New base energy news issue 879 dated 23 june 2016

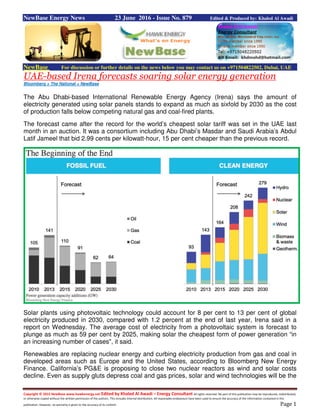

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 23 June 2016 - Issue No. 879 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE-based Irena forecasts soaring solar energy generation Bloomberg + The National + NewBase The Abu Dhabi-based International Renewable Energy Agency (Irena) says the amount of electricity generated using solar panels stands to expand as much as sixfold by 2030 as the cost of production falls below competing natural gas and coal-fired plants. The forecast came after the record for the world’s cheapest solar tariff was set in the UAE last month in an auction. It was a consortium including Abu Dhabi’s Masdar and Saudi Arabia’s Abdul Latif Jameel that bid 2.99 cents per kilowatt-hour, 15 per cent cheaper than the previous record. Solar plants using photovoltaic technology could account for 8 per cent to 13 per cent of global electricity produced in 2030, compared with 1.2 percent at the end of last year, Irena said in a report on Wednesday. The average cost of electricity from a photovoltaic system is forecast to plunge as much as 59 per cent by 2025, making solar the cheapest form of power generation “in an increasing number of cases", it said. Renewables are replacing nuclear energy and curbing electricity production from gas and coal in developed areas such as Europe and the United States, according to Bloomberg New Energy Finance. California’s PG&E is proposing to close two nuclear reactors as wind and solar costs decline. Even as supply gluts depress coal and gas prices, solar and wind technologies will be the

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 cheapest ways to produce electricity in most parts of the world in the 2030s, New Energy Finance said in a report this month. “The renewable energy transition is well underway, with solar playing a key role," said the Irena director general Adnan Amin. “Cost reductions, in combination with other enabling factors, can create a dramatic expansion of solar power globally." Bloomberg New Energy Finance also forecasts growth in solar photovoltaics, reaching 15 per cent of total electricity output by 2040, according to Jenny Chase, the head of solar analysis in Zurich. “Irena’s assumptions are reasonable," she said. “Solar just gets so cheap under any reasonable scenario." The “most attractive" markets for solar panels up to 2020 are Brazil, Chile, Israel, Jordan, Mexico, the Philippines, Russia, South Africa, Saudi Arabia and Turkey, according to Irena. Global capacity could reach 1,760gigawatts to 2,500GW in 2030, compared with 227GW at the end of 2015, it said. Smart grids, or power networks capable of handling and distributing electricity from different sources, and new types of storage technologies will encourage further use of solar power, Irena said. As of 2015, the average cost of electricity from a utility-scale solar photovoltaic system was 13 US cents per kilowatt hour. That is more than coal and gas-fired plants that averaged 5 cents to 10 cents per kilowatt hour, according to Irena. The average cost of building a solar-powered electricity utility could fall to 79 cents per watt in 2025 from $1.80 per watt last year, it said. Coal- fired power generation costs are about $3 per watt while gas plants cost $1 to $1.30 per watt, according to Irena.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UAE: Masdar aims to expand its footprint as demand for clean energy goes up .. Gulf News - fareed rahman Masdar is planning to tap new markets in the Gulf region, North Africa, the Indian subcontinent, South East Asia and China as the demand for clean energy goes up, the new Chief Executive Officer of Masdar told Gulf News in an interview. “Our footprint will grow in the coming years. There are huge opportunities for Masdar not only in this region but across the globe. The GCC region, North Africa, Levant and the Indian subcontinent will be the key markets for our growth,” said Mohammad Jameel Al Ramahi, who took over as the CEO of the company from Ahmad Belhoul in February. Belhoul was appointed as the new Minister of State for Higher Education. Outlining his vision for the company, Al Ramahi said they are targeting a production capacity growth of 20 per cent per annum in the next five years both in solar and wind energy. According to him, the growth will mainly come from Saudi Arabia, UAE and other parts in the region. “Saudi Arabia has announced the vision 2030 vision and one of the key components is renewable energy. They have announced nine gigawatt of renewable energy project by 2023. There are solar projects in Dubai and Abu Dhabi which we are bidding. There is a huge market for growth.” “We are actively seeking to deploy capital and are actively competing for projects. Our target of 20 per cent growth is not only achievable but doable and a must.” Speaking on Saudi Arabia, he said the country has all the resources for solar, wind and geothermal energy that can be tapped in. “The vision announced in Saudi Arabia is a clear indication that renewable energy is going to play an important role in the kingdom. They recently issued an expression of interest in two solar projects. We would like to invest in Saudi Arabia as the market opens up.” Saudi Arabia plans to generate 9.5 gigawatts of electricity from renewable energy by 2030 as part of Vision 2030 reform plan, a report by Reuters said. The country is investing billions of riyals to expand and nuclear capabilities. The 20-megawatt Gemasolar plant, built by Torresol Energy, a joint venture between Sener and Masdar in Spain. The success of Masdar in renewable energy projects has brought the attention of many countries across the globe

