 (15) CHZ Chesser Resources 0.03 ▼ (11%) (11%) 7 1 8 DCN Dacian Gold 0.31 ▲ 11% 11% 22 11 11 EXC Exterra Resources 0.013 — 0% 0% 2 1 2 EXG Excelsior Gold 0.063 ▲ 3% 3% 29 1 28 FML Focus Minerals 0.008 ▲ 14% 14% 73 81 73 GCY Gascoyne Resources 0.07 — 0% 0% 12 1 11 GMR Golden Rim Resources 0.006 — 0% 20% 8 1 9 GOR Gold Road Resources 0.28 ▲ 10% 12% 164 10 154 GRY Gryphon Minerals 0.073 ▲ 9% 14% 29 34 (6) IDC Indochine Mining 0.011 ▼ (15%) (8%) 14 0 16 KGD Kula Gold 0.038 ▼ (14%) (14%) 10 3 10 MSR Manas Resources 0.015 ▲ 7% 7% 7 6 5 MUX Mungana Goldmines 0.12 ▼ (4%) (4%) 29 5 24 MYG Mutiny Gold 0.053 ▲ 15% 20% 36 3 33 OBS Orbis Gold 0.58 — 0% 4% 145 5 140 OGX Orinoco Gold 0.062 ▲ 5% 5% 9 1 10 PNR Pacific Niugini 0.056 ▲ 8% 12% 18 3 15 PXG Phoenix Gold 0.100 ▲ 1% 2% 37 9 28 RED Red 5 0.105 ▲ 14% 14% 80 38 41 RNI Resource & Investment 0.075 ▲ 4% 0% 36 5 51 RNS Renaissance Minerals 0.065 — 0% 0% 26 2 24 SIH Sihayo Gold 0.010 ▲ 25% 25% 11 0 8 TAM Tanami Gold 0.014 — 0% 0% 16 1 23 WAF West African Resources 0.082 ▼ (18%) (18%) 22 3 21 WPG WPG Resources 0.043 ▲ 13% 13% 11 5 6