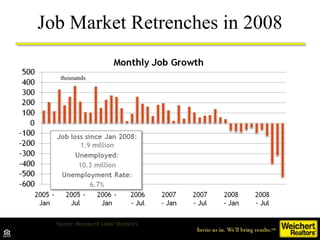

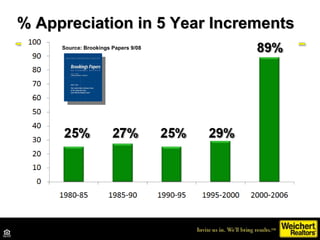

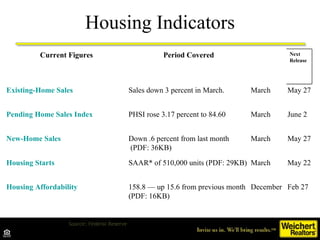

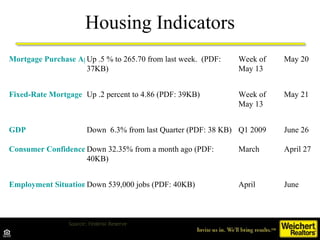

The document provides an analysis of the real estate market in 2009, including:

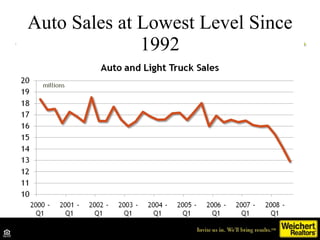

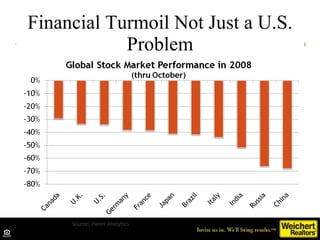

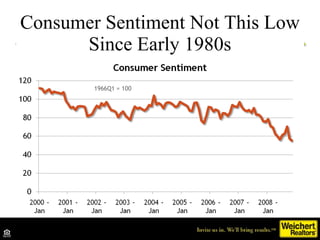

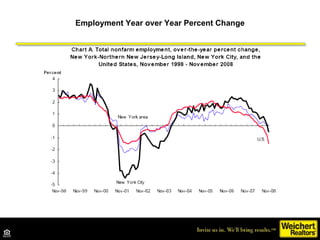

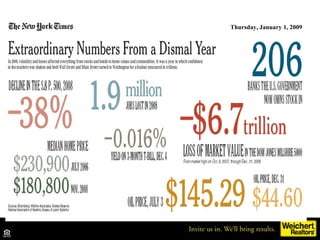

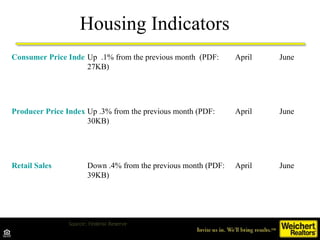

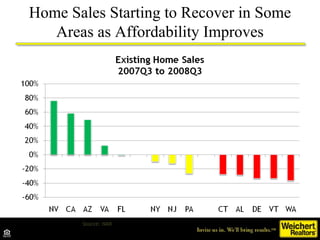

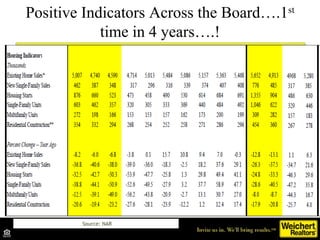

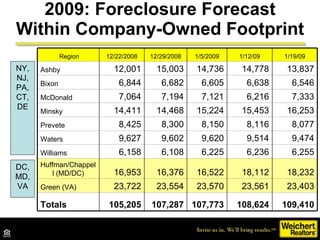

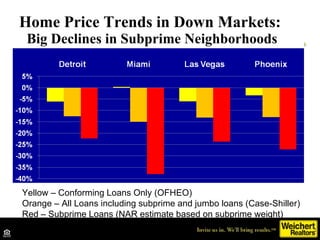

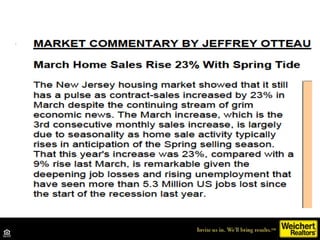

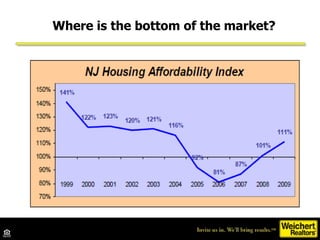

1. It summarizes housing indicators and economic data showing declines in home sales, construction, and rising foreclosure rates.