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 King Abdullah City for Atomic and Renewable Energy (Kacare) is leading the Kingdom’s drive toward diversification of energy sources, with special emphasis on solar energy. In the UAE, Masdar has several projects including the Shams concentrated solar project in the Western region and the first photo voltaic power plant in Masdar City. It is constructing the first commercial scale carbon capture facility with provision to capture 800,000 tons of carbon from Emirates steel. The project is set to be inaugurated later this year. “We are actively seeking new projects in the UAE. We participated in the 800 megawatt Dubai Electricity and Water Authority (Dewa) bid for solar plant and 300 megawatt Sweihan plant in Abu Dhabi is in tendering stage. We would love to invest in Dubai and be part of the renewable energy vision of the emirate.” The success of Masdar in renewable energy projects has brought the attention of many countries across the globe, he said. “When we did the projects in Pacific region, it attracted the interests of the large countries like New Zealand and Australia. In fact, New Zealand has cofounded the project with the UAE in Pacific Islands which Masdar has developed. A lot of other countries are coming forward to asking us if we can help them develop and identify projects in other areas in Asia and Africa.” Through the UAE-Pacific Partnership Fund’s two cycles of financing provided by the Abu Dhabi Fund for Development, eleven renewable energy projects have been delivered to Pacific Island nations of Solomon Islands, Palau, Marshall Islands, Nauru, and the Federated States of Micronesia last month, according to Masdar. The clean energy company owned by Mubadala has invested around $2.7 billion (Dhs10 billion) in projects around the world over the last ten years, with 1-gigawatt (GW) of installed capacity and 0.7GW under development. Masdar’s renewable energy projects span Abu Dhabi, Oman, Jordan, Mauritania, Egypt, Morocco, the UK, Spain, Seychelles, and the Pacific Islands.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Saudi Energy Minister Tells Houston Chronicle Oil Glut Is Over Collin Eaton Business Reporter, Houston Chronicle S audi Arabia's new energy minister said the supply glut that kindled a crippling oil rout around the world and thrashed Houston's biggest business for two years has finally vanished. "We are out of it," Khalid Al-Falih said in his first newspaper interview since his rise to the most powerful job in the global energy industry last month. "The oversupply has disappeared. We just have to carry the overhang of inventory for a while until the system works it out." Falih, Texas A&M University graduate and former Saudi Aramco chief executive, replaced the long- time Saudi oil policymaker Ali al-Naimi in May. He was in Houston this week to visit Saudi Aramco operations here and later joined in an evening meal to break the Ramadan fast at Houston's Museum of Fine Arts. Two years and day after U.S. oil price peaked at $107 barrel, he sketched out the end of the world's oil surplus and the beginning of a new chapter in the cyclical energy business in an exclusive interview with the Houston Chronicle. Prices tumbled as low as $26 a barrel in February in the biggest oil-market crash since the 1980's. Texas alone has lost 100,000 jobs since the slide in prices began in the summer of 2014. But countries like India and parts of Asia have a bigger appetite for oil now, Falih said, while crude production in the United States, Nigeria and other regions has fallen, closing the 1 million-barrel a day gap between supply and demand. The first phase of a long-anticipated industry recovery is underway as refineries on the Gulf Coast and around the world work through storage tanks of crude oil. The United States has a near- record stockpile of more than 530 million barrels, which could take months to cut down. "The question now is how fast you will work off the global inventory overhang," said Falih, who serves as chairman of Saudi Aramco, the company that produces one out of eight barrels of oil the world consumes every day. "That will remain to put a cap on the rate at which oil prices recover. We just have to wait for the second half of the year and next year to see how that works out." • Boom and busts In the first half of the decade, shale drillers in Texas and North Dakota put fracking in the nation's lexicon and led the United States to its biggest oil boom since the 1970s. But oil markets eventually became overstuffed as producers pumped more than 1 million barrels than the world needed each day. For Saudi Arabia and other OPEC nations, the surge in U.S. oil production proved shale drillers could respond faster to high crude prices than all but the lowest-cost producers – "a game- changer," Falih said, in the way the Organization of Petroleum Exporting Countries manages oil markets. Since November 2014, Saudi Arabia has refused calls by other OPEC nations to resume

