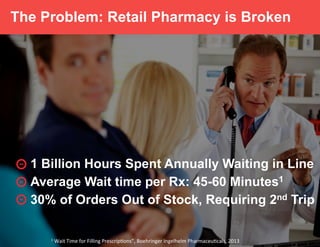

NowRx is proposing an on-demand pharmacy delivery service that delivers prescriptions to customers within one hour. Their business model involves central dispensing locations and delivery drivers instead of retail stores. Customers can have their prescriptions delivered to their home or work for free same-day delivery or $5 for one-hour delivery. NowRx aims to expand to multiple cities over 5 years and believes this model can capture 18% of the $40 billion retail pharmacy market.