New base energy news issue 1029 dated 14 may 2017

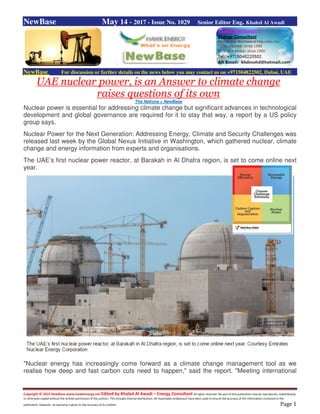

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase May 14 - 2017 - Issue No. 1029 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE nuclear power, is an Answer to climate change raises questions of its own The Nationa + NewBase Nuclear power is essential for addressing climate change but significant advances in technological development and global governance are required for it to stay that way, a report by a US policy group says. Nuclear Power for the Next Generation: Addressing Energy, Climate and Security Challenges was released last week by the Global Nexus Initiative in Washington, which gathered nuclear, climate change and energy information from experts and organisations. The UAE’s first nuclear power reactor, at Barakah in Al Dhafra region, is set to come online next year. "Nuclear energy has increasingly come forward as a climate change management tool as we realise how deep and fast carbon cuts need to happen," said the report. "Meeting international

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 climate goals of limiting temperature increases to 1.5°C to 2°C will require current emission levels to be reduced by 40 to 80 per cent by 2050 and near zero or negative by 2100." Alternatives to carbon-intensive energy sources, such as nuclear, will have to be introduced if targets are to be met. "The renewable energy sources like wind and solar energy are important in this regard but they cannot in the foreseeable future produce the energy that is needed in many countries. Therefore, an increased use of nuclear energy is crucial," said John Bernhard, one of the report’s authors and former Danish ambassador to the International Atomic Energy Agency. Others agreed. "The renewable sources are not yet ready to take over the world’s energy supply," said Dr Peter Bode, former associate professor in nuclear science and technology at the Delft University of Technology in the Netherlands. "Nuclear power is more-or-less a carbon dioxide-clean energy source." Some experts said a more balanced view on the prospects of nuclear power and its place in the future of energy production is required. "Nuclear governance does need significant strengthening, particularly with regard to safety, non- proliferation and security," said Nobuyasu Abe, commissioner of the Japan Atomic Energy Commission. "But nuclear power is necessary to address climate change if renewable energy cannot overcome intermittency of supply and improve its cost." Miles Pomper, senior research associate at the Monterey Institute of International Studies in Washington, voiced less hope that nuclear energy could tackle climate change in the long run. It’s got too many problems to be commercially viable in most places," he said. "It’s expensive, requires a highly trained workforce and regulators, and only Finland and maybe Sweden have figured out what to do with the waste. The future is with alternative energy and better storage."

