NewBase 22 January 2024 Energy News issue - 1692 by Khaled Al Awadi_compressed (1).pdf

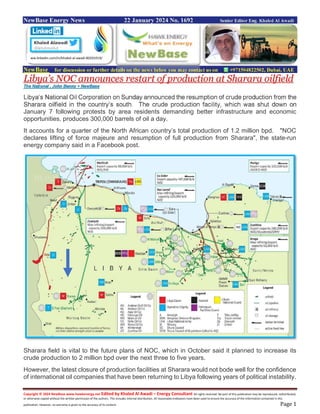

- 1. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 22 January 2024 No. 1692 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Libya’s NOC announces restart of production at Sharara oilfield The National , John Benny + NewBase Libya’s National Oil Corporation on Sunday announced the resumption of crude production from the Sharara oilfield in the country’s south. The crude production facility, which was shut down on January 7 following protests by area residents demanding better infrastructure and economic opportunities, produces 300,000 barrels of oil a day. It accounts for a quarter of the North African country’s total production of 1.2 million bpd. "NOC declares lifting of force majeure and resumption of full production from Sharara", the state-run energy company said in a Facebook post. Sharara field is vital to the future plans of NOC, which in October said it planned to increase its crude production to 2 million bpd over the next three to five years. However, the latest closure of production facilities at Sharara would not bode well for the confidence of international oil companies that have been returning to Libya following years of political instability. ww.linkedin.com/in/khaled-al-awadi-80201019/

- 2. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Last week, the country's oil minister said that the shutdown of the key oilfield could potentially impact the nation's gross domestic product and undermine Libya's reputation as a reliable energy supplier. “We believed the country had achieved stability, and customers had confidence in receiving consistent oil quantities. Losing customers is a real risk, jeopardising the future for everyone,” Mohamed Oun told reporters on the sidelines of an event in Tripoli at the time. Hydrocarbons make up about 95 per cent of Libya's exports and account for nearly 95 per cent of government revenue. The return of 300,000-bpd of Libyan crude to the market will likely impact oil prices when trading begins on Monday. Brent, the benchmark for two thirds of the world’s oil, settled 0.68 per cent lower at $78.56 a barrel on Friday. West Texas Intermediate, the gauge that tracks US crude, closed down 0.90 per cent at $73.41 a barrel.

- 3. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi Arabia setting standards for global energy, resource security TradeArabia + NewBase Saudi Arabia has said it is committed to collaborating with the global community to meet the growing demand for energy while driving green transformations and building integrated economic resilience. Speaking at the World Economic Forum (WEF) Annual Meeting 2024, Adel A Aljubeir, Minister of State for Foreign Affairs, Member of the Council of Ministers and Envoy for Climate, said: “We are a responsible actor in the global community and we want to not follow the standards, we want to set the standards.” At a session on ‘Bold Steps for a Sustainable Mena’, the minister said: “The world’s need for energy keeps expanding, and that extra need for energy has to be accommodated using alternative sources of energy. Renewables are a clear favourite.” Saudi Green Initiative Aljubeir pointed to the Saudi Green Initiative (SGI), which has implemented more than 80 public and private sector initiatives, representing an investment of over $188 billion towards achieving global climate goals. Earlier in a session on ‘Resilience: What It Means and What to Do About It’, Mohammed A Aljadaan, Minister of Finance stressed the need for significant structural reform for countries to improve resilience on an institutional level, a fiscal level, and a regulatory level. “Then you need to engage the private sector and your own people, making sure you’re providing them with safety nets in case of shocks,” he said.

