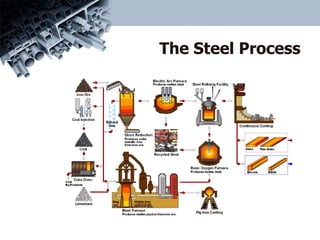

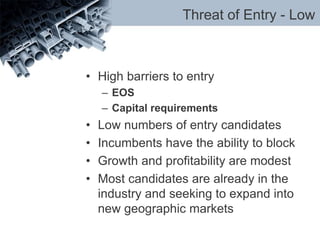

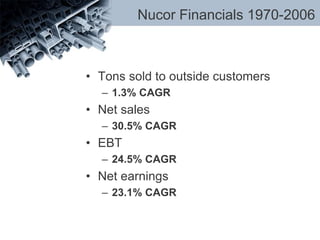

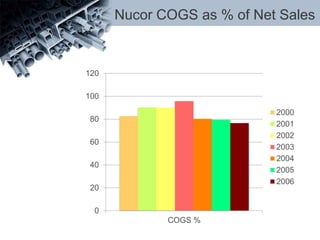

Nucor is the largest steel producer in the US. Its mission is to be the lowest cost and highest quality steel producer. It faces high competition globally and domestically. Nucor has been highly successful due to its strategy of pursuing cost reductions through advanced technology, empowering employees, and maintaining quality. However, rising iron ore and scrap prices present a threat. Nucor is well positioned due to its low costs and innovation, but further expansion and protecting its supply chain could strengthen its position.