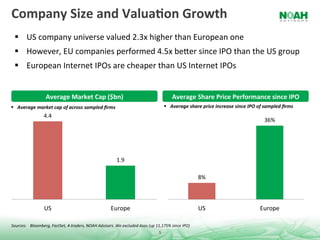

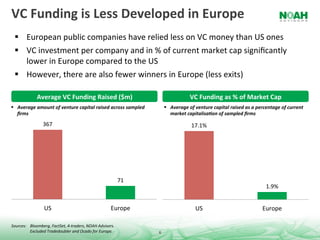

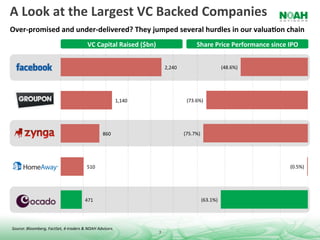

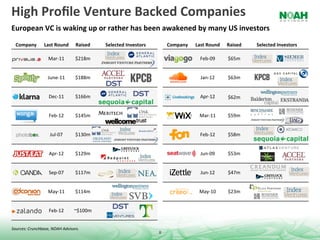

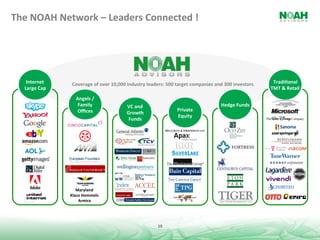

This document discusses the European technology sector and startup ecosystem. It notes that while US companies are valued higher on average, European companies have significantly outperformed since their IPOs. The document also analyzes trends in venture capital funding, noting it is less developed in Europe. Several high-profile European startups that have raised large funding rounds are presented. Overall the document presents a positive outlook on the growth of European tech companies and venture capital investment.