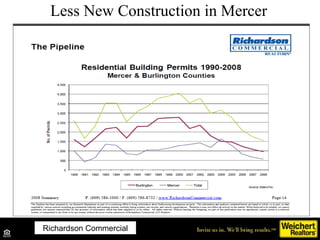

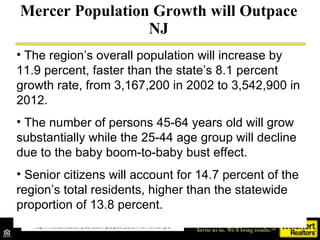

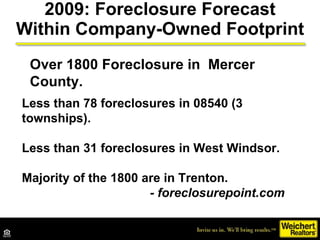

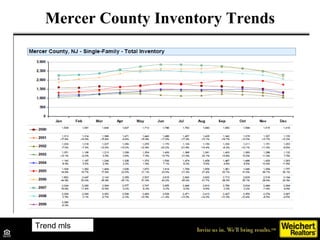

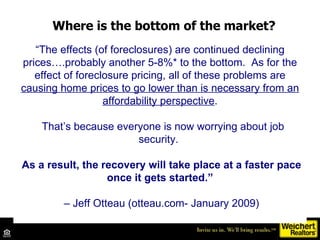

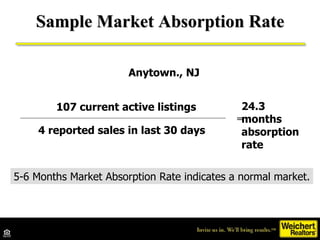

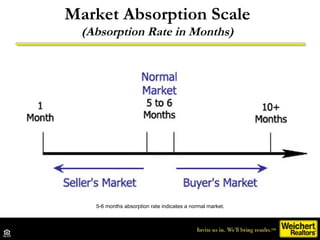

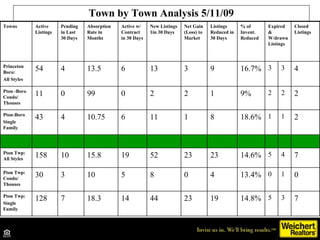

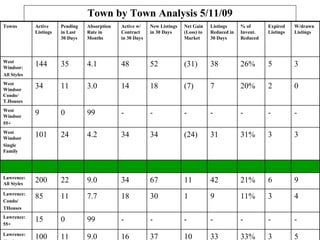

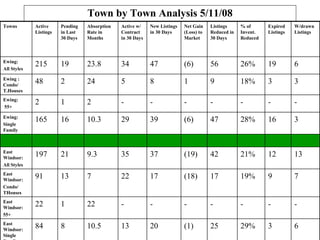

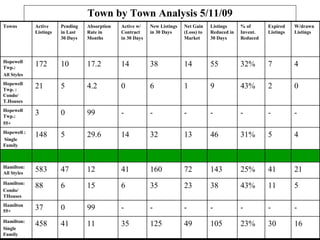

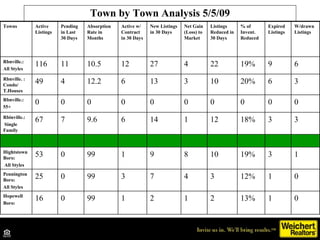

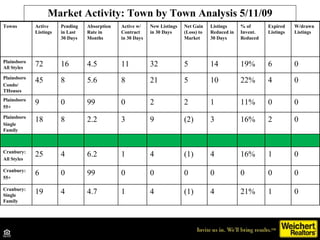

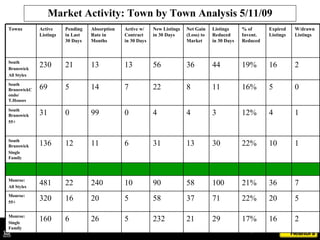

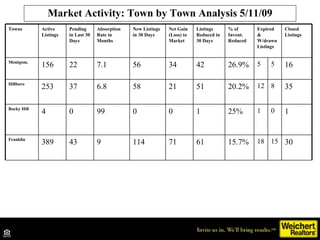

