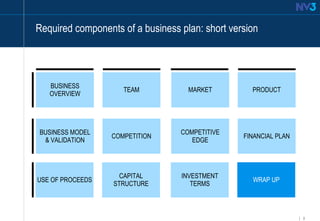

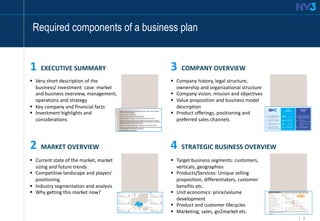

The document outlines a business planning workshop that covers the fundamentals and components of a successful business plan. The workshop will review the objectives and uses of financial business plans, and teach attendees how to develop the key components of a short and full business plan, including an executive summary, company overview, market overview, strategic business overview, operational overview, financial projections, management team, and investment highlights. The document provides examples of the required elements and recommends tips for developing an effective business plan, such as building a coherent story, showing validations, and ensuring numbers are accurate.