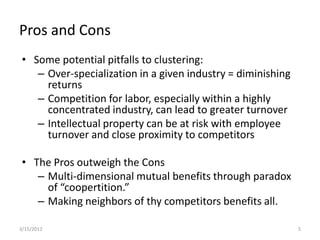

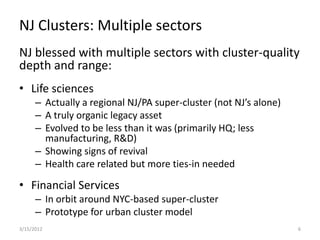

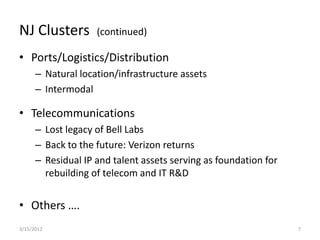

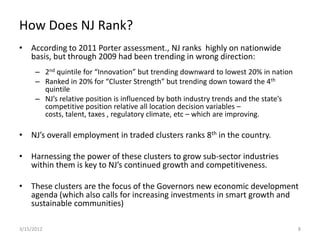

The document discusses the concept of industry clusters, highlighting their benefits such as increased efficiency, innovation, and employment growth through co-location of interconnected businesses. It outlines New Jersey's position in various clusters, including life sciences and financial services, while suggesting policies to enhance cluster development and address challenges like over-specialization and competition for talent. The document advocates for targeted incentives and urban development strategies to strengthen these clusters and promote regional economic growth.