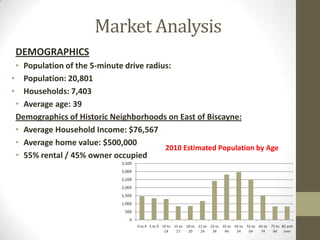

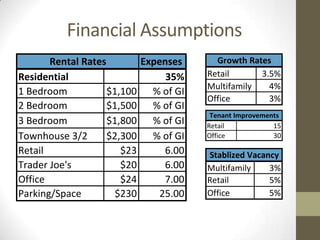

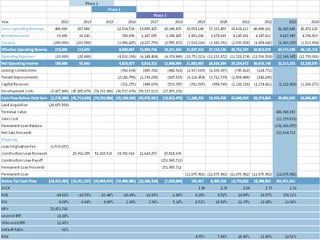

The document presents a proposal for a mixed-use development project at 79th & Biscayne consisting of 930 residential units, 183,995 square feet of retail space including a Trader Joe's, and 491,100 square feet of office space. It includes an analysis of the local market demographics, comparable properties, and financial assumptions for the construction loans and permanent financing. The projected internal rates of return range from 12.16% for parking to 23.09% for retail, with an overall IRR of 18.88% for the total development.