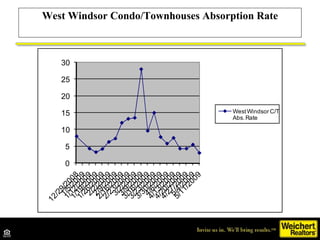

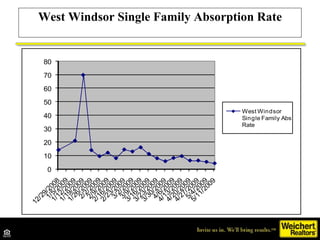

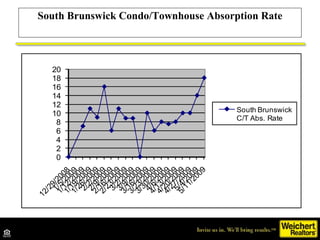

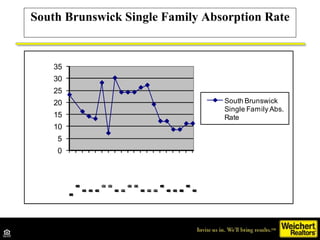

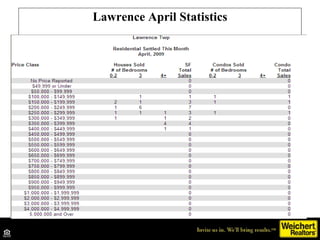

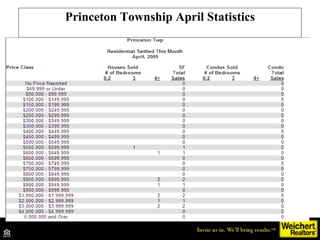

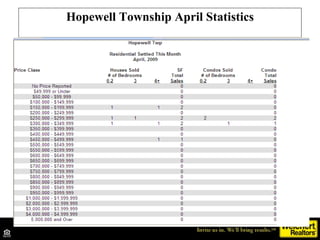

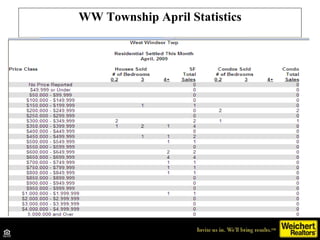

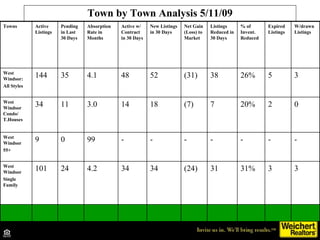

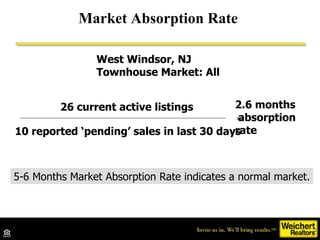

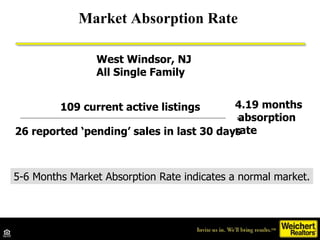

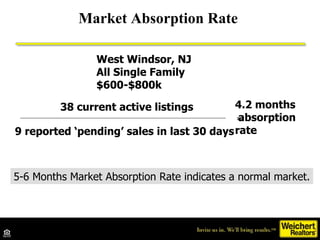

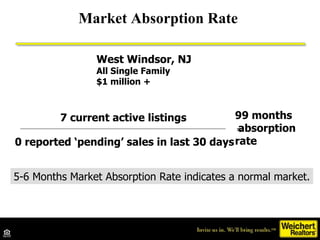

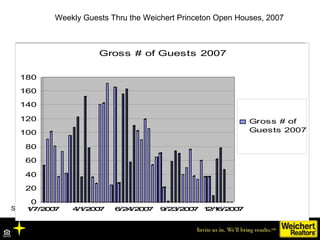

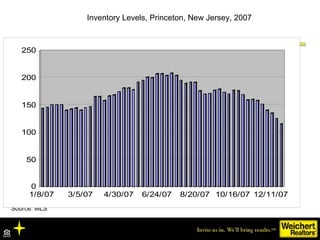

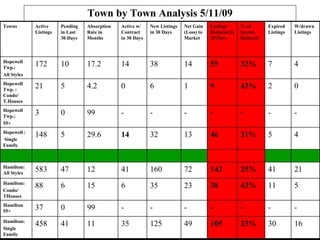