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 its role as the world's swing producer and cut its oil production in a bid to stabilize falling crude prices. "The tools that OPEC has used in the past – targeting specific prices – have not always worked in the long term," Falih said. "They create market dislocations that ultimately hurt producers and consumers." The Kingdom, which can profit off of oil even at low prices, opted to let market forces weed out higher-cost producers. U.S. oil production, driven by higher-cost shale plays, has dropped by more than half a million barrels a day since early 2015 and nearly 80 drillers have gone bankrupt."No matter what we do, ultimately markets win," Falih said. • "Not Afraid" Saudi Arabia's financial reserves have also declined as it collects less oil revenue, but it's in better shape than many of its rivals. The government is planning a series of reforms and investments to expand other parts of its economy outside of oil production, including tourism, services, mining, petrochemicals, even renewable energy. One goal of the plan, which Saudi officials call Saudi Vision 2030, is to bring its non-oil exports up from 16 percent to half of the exports it offers the world over the next decade. Deputy Crown Prince Mohammad bid Salman has said the Kingdom is striving to be able to live without oil by 2020 – a mere four years. The comment "impress on the urgency that this needs to happen quickly and it needs to happen now," Falih said. "But nobody has the intention of turning off the oil economy in Saudi Arabia," Falih said. "We're trying to build it up. But what we hope while we're doing this is the non-oil economy will grow even faster." It's a big play for the world's biggest oil producing country and some observers of the closely guarded Kingdom have wondered if it reflects anxiety over the possibility the world's oil and gas demand will eventually peak amid global efforts to limit rising temperatures by moving the world from combustion engines to electric vehicles – making the Kingdom's number one export a relic of a bygone age. Some industry players, including major oil companies like Statoil,believe it will take much more than the Paris climate accords signed last year to thwart the worst effects of climate change, including much tighter emissions rules for vehicles and massive growth of solar and wind power in electricity generation and a sharp reduction in coal production.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 • Still investing But Al-Falih said Saudi Aramco is still investing heavily in maintaining the Kingdom's capacity of 12.5 million barrels a day because Saudi officials believe global economic growth will continue to support rising energy demand of about 1.5 million barrels a day annually. Even as it pumps 10 million barrels of crude a day, he said, the world's largest oil company is working to offset natural declines in its spare oil production capacity so it's ready to meet demand if supplies drop somewhere else in the world. That's because Saudi Arabia, he said, isn't too worried about big changes in the world's energy mix. Unlike quickly evolving information technology, global energy systems take decades to build, and while the Kingdom plans to invest in renewable energy resources, it also recognizes "any transition is going to take decades." "We're going to invest in making it happen. We're not afraid of it, but we're also realists and we know that oil will be a significant part of the energy mix for decades to come," Falih said. "Even if the share of oil goes down from, say, 30 to 25 percent, 25 percent of a much bigger global demand means a much higher absolute number of barrels that will be in demand by 2030 or 2040." So while electric vehicles could one day make serious inroads in transportation, because of sheer demographic and economic growth in coming years, "we believe overall demand for petroleum in transportation and petrochemicals is going to rise for a long time before it starts falling in absolute numbers. Yes, we know it will fall in percentage terms – but very gradually." Collin Eaton Business Reporter, Houston Chronicle

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Mozambique: Wentworth Resources receives govt approval for appraisal of Tembo-1 gas discovery .. Source: Wentworth Resources Wentworth Resources, the Oslo Stock Exchange and AIM listed independent, East Africa-focused oil & gas company, has provided an operational update on its appraisal asset in northern Mozambique and its producing gas asset in Mnazi Bay, Tanzania; ahead of the Company's Annual General Meeting to be held later this morning in London. Mozambique - Operatorship and appraisal plan approved by Government