- 4. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 High-growth sectors Bandar I Alkhorayef, Minister of Industry and Mineral Resources, said in a session on ‘Supply Chains of the Future’ high-growth sectors including logistics, manufacturing and mining are becoming critical drivers of the kingdom’s nationwide diversification. “Saudi Arabia offers a combination of enablers, including energy and petrochemicals, but also our geographic location.” In industry, Alkhorayef added: “Saudi Arabia is working with investors to help build and export competitive, green products, “not only in the long-term, but in the medium-term.” Discussing the kingdom’s rapid economic transformation since the launch of Saudi Vision 2030, which is focused on developing new sectors, Faisal F Alibrahim, Minister of Economy and Planning, said: “Saudi has a playbook that everybody is looking into, and this playbook is all about bold movement. 13 sectors “In Saudi, we wanted to accelerate our diversification fast. We prioritised 13 sectors that created the conditions for profitability for the private sector,” Alibrahim added, noting that “this is the time where collaboration can lead to the acceleration of innovation”. A session took place at Saudi House under the Bold Visions Series. ‘The Future of Banking and Technology in Saudi Arabia: What it Means for Investors’ hosted Ibrahim Almubarak, Assistant Minister of Investment, Saudi Arabia and CEO of the Saudi Investment Promotion Agency (SIPA), and Eng Abdulla bin Mohammed Al Zamil, Chairman, Gulf International Bank, Kingdom of Saudi Arabia,

- 5. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 U.S Climate Test for N,Gas Exports Splits White House Advisers Bloomberg + NewBase The U.S President’s top advisers are divided over how much to ramp up environmental scrutiny of licenses to ship natural gas abroad as companies and industry groups warn it could slow development of new export terminals, according to people familiar with the matter. Administration officials who support taking a tougher approach argue it’s important on both climate and political grounds and are worried that the US has already authorized too much natural gas to flow overseas, said the people, who asked not to be named detailing private deliberations. Biden has already alienated some young, climate-minded voters with his administration’s approval of ConocoPhillips’ $8 billion Willow oil development in Alaska last year, and he’s under increasing pressure to limit US crude and gas exports before the November elections. The younger electorate, incensed over the Willow approval, have come to view the multibillion dollar liquefied natural gas export projects as a test of the president’s commitment to fighting climate change. Even so, the issue is complex — cutting across myriad geopolitical, domestic and other interests. Biden pledged to provide more natural gas to Europe after Russia’s invasion of Ukraine. The US is now the world’s largest LNG exporter, and any change in policy could have have far-reaching consequences for the industry. Advisers have raised concerns about the economic risk. Among the administration officials leading the push for a more stringent climate test are Energy Secretary Jennifer Granholm and advisers John Podesta and Ali Zaidi, according to the people. At the same time, officials who raised concerns include National Security Advisor Jake Sullivan, presidential energy adviser Amos Hochstein, and Sarah Ladislaw, Biden’s special assistant for climate and energy.

- 6. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 “The administration is aligned on the importance of this priority,” White House spokesperson Angelo Fernandez Hernandez said Friday. The Energy Department didn’t immediately respond to a request for comment. Increased climate scrutiny could imperil billions of dollars in new export projects that are awaiting the Energy Department’s blessing, including Venture Global LNG Inc.’s CP2 project, near its existing Calcasieu Pass export plant in Louisiana, and a proposed terminal in Louisiana by Commonwealth LNG. Overall, top advisers are broadly aligned on the need to make changes — especially after the US and nearly 200 other nations committed in December to transition away from fossil fuels. The fault lines are over how aggressive to be. Those pushing for less drastic action have invoked Russia’s invasion of Ukraine while advocating taking an approach that addresses the climate argument and preserves a US economic resource. A presidential decision memo on the issue is expected in the coming weeks. One option could be a formal Energy Department rulemaking that could require a robust federal environmental review of LNG export projects and their potential lifeycyle greenhouse gas emissions. The prospect has ignited a flurry of lobbying, as gas and pipeline companies warn the White House that a pause in LNG export approvals would undermine the climate benefits of using American natural gas to displace coal in power plants around the world. Even without formal rulemaking, a review could be used to justify a pause in a making decisions on existing LNG export applications — potentially until after the Nov. 5 presidential elections. Such an approach has been taken before by the Obama administration, which commissioned a third-party study of the potential economic consequences of expanded LNG exports after authorizing a Cheniere Energy Inc. LNG export facility in Louisiana — and as other potential exporters lined up for licenses. The Energy Department then factored those conclusions into individual, case-by-case reviews of proposed exports. Environmentalists have warned against an expansion of new natural gas infrastructure they say will prolong for decades the use of that fossil fuel, which burns more cleanly than coal but nevertheless contributes to climate change.

