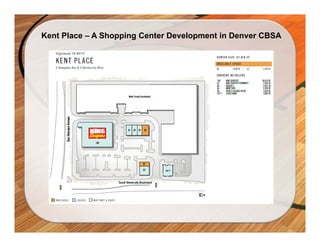

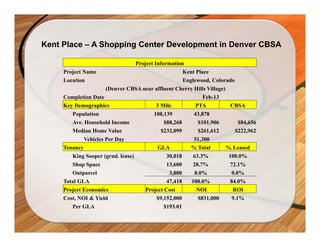

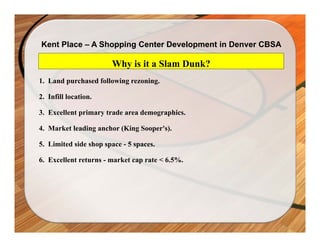

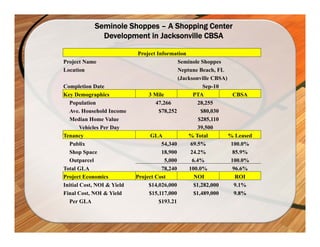

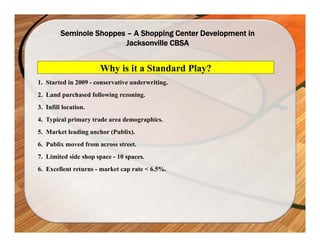

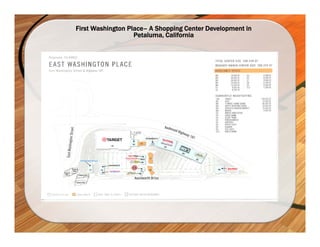

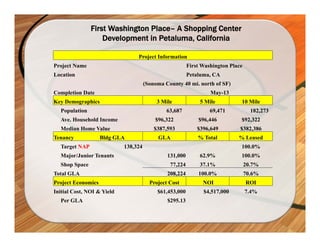

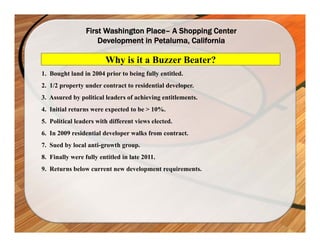

The document discusses three shopping center development case studies - Kent Place in Denver, Seminole Shoppes in Jacksonville, and First Washington Place in Petaluma, California. Kent Place is described as a "slam dunk" due to its infill location and demographics. Seminole Shoppes represents a "standard play" with typical demographics and anchor tenant. First Washington Place faced entitlement delays and lawsuits, making it a "buzzer beater" with returns below standard requirements.