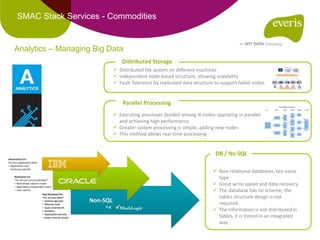

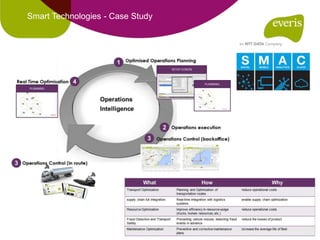

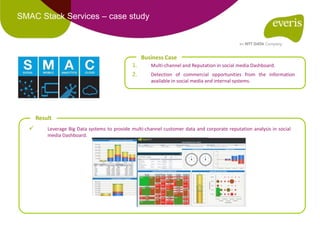

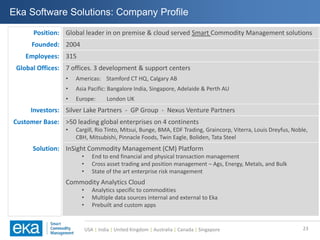

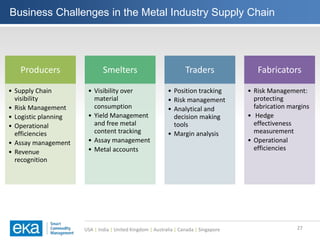

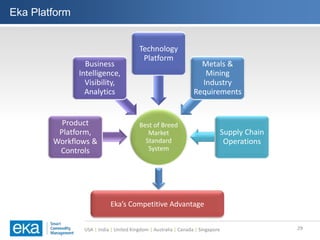

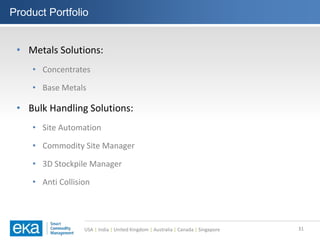

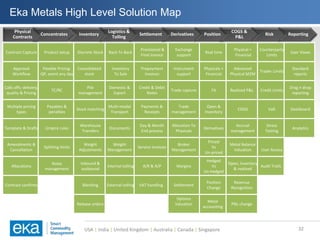

The document discusses the challenges faced in the metals and mining industry, including price volatility, regulatory pressures, and resource allocation. It highlights how technology, particularly through the SMAC (Social, Mobile, Analytics, Cloud) stack, can be utilized to improve commodity management and address these challenges. Additionally, it introduces the eka software solutions designed to enhance supply chain visibility and optimize trading and risk management processes in this sector.

![11

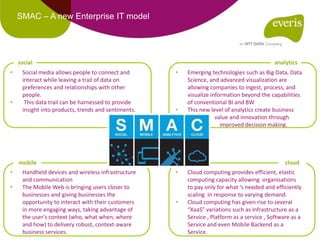

• IT spend on SMAC technologies expected to reach $360bn by 2016 [Gartner]

• The SMAC Stack is driving customer engagement, innovation and business productivity

SMAC Stack – Driving business productivity](https://image.slidesharecdn.com/webinarmetalsminingslideshare-150902182718-lva1-app6891/85/Overcoming-the-Commodity-Management-Challenges-in-Metals-Mining-11-320.jpg)