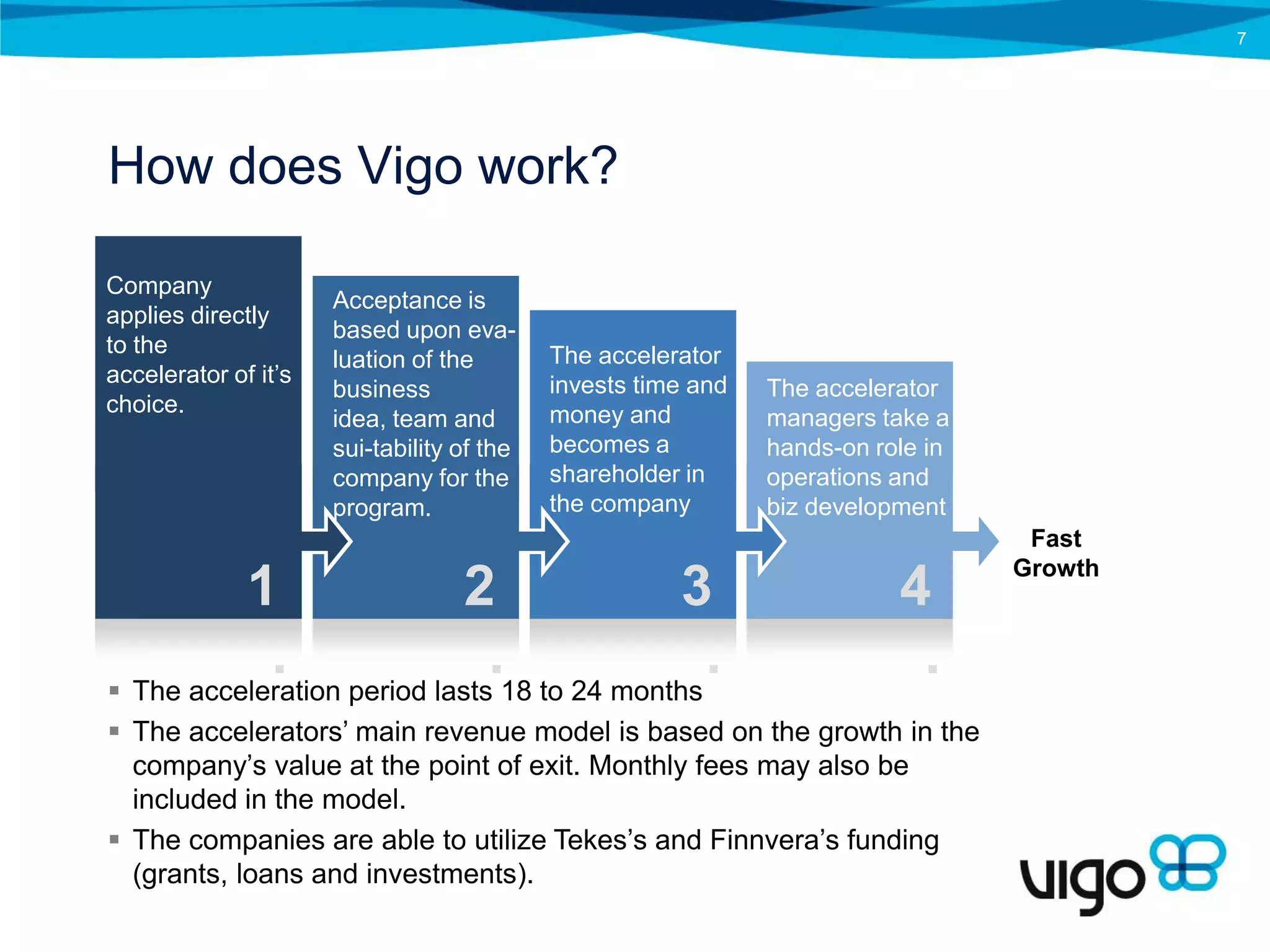

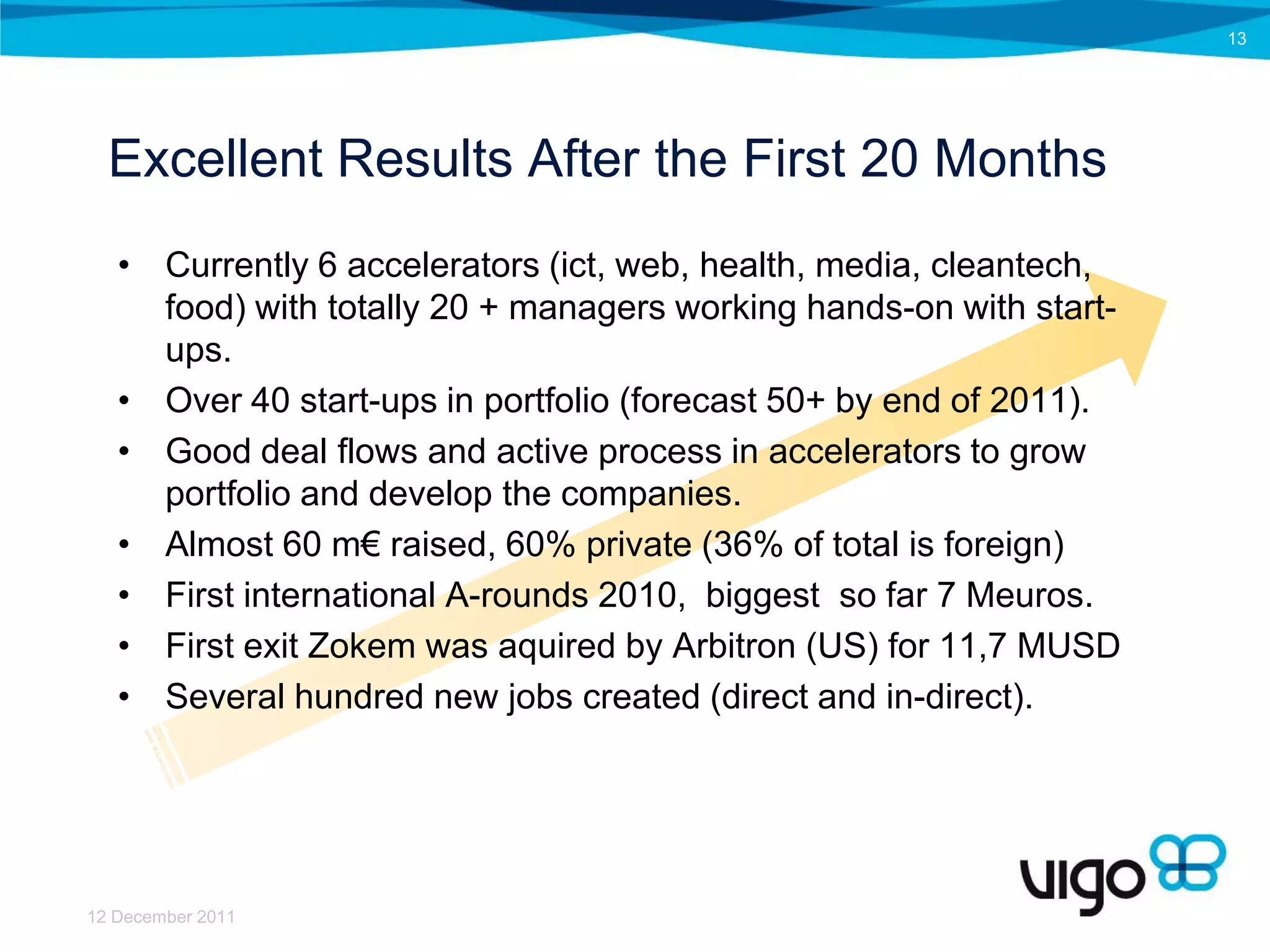

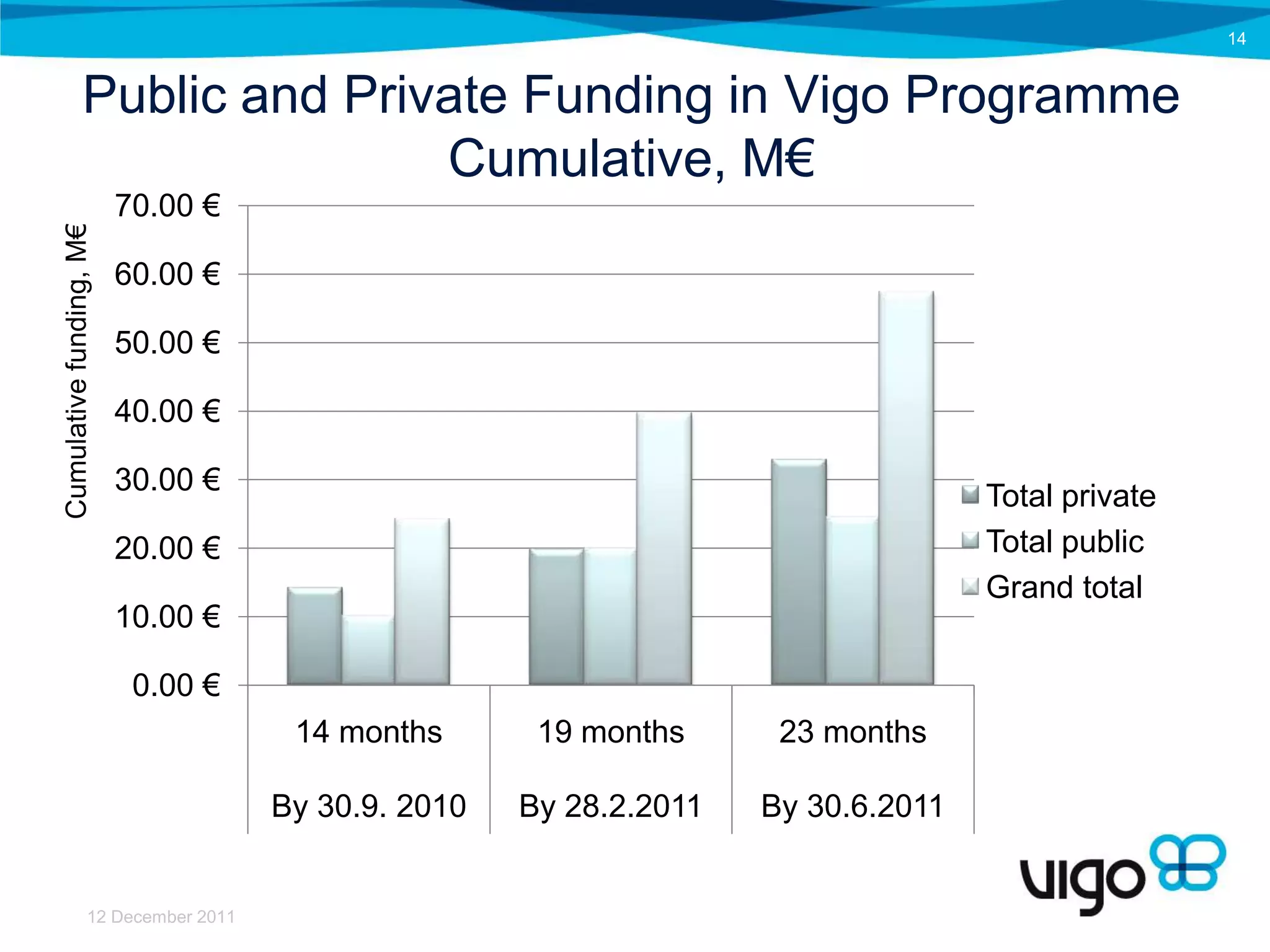

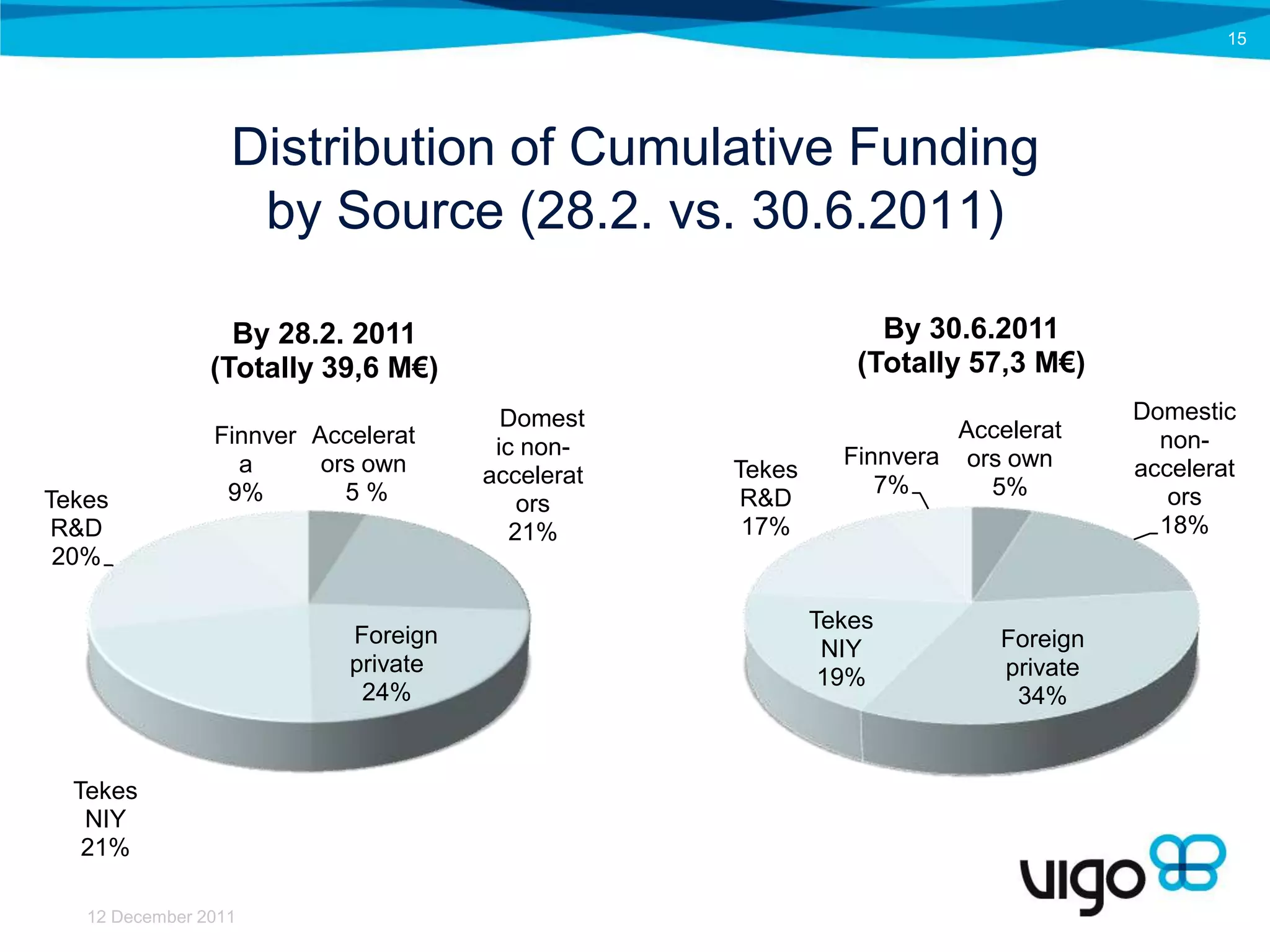

The Vigo Programme is a new type of acceleration program in Finland designed to complement the existing innovation ecosystem. It selects independent accelerator companies to provide support, experience, and financing to high-potential Finnish startups. The key objectives are to help promising startups grow, ensure early funding, increase company value, and attract venture capital investments. Six respected accelerators were initially selected to work with over 40 startups. The program has seen nearly 60 million euros raised to date, with successful exits and hundreds of new jobs created after the first 20 months of operation.