- 7. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Europe Moves Into a New World After a Crippling Energy Crisis (Bloomberg This month, a cold front swept across much of Europe and giant tankers that carry fuel through the Red Sea were rerouted to avoid escalating violence. That should have pushed gas prices higher. Instead, they just kept falling. Even if it’s a step too far to give Europe the all-clear, it’s a strong sign that the worst of the nightmare that sent energy bills soaring and pushed inflation to multi-year highs is in the past. Europe is benefiting from having amassed record gas reserves last year, along with help from renewables and a relatively mild winter — some cold snaps aside. Sluggish economic growth is also playing a part, capping demand for energy in major industrial powers such as Germany. That’s been enough to boost confidence across trading desks that the region is on a stable-enough footing to get through the rest of the winter with gas to spare. Benchmark European prices are currently trading under €30 a megawatt-hour, about a tenth of the peak levels in 2022. Still, having scraped through the crisis, Europe has emerged into a new reality that has its own list of challenges. It’s now relying more on renewables, and will have to deal with the intermittency of that power generation. With the loss of Russian gas, on which it was overly dependent before the invasion of Ukraine, it’s also had to look elsewhere to fulfill its fuel needs. That means vying for a share of foreign liquefied natural gas cargoes with other parts of the world.

- 8. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 “Just by looking at prices, it seems that the crisis is over,” said Balint Koncz, head of gas trading at MET International in Switzerland. “However, we are now reliant on global factors, which can change rapidly.” “Prices could rise again, even in this heating season, if there’s a sudden supply disruption or an extended period of cold weather,” he said. One key risk is the Middle East amid attacks on ships in the Red Sea, a route that Qatar uses to send LNG to Europe. Oil and gas tankers are avoiding the area, instead opting to go around the southern tip of Africa. On a typical day, roughly two to three LNG vessels would be using the passage, according to data from Kpler. Alternative Energy Gas prices plunged almost 60% in 2023 and are down a further 12% so far this year, which should help to lower consumers’ energy bills. In the UK, the state-regulated price cap will fall almost 14% by spring, consultancy Cornwall Insight estimated in December. “This is the second winter that Europe is experiencing without Russian gas,” said Kim Fustier, HSBC Holdings Plc head of European oil & gas research. “The fact that there is now a precedent — the 2022-2023 winter that went without any issues — is helping to calm traders’ nerves.” Europe’s build-out of renewable energy means a dwindling share for gas in the continent’s power mix. An increase in wind turbines and solar installations has helped reduce the need for the fuel, together with a recovery in French nuclear production last year. But there’s a long road ahead, with many potential bumps. A gas pipeline transit agreement between Russia and Ukraine expires at the end of this year — and is unlikely to be renewed — meaning that the continent could get even less gas from Russia. While there’s a massive global investment in LNG, much of the new capacity won’t come to the market until 2025 and 2026.

- 9. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 And extreme weather events are becoming more frequent, straining power systems and sometimes boosting demand for gas. In Asia, strong inventories mean gas prices there are also declining at the moment, and are at the lowest since June. LNG buyers in Japan, the world’s second biggest importer of the super-chilled fuel, are actively selling shipments because they have too much. Some of those cargoes are likely to make their way to Europe. While there are pockets of demand, particularly in India and China, those purchases are primarily driven by traders looking for a good deal. The story is much the same in the US, where gas futures dropped about 20% last week as storage remains well above the five-year average. Cold weather drove up power demand and froze some gas wells, but did little to boost futures. Canal Disruption Still, issues at two key LNG passages — the Suez Canal and the drought-hit Panama Canal — are lengthening journeys, adding to the cost of shipping and stretching the global fleet of ships. While traders don’t appear to be too fussed, a prolonged disruption could change that. The decline in gas prices from the 2022 peaks hasn’t always been one way. Intense bouts of volatility — from LNG strikes in Australia to outages in the US to the outbreak of the Israel-Hamas war — have caused spikes, offering reminders that the current calm isn’t guaranteed to last. “We are still very cautious on what is going to happen next,” Stefan Rolle, head of energy policy at Germany’s Energy Ministry said at the Americas Energy Summit in New Orleans on Thursday.

