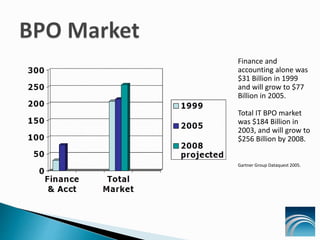

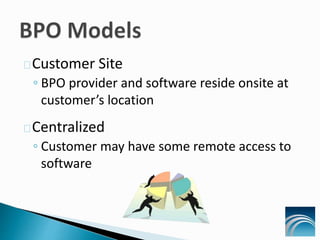

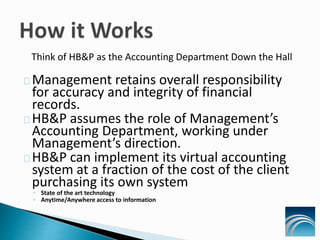

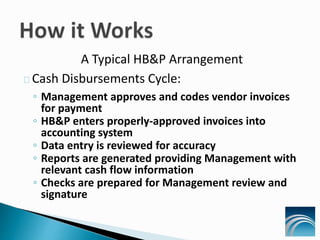

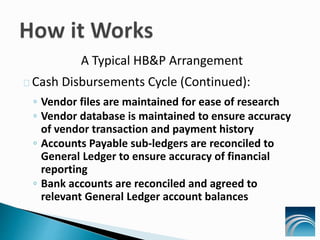

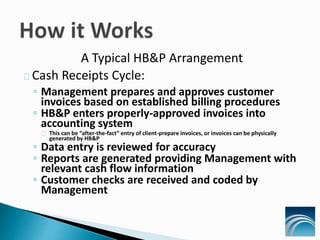

The document discusses traditional outsourcing and business process outsourcing (BPO), highlighting how BPO reengineers processes using technology to improve efficiency and lower costs. It emphasizes the growing trend of outsourcing in various non-core functions, supported by data indicating significant market growth and a correlation with shareholder value. The narrative illustrates specific operational cycles and benefits of utilizing BPO, such as access to expert resources and enhanced internal controls while retaining management responsibility for financial accuracy.