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Further to the gas discovery made at the Tembo-1 well location in December 2014, Wentworth reports that Government approval by the Ministerio dos Reuros Minerais e Energia (Minister of Minerals & Energy) for an Appraisal Plan has now been received. Under the two-year appraisal period, Wentworth becomes the Operator of the Rovuma Onshore Concession and increases its participation interest in the Concession from 11.59% to 85%. State owned Empresa Nacional de Hidrocarbonetos ('ENH') retains a 15% participation interest as a carried partner through to the commencement of commercial operations. In addition, ENH has the right to acquire a further 15% participation interest in the Concession from Wentworth within 18 months from the date of submission for a development plan for consideration equal to the proportionate share of past costs incurred. Implementation of a work program will commence in 2016 with the reprocessing of approx. 1,000 km of existing seismic data, the cost of which will be funded from internally generated cash flow. Commencing the second half 2017, the Company plans to acquire a minimum of 500 km of new onshore 2D seismic data. The drilling of an appraisal well is anticipated to occur in 2018 after the identification of a suitable drilling location based on the evaluation and integration of the new and existing seismic data. The Tembo-1 well was drilled to a total depth of 4,553 metres into rocks of Upper Jurassic age. Natural gas and some condensate was recovered by modular formation dynamics testing ('MDT') confirming the petro physical analysis of 11 meters of pay in sands of Cretaceous age. Tembo-1 was a milestone well for the Rovuma basin and an extensive amount of pertinent geologic data was collected which will have a significant impact on future exploration efforts in the basin. Further analysis of the geologic and petro physical data has led to the identification of additional zones of potential bypassed pay. These zones and the tested gas bearing sands will be subject to further evaluation with additional seismic and drilling. The agreed appraisal area, located around the Tembo-1 discovery onshore, measures approx. 2,500 km2 providing the necessary running room to develop this potentially world class play fairway. Tanzania - Production volumes continue to ramp up but have plateaued following impact of seasonal hydro-power generation and Symbion electrical power generation suspension In Mnazi Bay, Tanzania, gas deliveries continue to the new transnational pipeline and are ultimately used in power generation facilities near Tanzania's commercial capital, Dar es Salaam. Production volumes from the Mnazi Bay gas field have been ramping up and peaked at 74 MMscf/d during Q2. However, volumes were curtailed for a period of time during April 2016 due to heavy rains when some natural gas power generation was displaced by hydro generated power. Furthermore, sales volume to the pipeline have been maintained at 50 MMscf/d since 2 June 2016 due to a dispute between Symbion, one of the power plants which utilises Mnazi Bay gas which has temporarily ceased operations, and TANESCO. It is unclear how long it will be before the dispute is resolved and power generation at the Symbion power plant resumes and, until such time, volumes are expected to remain at this level. Daily production volumes of 70 - 80 MMscf/d are still expected to be achieved in 2016, once this dispute has been resolved and power demand stabilizes. As stated previously, payments to the Joint Venture for monthly gas sales delivered to the new pipeline by Tanzania Petroleum Development Corporation ('TPDC'), have been regularly received.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Malaysia: InterMoor completes marine aspects of Malikai TLP float-off operation in Malaysia …. Source: Intermoor InterMoor has completed its involvement in the Shell Malikai Tension Leg Platform (TLP) float-off operations. The TLP was loaded onto the Dockwise Heavy Lift Vessel White Marlin at Malaysia Marine and Heavy Engineering (MMHE) shipyard in Pasir Gudang, Malaysia and transported to a float-off location in the Singapore Straits. Contracted by TMJV, a joint venture between Technip and MMHE Shipyard, InterMoor Pte was responsible for the marine aspects of the float-off and tow of Shell’s Malikai TLP Through the Johor Straits into the Singapore Straits and to a float-off location for various nearshore commissioning tasks to be performed, prior to return to the shipyard. The work scope also included engineering analysis and procedures, project management for the nearshore operations, management of chartered vessels, provision of offshore personnel and various ancillary services. InterMoor also subcontracted Acteon sister company UTEC to provide survey and positioning for the TLP and marine spread. The offshore operation was completed safely and without incident in April this year. Martin Kobiela, managing director, InterMoor Pte in Singapore, said: 'From start to finish, InterMoor Pte’s contribution lasted six months. Although a lot of the work is standard for us, particularly the towing and marine activities, many of the work scopes were novel, particularly the provision of catering and sanitation services. Our team was diligent in their care of the project both from Singapore and on location in the MMHE shipyard, Malaysia, and is proud to have been associated with this important development for the region.' The TLP will be installed at the Malikai field in a water depth of approx. 600 m.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 • Malikai According to information on the Shell web site, Malikai is Shell’s second deep-water project in Malaysia, following Gumusut-Kakap, which started production successfully in 2014. The Malikai oil field lies around 100 kms (60 miles) off Sabah, Malaysia, in waters about 500 metres (1,640 feet) deep. It comprises two main reservoirs with a peak annual production of 60,000 bbl/d. The field is part of the Block G Production Sharing Contract awarded by PETRONAS in 1995. Shell, the operator, and ConocoPhillips each hold a 35% interest in the development, and PETRONAS Carigali has 30%. The project features the first tension-leg platform (TLP) in Malaysia, which will float on the surface of the while moored securely to the sea floor. The platform will produce and pipe oil 50km (around 30 miles) to the shallow-water Kebabangan platform for processing. A small amount of natural gas produced from the field will power the TLP, and be pumped into the production tubing to help oil flow from the reservoir ('gas lift'). Any extra gas will be sent out via the Kebabangan platform.