- 10. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase January 22 -2024 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil struggles to steady as economic headwinds weigh on demand outlook Reuters + NewBase Oil prices struggled to push ahead on Monday as economic headwinds pressured the global oil demand outlook and offset geopolitical concerns in the Middle East and an attack on a Russian fuel export terminal over the weekend. Brent crude fell 9 cents, or 0.1%, to $78.47 a barrel by 0353 GMT after settling down 54 cents on Friday. The front-month U.S. West Texas Intermediate crude futures , for February delivery, inched up 11 cents to $73.52 a barrel with the contract set to expire later on Monday. The more active March WTI contract was at $73.21 a barrel, down 4 cents. "This morning's subdued re-open speaks volumes about current sentiment in the crude oil market despite ongoing geopolitical tensions in Europe and the Middle East," IG analyst Tony Sycamore said. Prices barely budged despite an alleged Ukrainian drone attack at a huge Russian fuel export terminal. Russian producer Novatek (NVTK.MM), opens new tab said on Sunday it had been forced to suspend some operations at the Baltic Sea terminal because of a fire. Oil price special coverage

- 11. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 In the absence any major escalation, crude is set for rangebound trading, with some downward pressure, said Vandana Hari, founder of oil market analysis provider Vanda Insights. In the Middle East, the Gaza war rages on while the U.S. struck another anti-ship missile preparing to launch into the Gulf of Aden by Yemen's Houthi militants on Saturday. The attacks by the Iran-aligned group in the Red Sea and the Gulf of Aden have disrupted global trade. It has also tightened European and African crude markets and pushed the premium of the first-month Brent contract to the six-month contract to $1.99 on Friday, the widest since November. This structure, called backwardation, indicates a perception of tighter supply for prompt delivery. IG's Sycamore said oil fundamentals remain a headwind for prices. Oil "production is higher and the growth outlook in China and Europe is mixed at best, while GDP data this week is expected to show the velocity of the U.S. economy has slowed considerably," he added. The latest demand growth forecasts by the U.S. Energy Information Administration, the International Energy Agency and the Organization of the Petroleum Exporting Countries for 2024 are in a wide range between 1.24 million and 2.25 million barrels per day although all the three organizations expect demand to decelerate in 2025. The number of oil rigs operating in the U.S. fell by two to 497 last week, their lowest since mid November, Baker Hughes data showed on Friday.

- 12. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase Specual Coverage The Energy world –January 22 -2024 CLEAN ENERGY Massive expansion of renewable power opens door to achieving global tripling goal set at COP28 Global annual renewable capacity additions increased by almost 50% to nearly 510 gigawatts (GW) in 2023, the fastest growth rate in the past two decades. This is the 22nd year in a row that renewable capacity additions set a new record. While the increases in renewable capacity in Europe, the United States and Brazil hit all-time highs, China’s acceleration was extraordinary. In 2023, China commissioned as much solar PV as the entire world did in 2022, while its wind additions also grew by 66% year-on-year. Globally, solar PV alone accounted for three-quarters of renewable capacity additions worldwide. 2023 saw a step change in renewable capacity additions, driven by China’s solar PV market Prior to the COP28 climate change conference in Dubai, the International Energy Agency (IEA) urged governments to support five pillars for action by 2030, among them the goal of tripling global renewable power capacity. Several of the IEA priorities were reflected in the Global Stocktake text agreed by the 198 governments at COP28, including the goals of tripling renewables and doubling the annual rate of energy efficiency improvements every year to 2030. Tripling global renewable capacity in the power sector from 2022 levels by 2030 would take it above 11 000 GW, in line with IEA’s Net Zero Emissions by 2050 (NZE) Scenario.

