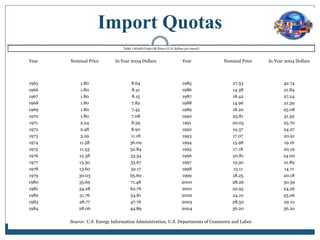

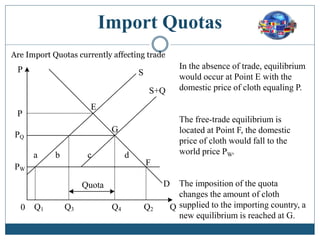

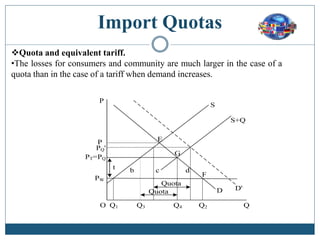

Non-Tariff Barriers such as import quotas can benefit domestic industries but hurt consumers. Import quotas fix the quantity of a good that can be imported, which raises the domestic price above the world price. This benefits domestic producers but harms consumers who face higher prices and less choice. The government also benefits from import quotas through increased tax revenue. However, free trade overall benefits consumers the most through lower prices and more options. There is an ongoing balance between protecting domestic jobs and pursuing economic efficiencies through open trade.