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Oman Cut to Junk by S&P as Crude Oil Decline Imperils Finances Bloomberg - Zainab Fattah Oman was cut to junk by S&P Global Ratings, which said a drop in crude could hamper exports from the largest Arab oil producer outside OPEC and jeopardize its finances. S&P lowered the Gulf state’s sovereign debt long-term rating to BB+, one level below investment grade, from BBB- and changed the outlook to negative, the New York-based firm said in a statement Friday. “The negative outlook reflects the potential for Oman’s income level to weaken and for its fiscal and external positions to deteriorate,” S&P said in a statement. The slump in oil prices since 2014 has put pressure on the finances of the sultanate, forcing it to join other Gulf countries in tapping international debt markets to plug budget shortfalls. Oman, which has the third-lowest investment grade rating at Moody’s Investors Service, raised $5 billion through a three-part sale of dollar bonds earlier this year. S&P estimates Oman’s net external asset position has fallen to 30 percent of current account receipts in 2017 from 60 percent last year. The country will post a budget deficit of 10.3 percent of gross domestic product in 2017, according to the median estimate of eight economists on Bloomberg.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Jordan: Questerre Energy acquires minority interest in Red Leaf Source: Questerre Energy Questerre Energy has made a strategic investment in Red Leaf Resources. Through an agreement with one of the vendors, Whitehorn Resources, Questerre also has the option to acquire over 280 sq km prospective for oil shale in the Kingdom of Jordan. Michael Binnion, President & Chief Executive Officer of Questerre, commented, 'This investment gives us a minority control block in Red Leaf. They now have over US$100 million in cash and are committed to their business plan of commercializing EcoShale technology and supporting their license holders to develop their projects. We will also have access to significant additional oil shale resources in Jordan through our agreement with Whitehorn.' He added, 'Their recent engineering work with Questerre on the use of coker drums as reusable capsules is encouraging for the commercial development of our project in Jordan. Combined with the initial positive results from testing our oil shale using the EcoShale process, this investment could materially accelerate the timeline for our economic feasibility work.' Adolph Lechtenberger, Chief Executive Officer of Red Leaf, noted, 'Commercializing the EcoShale process remains our top priority. Over the last year, we have been working with Questerre on their independently assessed multi-billion barrel deposit in Jordan. This is a unique opportunity for both our companies. Red Leaf is in a solid financial position and we look forward to continuing our work to support Questerre in developing this project.' Questerre reported that it has entered into agreements to acquire 103,751 common shares of Red Leaf representing approx. 25% of Red Leaf’s outstanding Common Shares. The first tranche of the acquisition for 82,015 Common Shares closed earlier this week with the second tranche scheduled to close later this month. On closing of the second tranche, Questerre will hold approx. 30% of the common share capital of Red Leaf. The acquisition price is US$60 per Common Share paid concurrently with the applicable closing and a contingent payment of US$12.50 per Common Share subject to the fulfillment of certain conditions. The second tranche of the acquisition includes the option to acquire Whitehorn. In addition to the Red Leaf Common Shares held by Whitehorn, its assets include a Memorandum of Understanding ('MOU') with the Ministry of Energy and Mineral Resources in Jordan granting Whitehorn the exclusive right to explore for oil shale on 282 sq km in the Wadi Abu Al Hamam area. This acreage lies to the northwest of Questerre’s acreage. There are 30 core holes that have been drilled on this acreage with yields of between 15 and 25 gallons per ton. The term of the MOU was recently extended until 2019. Questerre also announced that it has disposed of shallow exploration rights over 960 net acres, primarily on its operated acreage in the Kakwa area, for gross proceeds of $4.45 million and an

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 overriding royalty. Questerre continues to retain the rights to develop the Montney formation on this acreage. No reserve value was attributed to the disposed rights as at December 31, 2016. The Company also reported that it has been refunded approx. $6 million following the successful appeal of a summary judgment hearing in November 2016. The amounts relate to a claim by a joint venture operator primarily relating to the costs of drilling two wells in Quebec in 2010. The operator has appealed this ruling and a hearing is scheduled for early June 2017. A trial is currently scheduled for late 2018 in respect of this matter. Questerre Energy Corp is leveraging its expertise gained through early exposure to shale and other non-conventional reservoirs. The Company has base production and reserves in the tight oil Bakken/Torquay of southeast Saskatchewan. It is bringing on production from its lands in the heart of the high-liquids Montney shale fairway. It is a leader on social license to operate issues for its Utica shale gas discovery in the St. Lawrence Lowlands, Quebec. It is pursuing oil shale projects with the aim of commercially developing these significant resources. Questerre is a believer that the future success of the oil and gas industry depends on a balance of economics, environment and society. We are committed to being transparent and are respectful that the public must be part of making the important choices for our energy future.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Mauritania: Total awarded exploration block 7 offshore Source: Total Total and Mauritania have signed an exploration and production contract to perform exploration works on Block C7, which covers an area of 7,300 sq kms. The Group will be the operator with a 90% interest alongside the Société Mauritanienne des Hydrocarbures et de Patrimoine Minier (SMHPM) holding the remaining 10%. 'This agreement is part of Total’s strategy to explore new deepwater basins in Africa. The addition of the C7 block to our existing C9 deepwater licence creates a contiguous exploration area of around 17,000 sq kms in a high-potential zone in offshore Mauritania,' said Guy Maurice, Senior Vice President, Africa at Total Exploration & Production, following his meeting with Mohamed Abdel Vetah, Minister of Petroleum, Energy and Mines of the Islamic Republic of Mauritania. The company will operate with a 90% interest in partnership with state-owned Société Mauritanienne des Hydrocarbures et de Patrimoine Minier (SMHPM). Guy Maurice, svp, Africa at Total Exploration & Production, said: “This agreement is part of Total’s strategy to explore new deepwater basins in Africa. The addition of the C7 block to our existing C9 deepwater license creates a contiguous exploration area of around 17,000 sq km [6,564 sq mi] in a high-potential zone in offshore Mauritania.”

