This document discusses plans for a new soy-fortified fruit juice product called N'Rich. Key points:

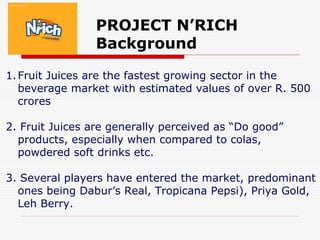

- The fruit juice market is growing and perceived as healthy, but most brands only provide taste. The proposed N'Rich product will provide both taste and added health benefits from soy protein.

- N'Rich will be marketed under the established Nutrela brand to leverage its health image. The sub-brand name will reflect the protein enrichment.

- The target audience is young mothers buying juice for their school-going children, positioning it as a healthier beverage option.

- N'Rich will contain 2g of soy protein isolate added to 200ml servings, providing 12-15%