1. The document discusses using complex option strategies to mitigate the convexity risk in mortgage portfolios from potential interest rate declines following the upcoming Federal Reserve meeting.

2. It proposes a combination of put spreads, call spreads, and leveraged option packages with varying expirations in September and October to restore performance if rates fall and deflect the impacts of theta and vega decay as well as the expected post-Fed decline in implied volatility.

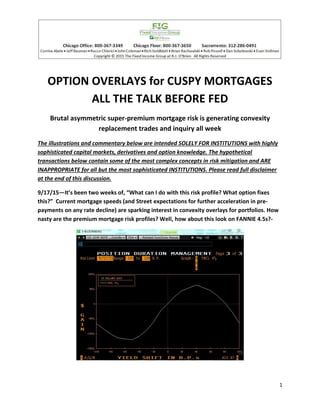

3. One example strategy discussed uses a combination of ATM and OTM 10-year Treasury options to target carrying the position for one week while hedging the implied volatility beat-down, with the goal of producing a "risk neutral" profit/loss graph