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Italy: Saffron Energy begins commercial production at Bezzecca in northern Italy.. Source: Saffron Energy AIM listed Saffron Energy, the natural gas producer with interests in northern Italy, has announced that testing of the primary production layers from the Bezzecca well is complete and production planning has been finalised. The initial plan now is to operate all three levels with an estimated combined flow of 30,000-35,000 cubic meters per day (scm/day). Steady commingled production will be achieved through the installation of a downhole choke above the Miocene level R. Level A in the Pliocene has flowed in excess of the planned production rates at stabilised flows of 20,000-25,000 scm/day and is on production. This flow rate is above the levels estimated in the CPR. Level R in the Miocene has also been tested and flowed at 25,000 scm/day slightly below CPR estimates. In addition, level S was flow tested for a shorter period, and will contribute to production at around 5,000-10,000 scm/day. Production will continue in level A at 20,000-25,000 scm/day up to the end of June, with production levels increasing to 30,000-35,000 scm/day from early July when levels R and S will be added, once the bottom hole choke is delivered and installed. Bezzecca is located east of Milan within the established prolific, gas-producing Po Valley region in northern Italy and operated by Saffron's subsidiary Northsun Italia SPA (NSI). Gas from Bezzecca 1 is processed at the Vitalba processing plant and directly connected to the national grid, which is owned and operated by SNAM Rete Gas S.p.A. The gas is sold to Shell Energy Italia S.r.l. under an existing off-take agreement. The Company will provide a trading update in due course to include the Group revenue and profit figures, along with updated flow rates. Chief Executive Officer of Saffron Energy, Michael Masterman commented: 'It's a very important achievement for Saffron to have moved into revenue producing commercial production at Bezzecca following completion of the commissioning and testing stage. Level A is now in production, producing above expected rates. We look forward to further increasing production in July when we move to comingled production from all three levels. We are also on track to bring Sant' Alberto on stream in Q4 2017 as well as actively seeking new opportunities to substantially increase revenue and production within the Group.'

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 U.S. nuclear capacity and generation expected to decline as existing generators retire…Source: U.S. Energy Information Administration, Annual Energy Outlook 2017 Nuclear power currently accounts for about 20% of electricity generation in the United States, playing an important role in electricity markets. EIA’s 2017 Annual Energy Outlook (AEO2017) Reference case assumes that about 25% of the nuclear capacity now operating that does not have announced retirement plans will be removed from service by 2050. Nearly all nuclear plants now in use began operation between 1970 and 1990. These plants would require a subsequent license renewal before 2050 to operate beyond the 60-year period covered by their original 40-year operating license and the 20-year license extension that nearly 90% of plants currently operating have either already received or have applied for. The AEO2017 Reference case projections do not envision a large amount of new nuclear capacity additions. By 2050, only four reactors currently under construction and some uprates at existing plants are projected to come online. Except during maintenance or refueling cycles, nuclear plants operate around the clock as baseload generators, meaning nuclear plants make up a disproportionately large share of generation compared with their share of electricity generating capacity. Generating capacity using other fuels is typically dispatched at much lower rates than nuclear units. As more nuclear capacity is retired than built, and as other fuels such as natural gas and