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 U.S. crude oil storage capacity utilization rises even as storage capacity grows…Source: U.S. EIA, Weekly Petroleum Status Report Weekly U.S. commercial crude oil inventories have increased by more than 71 million barrels (15%) since the end of September, pushing crude oil storage capacity utilization to a near record high of 73% for the week ending June 10. The U.S. Energy Information Administration measures crude oil storage capacity twice each year. From September 2015 to March 2016, the United States added 34 million barrels (6%) of working crude oil storage capacity, the largest expansion of commercial crude oil storage capacity since EIA began tracking such data in 2011. The expansion of crude oil storage capacity helped to accommodate the growth in U.S. crude oil inventories, which surpassed 500 million barrels at the end of January 2016. U.S. crude oil inventories increased in 24 of the 30 weeks from September to March, reaching 532 million barrels for the week ending June 10. These commercial volumes exclude the 695 million barrels in the U.S. Strategic Petroleum Reserve. Despite the large expansion in crude oil storage capacity, the net effect of capacity growth and increased inventories resulted in high storage utilization rates. Storage utilization at Cushing, Oklahoma, averaged 87% over the past four weeks, compared with 81% for the same period last year. U.S. Gulf Coast region storage utilization rates averaged 72% over the past four weeks, after never being more than 70% in the previous four years. The large increase in crude oil storage capacity between September and March was prompted by increased demand for crude oil storage as global supply has outpaced global demand for most of the past two years. Because of generally rising crude oil inventories since the end of 2014, the structure of crude oil futures prices has been in steep contango, where near-term deliveries are priced lower than long-term deliveries. The large and continued contango structure prompted many market participants to place more crude oil into storage. The largest commercial crude oil storage capacity expansions since September were in the Midwest and Gulf Coast regions, which added 19 million barrels and 13 million barrels, respectively. Combined, these regions account for 82% of total U.S. commercial crude oil storage capacity. Within the Midwest, storage capacity at Cushing, the delivery point for the Nymex WTI futures contract, expanded 1.5 million barrels.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase 23 June 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil ends lower after small US drawdown; choppy ahead of Brexit vote Reuters + NewBase Oil prices settled down more than 1 percent on Wednesday after a smaller-than-expected U.S. inventory drawdown and amid jitters ahead of a vote on whether Britain should stay in the European Union. Crude futures rose early in the day, before the U.S. Energy Information Administration (EIA) reported a stockpile decline of 917,000 barrels for the week ended June 17. While it was the fifth consecutive weekly draw for crude, the number posted by the EIA was smaller than a 1.7 million-barrel drawdown forecast by analysts in a Reuters poll. It was also about a third of the 5.2 million-barrel drop reported on Tuesday by trade group the American Petroleum Institute (API). In Tuesday's session, crude prices settled lower but rose in after-hours trade, helped by the huge draw reported by the API. The positive sentiment extended into early Wednesday, with futures of Brent and U.S. crude's West Texas Intermediate (WTI) both trading above the psychological $50 a barrel level at one point. Brent crude eventually settled down 74 cents, or 1.5 percent, at $49.88 a barrel, and last traded down 73 cents at $49.89. U.S. crude fell 72 cents, or 1.4 percent, to settle at $49.13. WTI last traded down 73 cents at $49.12. Oil price special coverage

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 "Today's report is decidedly bearish, which has caught markets off guard after yesterday's API expectation of a 5 million-barrel crude draw," Troy Vincent, analyst at New York-based crude cargo tracker ClipperData, said, referring to the EIA data. "Although gasoline demand is still strong relative to year-ago levels, a build to both gasoline and distillate inventories does not bode well for product prices either. With this report, we should expect WTI to move back below $49 this week." U.S. gasoline demand over past four weeks rose 3.9 percent year-on-year, but stocks of the motor fuel rose 627,000 barrels last week, while distillates grew 151,000 barrels. Investors also braced for more market swings as the dollar gyrates on speculation over Britain's referendum on the EU on Thursday. The greenback determines demand for dollar-denominated oil among holders other currencies when other