- 13. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Under existing policies and market conditions, global renewable capacity is forecast to reach 7 300 GW by 2028. This growth trajectory would see global capacity increase to 2.5 times its current level by 2030, falling short of the tripling goal. Governments can close the gap to reach over 11 000 GW by 2030 by overcoming current challenges and implementing existing policies more quickly. These challenges fall into four main categories and differ by country: 1) policy uncertainties and delayed policy responses to the new macroeconomic environment; 2) insufficient investment in grid infrastructure preventing faster expansion of renewables; 3) cumbersome administrative barriers and permitting procedures and social acceptance issues; 4) insufficient financing in emerging and developing economies. This report’s accelerated case shows that addressing those challenges can lead to almost 21% higher growth of renewables, pushing the world towards being on track to meet the global tripling pledge. What is needed to reach the collective target to triple renewables by 2030 varies significantly by country and region. G20 countries account for almost 90% of global renewable power capacity today. In the accelerated case, which assumes enhanced implementation of existing policies and targets, the G20 could triple their collective installed capacity by 2030. As such, they have the potential to contribute significantly to tripling renewables globally. However, to achieve the global goal, the rate of new installations needs to accelerate in other countries, too, including many emerging and developing economies outside the G20, some of which do not have renewable targets and/or supportive policies today.

- 14. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 The world is on course to add more renewable capacity in the next five years than has been installed since the first commercial renewable energy power plant was built more than 100 years ago. In the main case forecast in this report, almost 3 700 GW of new renewable capacity comes online over the 2023-2028 period, driven by supportive policies in more than 130 countries. Solar PV and wind will account for 95% of global renewable expansion, benefiting from lower generation costs than both fossil and non-fossil fuel alternatives. Over the coming five years, several renewable energy milestones are expected to be achieved: In 2024, wind and solar PV together generate more electricity than hydropower. In 2025, renewables surpass coal to become the largest source of electricity generation. Wind and solar PV each surpass nuclear electricity generation in 2025 and 2026 respectively. In 2028, renewable energy sources account for over 42% of global electricity generation, with the share of wind and solar PV doubling to 25%. The global power mix will be transformed by 2028 China accounts for almost 60% of new renewable capacity expected to become operational globally by 2028. Despite the phasing out of national subsidies in 2020 and 2021, deployment of onshore wind and solar PV in China is accelerating, driven by the technologies’ economic attractiveness as well as supportive policy environments providing long-term contracts. Our forecast shows that China is expected to reach its national 2030 target for wind and solar PV installations this year, six years ahead of schedule. China’s role is critical in reaching the global goal

- 15. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 of tripling renewables because the country is expected to install more than half of the new capacity required globally by 2030. At the end of the forecast period, almost half of China’s electricity generation will come from renewable energy sources.

- 16. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Solar PV and onshore wind additions through 2028 is expected to more than double in the United States, the European Union, India and Brazil compared with the last five years. Supportive policy environments and the improving economic attractiveness of solar PV and onshore wind are the primary drivers behind this acceleration. In the European Union and Brazil, growth in rooftop solar PV is expected to outpace large-scale plants as residential and commercial consumers seek to reduce their electricity bills amid higher prices. In the United States, the Inflation Reduction Act has acted as a catalyst for accelerated additions despite supply chain issues and trade concerns in the near term. In India, an expedited auction schedule for utility-scale onshore wind and solar PV along with improved financial health of distribution companies is expected to deliver accelerated growth. Renewable energy expansion also starts accelerating in other regions of the world, notably the Middle East and North Africa, owing mostly to policy incentives that take advantage of the cost- competitiveness of solar PV and onshore wind power. Although renewable capacity growth picks up in sub-Saharan Africa, the region still underperforms considering its resource potential and electrification needs. The US, the EU, India and Brazil remain bright spots for onshore wind and solar PV growth In 2023, spot prices for solar PV modules declined by almost 50% year-on-year, with manufacturing capacity reaching three times 2021 levels. The current manufacturing capacity under construction indicates that the global supply of solar PV will reach 1 100 GW at the end of 2024, with potential output expected to be three times the current forecast for demand. Despite unprecedented PV manufacturing expansion in the United States and India driven by policy support, China is expected to maintain its 80-95% share of global supply chains (depending on the manufacturing segment). Although developing domestic PV manufacturing will increase the security of supply and bring economic benefits to local communities, replacing imports with more expensive production in the United States, India and the European Union will increase the cost of overall PV deployment in these markets. Solar PV prices plummet amid growing supply glut In 2023, an estimated 96% of newly installed, utility-scale solar PV and onshore wind capacity had lower generation costs than new coal and natural gas plants. In addition, three-quarters of new wind and solar PV plants offered cheaper power than existing fossil fuel facilities. Wind and solar PV systems will become more cost-competitive during the forecast period. Despite the increasing contribution needs for flexibility and reliability to integrate variable renewables, the overall competitiveness of onshore wind and solar PV changes only slightly by 2028 in Europe, China, India and the United States. Onshore wind and solar PV are cheaper than both new and existing fossil fuel plants In 2023, new renewable energy capacity financed in advanced economies was exposed to higher base interest rates than in China and the global average for the first time. Since 2022, central bank base interest rates have increased from below 1% to almost 5%. In emerging and developing economies, renewables developers have been exposed to higher interest rates since 2021, resulting in higher costs hampering faster expansion of renewables. The implications of this new macroeconomic environment are manifold for both governments and industry. First, inflation has increased equipment costs for onshore and offshore wind and partly for solar PV (excluding module costs). Second, higher interest rates are