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 renewables gain market share, the nuclear share of the U.S. electricity generation mix declines from 20% in 2016 to 11% in 2050 in EIA’s Reference case projections. Source: U.S. Energy Information Administration, Annual Energy Outlook 2017 From 2018 through 2050, 9.1 gigawatts (GW) of nuclear capacity is added in the AEO2017 Reference case, which assumes that current laws and policies do not change. Two projects under construction—V.C. Summer in South Carolina and Vogtle in Georgia—each have two reactors and are expected to add 4.4 GW of new nuclear capacity, although their progress has been uncertain since the company manufacturing their reactors, Westinghouse Electric, recently filed for bankruptcy. Another 4.7 GW of added nuclear capacity results from uprates, or operational changes that allow existing plants to produce more electricity. Increases from uprates are expected to end by 2040, as EIA expects that all plants planning to uprate will have completed the projects by 2040. More than offsetting the total addition of 9.1 GW of nuclear capacity from new plants and uprates in the AEO2017 Reference case are projected retirements of 29.9 GW of nuclear capacity from 2018 through 2050. Many of EIA’s anticipated near-term retirements include those that have been announced by plant operators. When the AEO2017 assumptions were finalized in late 2016, nuclear plant operators had announced intentions to retire five facilities between 2017 and 2026: Quad Cities Units 1 and 2 in 2017, Clinton Unit 1 in 2018, Pilgrim Unit 1 in 2019, Oyster Creek Unit 1 in 2020, and Diablo Canyon Units 1 and 2 in 2025 and 2026.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Source: U.S. Energy Information Administration, Annual Energy Outlook 2017 Since AEO2017 assumptions were finalized, legislation passed by the Illinois government created financial incentives through 2026 to support the continued operation of Quad Cities and Clinton. Operators of these two plants subsequently withdrew their announcements to retire those plants, reducing the amount of capacity likely to retire in 2017 and 2018. However, in the months since AEO2017 assumptions were finalized, Entergy also announced its intention to retire three plants: Michigan’s Palisades in 2018 and New York’s Indian Point Units 2 and 3 around 2020. New commercial nuclear power plants are licensed by the Nuclear Regulatory Commission (NRC) for 40 years. Because many nuclear plants were built more than 40 years ago, nearly 90% of currently operating nuclear plants are currently operating under or have applied for 20-year license renewals. Plant operators may apply for subsequent license renewals to continue operating for an additional 20 years (a total of 80 years). The capital investment needed to extend the life of nuclear plants beyond 60 years is currently unknown and could vary significantly across the nuclear power fleet. Other areas of uncertainty include plant operators’ interest in obtaining subsequent license renewals and the Nuclear Regulatory Commission’s willingness to grant those license renewals for plants to operate beyond 60 years. Furthermore, policy or technology cost developments that might advantage or disadvantage existing nuclear plants relative to other generation technologies and the cost of natural gas are likely to play an important role in future retirement decisions.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase 14 May 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil prices settles at $47.84 & $50.11breaking three-week losing streak Oil prices were little changed on Friday, as evidence that U.S. production was still rising overshadowed hopes that the global crude glut would diminish on expected production cut extensions from OPEC and other producing countries. A weekly report by Baker Hughes showed American drillers added oil rigs for the 17th straight week in a row. The number of rigs drilling for new production jumped by 9 to a total of 712, versus 318 at this time last year. U.S. West Texas Intermediate (WTI) crude oil futures ended Friday's session at $47.73 per barrel, eking out a 1 cent gain on the day and posting the biggest weekly gain in six weeks. Brent crude futures, the international benchmark for oil prices, rose 6 cents to $50.83 per barrel by 2:36 p.m. ET (1836 GMT) on Friday. On Thursday, oil prices rallied as a larger-than-expected weekly draw in U.S. crude inventories of 5.3 million barrels suggested that output cuts by OPEC and other producers were helping reduce a global glut in crude, analysts said. "The market overall is trying to balance OPEC and non-OPEC production cuts with increasing production all over the world as they reduce their costs and improve their efficiency." Prices pared early gains in late morning trade after U.S. crude briefly breached a technical support level at $48 a barrel. "That $48 level is a key support point," said John Kilduff, partner at energy hedge fund Again Capital. "You're seeing selling pressure come in at that level." U.S. crude production has Oil price special coverage

