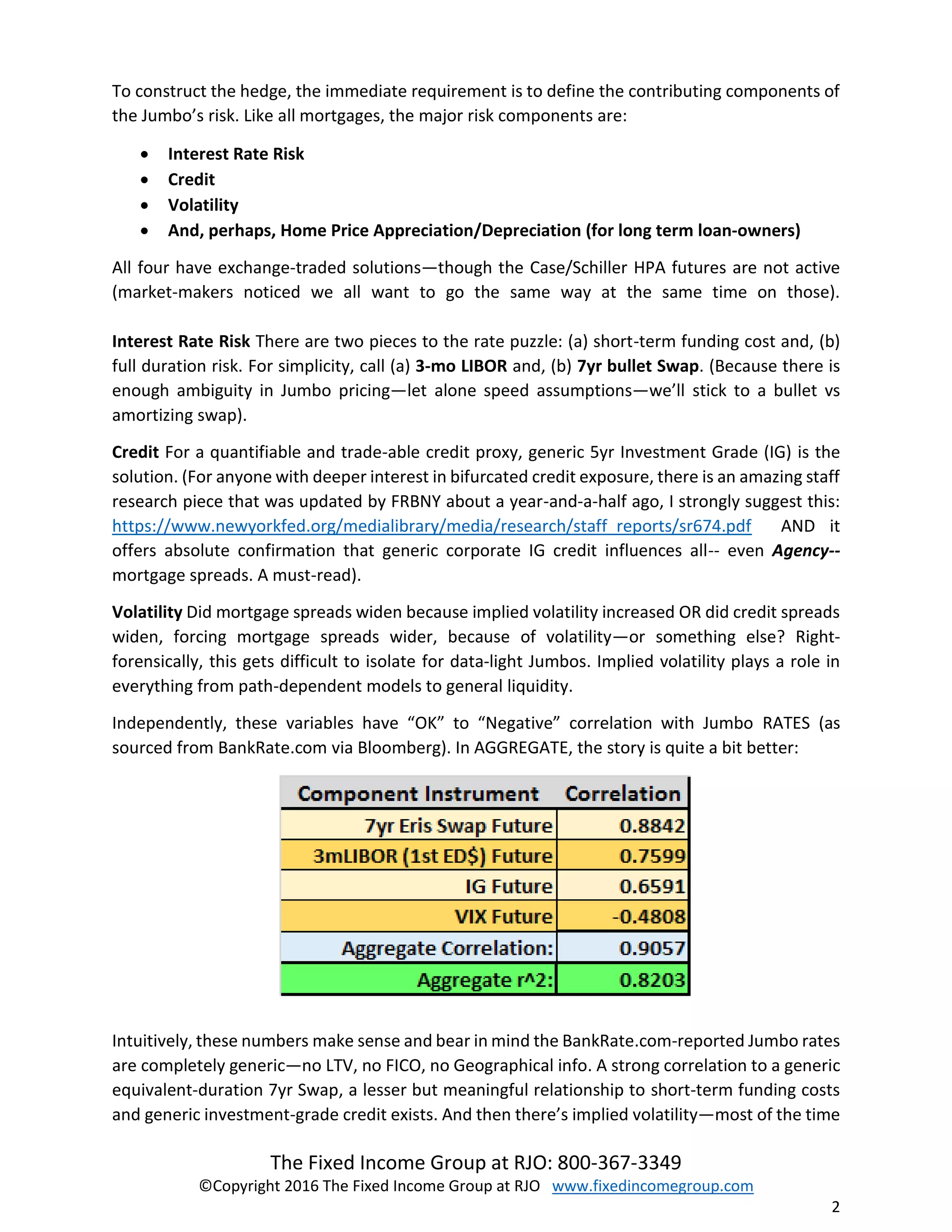

This document discusses the complexities of hedging jumbo 30-year fixed-rate mortgages during the volatile period from December 2015 to March 2016, focusing on how the pricing of jumbo loans has become increasingly challenging. It outlines the risks associated with these mortgages, including interest rate risk, credit, and volatility, and emphasizes the importance of correlation with futures contracts for effective hedging. The text also highlights the necessity for customizable strategies due to market conditions and the evolving nature of available financial instruments.