fundamental factors are less compelling. "In any event, our perception of a choppy/sideways trading affair within about a $5-6 range per nearby WTI and Brent remains unchanged," Jim Ritterbusch of Chicago-based oil markets consultancy Ritterbusch & Associates said in a commentary. "We would steer clear of either long or short positions at current price levels," he wrote, adding that he will reevaluate his stance after the referendum. In other industry news, top crude exporter Saudi Arabia said it may reprise its role of balancing supply and demand once the global market for oil recovers. OPEC Says Its Oil Revenue Plunges $438 Billion to 10-Year Low Bloomberg - Grant Smith OPEC said its oil revenue plunged by $438 billion to a 10-year low last year, as an increase in export volumes failed to compensate for the collapse in prices. The Organization of Petroleum Exporting Countries earned $518.2 billion in 2015 from the sale of crude and refined fuels, the lowest figure since 2005, the group’s Vienna-based secretariat said in its Annual Statistical Bulletin. It boosted exports by 1.7 percent to 23.6 million barrels a day, maintaining its share of global markets, as Iraq increased output and Saudi Arabia pressed on with a policy to squeeze rivals. Oil futures tumbled by 35 percent last year as U.S. crude production held up despite the Saudi-led strategy to pressure OPEC’s competitors with lower prices. Crude has since recovered, rising almost 90 percent in London from the lows reached in January, as U.S. output retreats and disruptions from Canada to Nigeria help whittle away a global surplus. The organization’s exports increased by an average of 400,000 barrels a day in 2015, raising its share of global production for the first time in four years, by 0.2 percentage points to 43 percent. Still, that wasn’t enough to compensate for the price rout. As a result of the lost revenue, OPEC nations recorded their first current account deficit since 1998, at $99.6 billion, compared with a surplus in 2014 of $238.1 billion, according to the report.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Exports from Saudi Arabia, which has steered the group’s policy often in defiance of poorer members like Venezuela and Algeria, were steady last year at 7.163 million barrels a day. The kingdom’s production rose by 4.9 percent to 10.193 million a day, according to the report. While drilling activity declined in OPEC nations last year, with the number of rigs dropping by 60 to 887, the drop-off in other parts of the world was far more severe, the report showed. Oil analysts agree price will rise, but disagree on magic number CNBC - Tom DiChristopher | Just months after asking, "How low can it go?" oil analysts are raising price forecasts for 2017 and beyond. But they differ on how high it will go, and when. Many firms see a gradual increase toward $80 a barrel in the coming years, but one believes the oil cycle will peak next year. On Monday, Raymond James increased its already bullish forecast, calling for U.S. crude at $80 a barrel in 2017, up $5 from its previous forecast. Thereafter, it believes oil will fall to $75 in 2018 and $70 in 2019. The firm made waves earlier this year when it said U.S. crude's West Texas Intermediate contract would be pushing $70 a barrel by December. Since then, oil prices have rebounded by 85 percent from a low of about $26 a barrel to nearly $50. They rose to just more than $51 earlier this month. That gap in price forecasts is important. If an investor believes oil prices will peak next year, the case for buying into energy stocks becomes more urgent, since they typically correlate closely with crude futures. So if Raymond James is right, investors on the sidelines would likely miss out on gains. Raymond James cuts a lonely figure at $80 a barrel in 2017, though. Morgan Stanley recently increased its outlook to align with average futures market prices, putting 2017 oil at $51. It doesn't expect crude to hit $77 until 2019. Piper Jaffray's Simmons & Co. International raised its forecast last week, but only to $60 in 2017 and $70 in 2018.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase Special Coverage News Agencies News Release 23 June 2016 NEW ENERGY OUTLOOK 2016 POWERING A CHANGING WORLD New Energy Outlook (NEO) is Bloomberg New Energy Finance's annual long-term view of how the world's power markets will evolve in the future. Overview Focused on the electricity system, NEO combines the expertise of over 65 country and technology specialists in 11 countries to provide a unique view of how the market will evolve. What sets NEO apart is that our assessment is focused on the parts of the system that are driving rapid change in markets, grid systems and business models. This includes the cost of wind and solar technology, battery storage, electricity demand and consumer dynamics among others. Cheaper coal and cheaper gas will not derail the transformation and decarbonisation of the world’s power systems. By 2040, zero-emission energy sources will make up 60% of installed capacity. Wind and solar will account for 64% of the 8.6TW of new power generating capacity added worldwide over the next 25 years, and for almost 60% of the $11.4 trillion invested. • Weaker coal and gas prices have reduced the cost of electricity from new fossil fuel power stations. Recovering oil prices in the near term and the influence of rising US production costs on LNG