- 17. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 increasing the financing costs of capital-intensive variable renewable technologies. Third, policy has been relatively slow to adjust to the new macroeconomic environment due in part to expectations that cost reductions would continue together with permitting challenges. This has left several auctions in advanced economies undersubscribed, particularly in Europe. Additionally, some developers whose power purchase contracts were signed prior to these macroeconomic changes have had to cancel their projects. Efforts to improve auction design and contract indexation methodologies are needed to resolve these challenges and unlock additional wind and solar PV deployment. The renewable energy industry, particularly wind, is grappling with macroeconomic challenges affecting its financial health – despite a history of financial resilience. The wind industry has experienced a significant decline in market value as European and North American wind turbine manufacturers have seen negative net margins for seven consecutive quarters due to volatile demand, limited raw material access, economic challenges, and rising interest rates. To address these issues, the European Union launched a Wind Power Action Plan in October 2023, aiming to enhance competitiveness, improve auction design, boost clean technology investment, streamline permitting, and ensure fair competition. Chinese wind turbine manufacturers, benefiting from strong domestic demand and vertical integration, remain relatively stable amid global challenges. The new macroeconomic environment presents further challenges that policy makers need to address Weighted average net margins of renewable energy companies, large utilities and oil majors, Q1-Q4 2022 and Q1-Q3 2023

- 18. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 The wind industry, especially in Europe and North America is facing challenges due to a combination of ongoing supply chain disruptions, higher costs and long permitting timelines. As a result of these challenges, the forecast for onshore wind outside of China has been revised downwards as overall project development has been slower than expected. Offshore wind has been hit hardest by the new macroeconomic environment, with its expansion through 2028 revised down by 15% outside China. The challenges facing the industry particularly affect offshore wind, with investment costs today more than 20% higher than only a few years ago. In 2023, developers have cancelled or postponed 15 GW of offshore wind projects in the United States and the United Kingdom. For some developers, pricing for previously awarded capacity does not reflect the increased costs facing project development today, which reduces project bankability. The forecast for wind capacity additions is less optimistic outside China, especially for offshore The share of solar PV and wind in global electricity generation is forecast to double to 25% in 2028 in our main case. This rapid expansion in the next five years will have implications for power systems worldwide. In the European Union, annual variable renewables penetration in 2028 is expected to reach more than 50% in seven countries, with Denmark having around 90% of wind and solar PV in its electricity system by that time. Although European Union interconnections help integrate solar PV and wind generation, grid bottlenecks will pose significant challenges and lead to increased curtailment in many countries as grid expansion cannot keep pace with accelerated installation of variable renewables. Faster deployment of variable renewables increases integration and infrastructure challenges Renewable power capacity dedicated to hydrogen-based fuel production is forecast to grow by 45 GW between 2023 and 2028, representing only an estimated 7% of announced project capacity for the period. China, Saudi Arabia and the United States account for more than 75% of renewable capacity for hydrogen production by 2028. Despite announcements of new projects and pipelines, the progress in planned projects has been slow. We have revised down our forecasts for all regions except China. The main reason is the slow pace of bringing planned projects to final investment decisions due to a lack of off-takers and the impact of higher prices on production costs. The development of an international hydrogen market is a key uncertainty affecting the forecast, particularly for markets that have limited domestic demand for hydrogen. Current hydrogen plans and implementation don’t match Emerging economies, led by Brazil, dominate global biofuel expansion, which is set to grow 30% faster than over the last five years. Supported by robust biofuel policies, increasing transport fuel demand and abundant feedstock potential, emerging economies are forecast to drive 70% of global biofuel demand growth over the forecast period. Brazil alone accounts for 40% of biofuel expansion to 2028. Stronger policies are the primary driver of this growth as governments expand efforts to provide affordable, secure and low-emission energy supplies. Biofuels used in the road transport sector remain the primary source of new supply, accounting for nearly 90% of the expansion.