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 risen more than 10 percent since mid-2016 to more than 9.3 million bpd, close to the levels of top producers Russia and Saudi Arabia. Norwegian consultancy Rystad Energy said U.S. output had gained "significant momentum." U.S. output, excluding Alaska, would expand by 390,000 bpd from May 2017 to December 2017, assuming a U.S. light crude price of $50, it said. OPEC and other producers meet on May 25 to decide whether to extend cuts. Saudi Arabia, OPEC's de facto leader, has said it expects an extension to the end of 2017 or possibly beyond. Commerzbank said in a note it was skeptical about OPEC's ability to support prices in the long term. "Owing to the rapid recovery in U.S. oil production, OPEC obviously only has limited influence on prices via supply curbs," it said, adding an extension "is unlikely to be more successful than the cuts implemented so far in the longer-term." Rob Haworth, senior investment strategist at U.S. Bank Wealth Management, said the market will be watching for a possible drawdown in U.S. rig counts. "The market needs to be looking for a sign you've been getting a response 1/8 to lower prices 3/8 from U.S. producers. That's part of what's going to keep this floor in on the oil prices," he said. Oil Rally Fizzles Oil’s rebound ran out of steam as investors focus on all the production that OPEC can do nothing about. Futures were little changed in New York as they capped the first weekly gain in a month. The Organization of Petroleum Exporting Countries boosted estimates for growth in rival supplies by 64 percent, as producers in the U.S. shale patch, Brazil and elsewhere keep boosting production. "Prices have come up quite a bit this week, and it looks like the market just ran out of steam," Kyle Cooper, director of research with IAF Advisors in Houston, said by telephone. "There’s concern about rising non-OPEC supply and whether they will stick to their guns when they meet later this month. They will need to, because of rising U.S. production." Oil rebounded somewhat this week after the biggest decline in American crude inventories since December helped allay concerns that OPEC won’t be able to ease a supply glut. But the U.S. benchmark is still down 11 percent for the year after a rout last week dragged prices back to where they were before OPEC’s deal at the end of November. OPEC ministers will meet May 25 to decide whether to go forward with an extension of their production cuts.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 West Texas Intermediate for June delivery advanced 1 cent to $47.84 a barrel on the New York Mercantile Exchange. It was the highest close since May 1. Total volume traded was about 3 percent below the 100-day average. Prices rose 3.5 percent this week. Brent for July settlement rose 7 cents to $50.84 a barrel on the London-based ICE Futures Europe exchange. Prices increased 3.5 percent this week. The global benchmark crude closed at a $2.67 premium to July WTI. U.S. supplies declined by 5.25 million barrels to 522.5 million last week, Energy Information Administration data showed Wednesday. While that’s down from a record 535.5 million barrels at the end of March, output rose for a 12th week to 9.3 million barrels a day, the highest since August 2015. OPEC and its allies support extending the curbs for a further six months, Iraq’s Jabbar Al-Luaibi and Algeria’s Noureddine Boutarfa said Thursday in Baghdad. The two biggest producers participating in the curbs, OPEC’s Saudi Arabia and non-member Russia, both signaled willingness on May 8 to prolong the deal.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase Special Coverage News Agencies News Release 14 May 2017 OPEC's Staring Down a Double-Barrel Cut By Julian Lee OPEC is going to have to do much more than simply extend its current production deal when it meets next week if it's serious about addressing surplus inventory. In fact, its own figures show it needs to double the cut it made in January. That means finding another 1.2 million barrels a day to take out of production. In its latest forecast, published last week, the producer group trimmed its estimate of the need for OPEC crude this year by 300,000 barrels a day. At that level of production -- 31.92 million barrels a day -- inventories will remain static, assuming demand and non-OPEC supply forecasts are correct. OPEC produced 31.74 million barrels a day in April, according to secondary-source estimates published by the group. Simply rolling that level forward for another six months will exhaust the excess at an average rate of 722,000 barrels a day in the second half and will see about 120 million barrels removed from inventories in the nine months begun at the end of March. That may seem like a lot, but OPEC puts the excess at the end of the first quarter at 276 million barrels -- and that's just in the developed countries of the OECD. Merely extending the cuts won't bring oil inventories anywhere close to their five-year average level by the end of December. And let's set aside the fact that the five-year average has been inflated by two years of surplus, which means stockpiles will have to come down significantly below that to return to normal levels. Implementation of the agreement so far has been better than expected, but that does more to highlight the deal's weakness than anything else. Ensuring compliance in the second half will probably prove much harder. Several key producers have achieved their targets by simply bringing forward maintenance at oil fields and refineries. Extending the cuts will require real sacrifices, like shuttering production and reducing exports. There's a risk even that won't be sufficient.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 What It Takes Doubling OPEC's cut will drain excess inventories this year; extending it won't North American output is booming, and there are signs of recovery in Libya and Nigeria. The U.S. Department of Energy recently published a new forecast that revised the country's oil output up yet again. Crude-oil production is now expected to rise by 960,000 barrels a day between December 2016 and December 2017. That compares with a 210,00 barrel a day increase it foresaw just before OPEC's November gathering. Add in a 470,000 barrel a day ramp up in the production of natural gas liquids, and OPEC's entire cut is more than offset. OPEC's numbers show the group needs to limit its total production to 30.88 million barrels a day from July to deplete the excess OECD inventory -- a decrease of 900,000 barrels a day from current levels. But with Libya and Nigeria, which are exempt from the supply-reduction deal, both restoring production after months-long disruptions, deeper cuts will be required still. If OPEC wants to drain surplus inventories by the end of the year, its members are going to have to accept some real pain. Even then, the risk is that their actions spur more supply from U.S. shale. It's time for some tough decisions. This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase May 2017 K. Al Awadi

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Solar power is the key to renewable development in the GCC. Installed solar capacity is expected to reach 76 GW by 2020, representing massive opportunity for suppliers in the region. Co-located with The Big 5 Dubai, The Big 5 Solar launches this November 26 - 29th 2017. 20% of The Big 5 visitors in 2016 were looking for solar technologies making The Big 5 Solar an ideal platform to meet dedicated buyers, get inspired at the Global Solar Leader's Summit and open up to new markets.