markets in the longer-term will put upward pressure on gas prices, which we forecast rising to $6-9/MMBtu in 2040. Seaborne coal however appears to be in structural decline. Coal prices have been falling since their last peak in 2011 and a combination of China’s economic slow-down coupled with developed country emissions regulations, carbon prices, cheap gas and India’s plan to develop its domestic resources leads us to conclude that coal prices will remain low. • At the same time wind and solar keep getting cheaper. While already competitive in a number of countries today without policy support, the cost of onshore wind is expected to drop 41% by 2040, driven primarily by improving capacity factors – which reach 33% on average in 2030 and 41% in 2040. The solar experience curve also marches on, but decline in technology cost is increasingly accompanied by a reduction in the cost of development, finance and operation pushing new utility-scale solar down 60% from a $74-$220/MWh range today, to a central estimate of around $40/MWh worldwide in 2040.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 • Solar’s precipitous cost decline sees it emerge as the least-cost generation technology in most countries by 2030. It will account for 3.7TW, or 43%, of new power generating capacity added in 2016-40 and for over $3 trillion of new investment. Small-scale solar makes up a bit more than a third of this new capacity. Starting with Europe, Australia and the US but quickly spreading to India and other countries, households and businesses add solar PV on the rooftops to offset retail power bills almost everywhere. The bulk of solar PV is utility-scale, installation of which accelerates in China, Europe, the US and Africa from 2025 and in India from 2030. Overall, solar PV supplies 15% of world electricity by 2040, seeing an average $135bn invested per year over the next 25 years. • Non-OECD countries will see the bulk of new capacity, with China and India leading the way. Renewables make up 61% of deployment in non-OECD economies but, in the absence of carbon policy, coal will continue to be important. In the next five years we see China adding almost 190GW of coal plants, but a moratorium on new coal plants there post-2020 will leave India, South East Asia and the Middle East adding the most new capacity thereafter. • In the OECD, electricity demand fundamentals continue to look weak as economic and population growth fails to keep up with falling electricity intensity. Daily load profiles are also getting ‘peakier’, reflecting more household and commercial consumption and less steady industrial baseload. This trend, coupled with higher renewables penetration, means that power systems will increasingly need to reward system services such as demand response, battery storage, interconnectors and control systems that work along with traditional firm capacity to help match supply with demand. Around 336GW of this ‘flexible capacity’ is added in the OECD, and 938GW globally, to 2040. • By around 2027, new wind and solar gets cheaper than running existing coal and gas generators, particularly where carbon pricing is in place. This is a tipping point that results in rapid and widespread renewables development. Repowering of existing wind sites also begins to make- up a larger fraction of activity in Germany, Denmark, California and China, accounting for 43% of wind development by the early 2030s. • Over the next 25 years, electric vehicles will provide 2,701TWh of additional electricity demand, to reach 8% of world consumption. Our modelling suggests electric vehicles will make up 25% of the global car fleet by 2040, putting continuous downward pressure on battery costs through technology development, economies of scale and manufacturing experience. Cheaper batteries increasingly bring small-scale and grid-scale storage options into play. • Small-scale PV reaches socket parity in all major developed economies and by 2020 we expect battery storage to become commonly deployed alongside rooftop systems. Driven by strong consumer uptake economics, over 10% of global generating capacity will be smallscale PV by 2040, though in some countries this share will be significantly higher. Adjoined battery systems increase the capacity factor of home solar systems by around 5 percentage points and help push around 1,795TWh of generation worldwide behind the meter. • The cost of gas-fired power has fallen in line with oil prices and oversupply in the LNG market, making it broadly cheaper than renewables for the time being. However, in only a handful of countries do we see material uptake in new gas-fired power as a transition fuel. These include the US, where gas capacity grows by 97GW to 2040 – though the bulk of that happens in the years to 2030. • As new wind and solar capacity is added worldwide, generation using these technologies rises ninefold to 10,591TWh by 2040, and to 30% of the global total, from 5% in 2015. By 2040,