- 19. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Electric vehicles (EVs) and biofuels are proving to be a powerful complementary combination for reducing oil demand. Globally, biofuels and renewable electricity used in EVs are forecast to offset 4 million barrels of oil-equivalent per day by 2028, which is more than 7% of forecast oil demand for transport. Biofuels remain the dominant pathway for avoiding oil demand in the diesel and jet fuel segments. EVs outpace biofuels in the gasoline segment, especially in the United States, Europe and China. This report’s main case forecast is not in line with the near tripling of biofuels demand by 2030 seen in the IEA’s Net Zero Emissions by 2050 (NZE) Scenario. In the aviation sector for instance, the Net Zero Scenario would require 8% of fuel supply coming from biojet fuel by 2030, while existing policies in this forecast will only bring biojet fuel’s share to 1% by 2028. Bridging this gap requires new and stronger policies, as well as diversification of feedstocks. Much faster biofuel deployment is possible through new policies and addressing supply chain challenges. In this report’s accelerated case, biofuel supply growth is nearly triple that of the main case, closing the gap with the Net Zero Scenario by nearly 40%. Nearly half of this additional growth, almost 30 billion litres, is driven by strengthened policies in existing markets such as the United States, Europe and India. Another 20 billion litres comes mainly from biodiesel in India and ethanol in Indonesia. Biojet fuel offers a third growth avenue, expanding to cover nearly 3.5% of global aviation fuels, up from 1% in the main case. Fuels made from waste and residues also grow four times faster in the accelerated case. Aligning biofuels with a net zero pathway requires a huge increase in the pace of deployment

- 20. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 Modern renewable heat consumption expands by 40% globally during the outlook period, rising from 13% to 17% of total heat consumption. These developments come predominantly from the growing reliance on electricity for process heat – notably with the adoption of heat pumps in non-energy-intensive industries – and the deployment of electric heat pumps and boilers in buildings, increasingly powered by renewable electricity. China, the European Union and the United States lead these trends, owing to supportive policy environments; updated targets in the European Union and China; strong financial incentives in many markets; the adoption of renewable heat obligations; and fossil fuel bans in the buildings sector. However, the trends to 2028 are still largely insufficient to tackle the use of fossil fuels for heat and put the world on track to meet Paris Agreement goals. Without stronger policy action, the global heat sector alone between 2023 and 2028 could consume more than one-fifth of the remaining carbon budget for a pathway aligned with limiting global warming to 1.5°C. Global renewable heat consumption would have to rise 2.2 times as quickly and be combined with wide-scale demand-side measures and much larger energy and material efficiency improvements to align with the NZE Scenario.

- 21. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 NewBase Energy News 22-January - Issue No. 1692 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as self leading external Energy consultant for the GCC area via many leading Energy Services companies. Khaled is the Founder of the NewBase Energy news articles issues, Khaled is an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with over 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management, plant Automation IA and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 22. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22

- 23. Copyright © 2024 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23