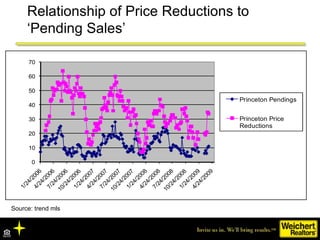

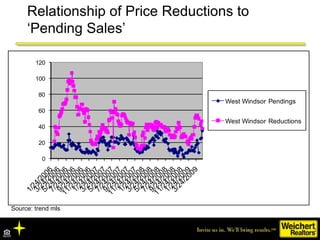

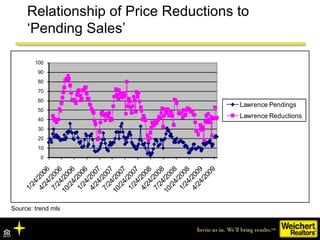

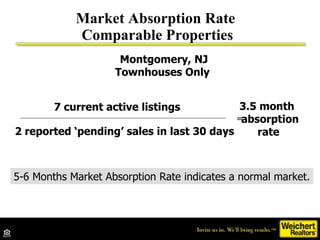

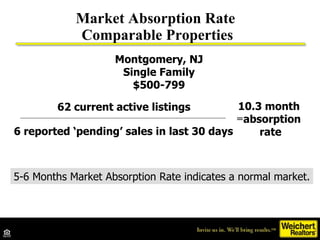

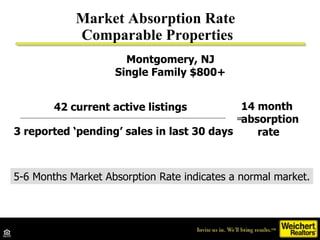

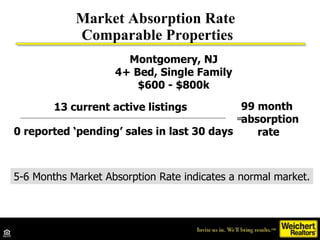

2. It analyzes real estate market conditions in multiple towns in Mercer County, providing data on inventory levels, sales rates, and forecasts that prices may continue to decline another 5-8% before bottoming out.

3. It emphasizes that the real estate market is local and conditions can vary significantly between different towns.