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Germany, Mexico, the UK and Australia all have average wind and solar penetration of more than 50%. With the increase in renewable generation comes a fall in the run-hours of coal and gas plants, contributing to the retirement of 819GW of coal and 691GW of gas worldwide over the next 25 years. The fossil plant remaining on-line will increasingly be needed, along with new flexible capacity, to help meet peak demand, as well as to ramp up when solar comes offline in the evening. • Despite retirements, coal generation remains almost flat to 2040. The combination of pollution regulations, carbon prices and a lack of electricity demand growth, drives net closure of 286GW of coal in OECD economies to 2040. Meanwhile, China’s moratorium on new coal fired power post- 2020 as it deals with its air pollution problems, coupled with its near-term slowdown in electricity demand growth, means that country sees 66GW less coal installed to 2040 than we anticipated last year. And despite some uptick in the near term, by 2020 US coal has joined Europe in terminal decline. However, low coal prices also mean more new coal capacity in countries such as India. It will see 258GW of new capacity and a trebling of coal consumption by 2040. • Gas’ role as a 'transitional fuel’ appears overstated outside the US as it accounts for just 16% of global generation in 2040, with TWh generated up only modestly. Demand increases about 10% to 2026 as France, the UK and Germany retire nuclear plants and consumption rises in North America and the Middle East. However from 2027, gas generation begins a slow decline in Europe, and then in the US and China. India once again is the major economy to buck the trend, becoming Asia’s largest gas power market by 2040, with 79GW of cumulative capacity. • Although nuclear retirements to 2025 slow the decline of fossil fuel generation, Europe sees significant decarbonisation to 2040, with renewables rising to 70% of generation in 2040. Solar accounts for almost half of all new capacity. This is driven initially by small-scale adoption, before ongoing cost declines makes large-scale solar cost-competitive. Onshore wind sees half of all new investment in Europe as green-field projects increasingly give way to repowering. The uptake of electric vehicles now adds around 455TWh of new consumption in 2040, potentially providing some respite for European utilities in the face of weak demand fundamentals. There is also a 405% increase in behind-the-meter generation to a tenth of total electricity in 2040, as households increasingly add battery storage to small-scale PV systems. • The Asia-Pacific region will experience colossal growth in new power generation capacity over the next 25 years, with installed capacity tripling and electricity generation doubling. Renewable energy will make up nearly two-thirds – or $3.6tn – of the 4,890GW added during this period. Onshore wind will bring in the largest share of investment at $1.3 trillion, while utility-scale PV sees $897bn. This mountain of capacity will drive renewable energy penetration to 38% by 2040, up from 21% in 2015. However, helped by abundant seaborne and domestic supplies, coal will remain the biggest source of electricity for the region through 2040. All that coal means that power sector emissions in Asia-Pacific region do not peak over our forecast time horizon, rising to 9.9Gt per year in 2040, up 32% compared with 2015. Behind this there is of course great country- level divergence. For example, China’s power sector emissions fall by 5% over the 2015-40 period, while emissions in India treble. • Different countries in the Americas will follow different pathways to change. In North America, total capacity stands to grow by a third to 2040 as the region forms a more integrated market in which electricity and natural gas flow across borders in unprecedented quantities and renewables take greater prominence. Natural gas will play a key role in electricity generation across North America over the next decade, accounting for 15% of all new build, replacing coal in the US and seeing strong growth in Mexico. At the same time, renewable continue to grow, helped in the short term by US tax incentives but in the medium term by out-competing gas and coal in

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 many countries. Latin America sees over 798bn of investment in new power generation capacity as it continues to diversify away from an overreliance on drought-prone hydro. • In the Middle East & Africa, renewables enjoy an eightfold increase over the next 25 years to reach 55% of all power generating capacity by 2040, up from 16% today. Solar and wind see 646GW, or around 60%, of total additions, the bulk of which is utility-scale solar PV. This is already emerging as a competitive alternative to gas-fired power and becomes the leastcost option universally by 2030. In contrast, gas sees around 20% of the additions to 2040, when it will account for just over a third of generation, down from over 50% today. Oil-fired power drops from around 20% to 2% in 2040 as the countries of the region shift their focus to more economic sources of power generation. • World power sector emissions peak in 2027 at 13,728Mt as China’s economic slow-down limits global emissions growth in the near term. However, despite $9.2 trillion of new clean energy investment worldwide, equating to $370bn per year, power sector emissions will still be 5% higher in 2040, as progress in the EU, US and China is offset by steep emissions growth in India and SE Asia. To bridge the gap to a two-degree emissions trajectory, we would need another $5.3 trillion, or $212bn per year, over the next 25 years. Ll L L L

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 23 June 2016 K. Al Awadi

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22