New base energy news issue 866 dated 06 june 2016

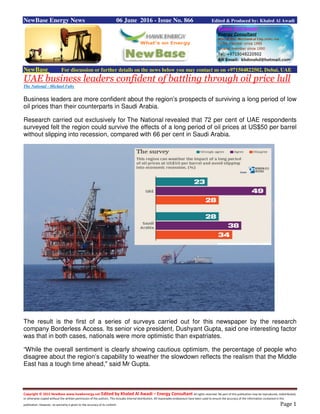

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 06 June 2016 - Issue No. 866 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE business leaders confident of battling through oil price lull The National - Michael Fahy Business leaders are more confident about the region’s prospects of surviving a long period of low oil prices than their counterparts in Saudi Arabia. Research carried out exclusively for The National revealed that 72 per cent of UAE respondents surveyed felt the region could survive the effects of a long period of oil prices at US$50 per barrel without slipping into recession, compared with 66 per cent in Saudi Arabia. The result is the first of a series of surveys carried out for this newspaper by the research company Borderless Access. Its senior vice president, Dushyant Gupta, said one interesting factor was that in both cases, nationals were more optimistic than expatriates. “While the overall sentiment is clearly showing cautious optimism, the percentage of people who disagree about the region’s capability to weather the slowdown reflects the realism that the Middle East has a tough time ahead," said Mr Gupta.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Majed Al Ghalib, a senior economist at Saudi Arabia’s National Commercial Bank, said the fact the UAE took its decision to cut fuel subsidies earlier (in July last year, compared to November in Saudi Arabia) may explain the greater confidence. NCB is predicting an average price of $45 per barrel of oil for 2016, which suggests a continued recovery from the early part of the year when it was trading at $25-26 per barrel. The road ahead ■ Throughout the summer, The National will be running reports focused on sentiment within the business communities in the UAE and Saudi Arabia around a series of key issues affecting the regional economy as we look ahead to 2017 and beyond. Survey results will be provided by the online marketing and research firm Borderless Access. Emailbusiness@thenational.ae or WhatsApp 056 995 1624 to tell us what matters most to you. “I don’t think we’re up to $50 through a pickup in demand. It’s more a risk premium," he said. “You’ve seen supply disruption in various places such as Kuwait, Nigeria, Libya and in Canada." Dima Jardaneh, the head of Standard Chartered’s Mena research team, said the UAE and Saudi Arabia are both going through slowdowns, but have managed to avoid a contraction of their non- oil economies. “The burden of adjustment is larger for Saudi Arabia since it is running a much wider fiscal deficit and faced with larger drains on liquidity," she said. She added that raising non-oil revenue was likely to take time, and the immediate focus was likely to remain on cuts to government spending. Some support is likely to come by way of a further strengthening in oil prices as supply continues to decline from other sources – most notably US shale. “We expect the oil price to reach above $60 per barrel by year end," said Ms Jardaneh. Mr Al Ghalib said that Saudi Arabia’s ability to cope with lower oil prices over the longer term depended on its success in implementing the recently announced 2030 Vision. This included an intention to boost foreign direct investment to 5.7 per cent of GDP by 2030, up from its current level of 3.7 per cent. One way to do this would be to increase the threshold for foreign investors in Saudi Arabia’s stock exchange to more than 10 per cent of the total. “If they readjust that, you would be able to more easily attract FDI into the economy over the course of the next 10 to 15 years," he argued. Neil Shearing, the chief emerging markets economist at London-based Capital Economics, said that while plans for Saudi’s 2030 Vision looked impressive, delivery “will be a slow grind". “Diversifying the economy is something that has been talked about for decades and won’t happen overnight," he added.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UAE: Japanese firms urged to invest in Dubai TradeArabia News Service Japanese companies were urged to explore investment opportunities in Dubai and other parts of the UAE in the areas of energy, renewable energy, water, and environment. “The UAE is one of Japan’s major bilateral trade partners, having posted a business of over $51 billion in 2014, with non-oil trade between the two countries reaching $15 billion in 2015," said Saeed Mohammed Al Tayer, managing director and CEO of Dubai Electricity and Water Authority (Dewa), participating in the Dewa-Japan Business Seminar & Networking event. The event, organised by Dewa in cooperation with the Japan External Trade Organisation (Jetro), was attended by over 50 Japanese companies and was held at Dewa’s Sustainable Building in Al Quoz. The seminar supports Dewa’s efforts to enhance networking and strengthen relationships with Japanese companies. During the seminar, Dewa invited Japanese companies to participate in the 18th Water, Energy, Technology, and Environment Exhibition (Wetex 2016) and the 1st Dubai Solar Show from October 4-6. The seminar was attended by Hisashi Michigami, consul general of Japan in Dubai; Masami Ando, managing director of Jetro; Dewa’s executive vice presidents and vice presidents, and officials from Jetro and Dewa. Al Tayer hoped that the seminar will help enhance the bilateral trade between the UAE and Japan that has grown continuously over the past few years. "Over 300 Japanese companies work in the UAE, 250 of which are in Dubai. In light of the growth in Dubai and the UAE in all walks of business, these figures will grow further where Dubai offers promising opportunities to Japanese companies, especially with the ambitious vision of the emirate being realised by its major projects," he said. "These include the Smart Dubai initiative launched by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, to make Dubai the happiest city in the world, and to become the innovation benchmark for smart cities seeking global sustainability and competitiveness. Dewa is a strategic partner and actively contributes to achieve this initiative by implementing major projects in collaboration with our partners in the public and private sectors. "Dewa has launched three pioneering initiatives that support the Smart Dubai initiative. These are Shams Dubai to encourage building owners to install photovoltaic panels to generate electricity and connect it to Dewa’s grid, Smart Applications through Smart Meters and Grids, and the Green Charger to set up the infrastructure and install electric-vehicle charging stations across the Emirate,” added Al Tayer. Al Tayer emphasised that Dubai has a clear strategy for sustainable development based on the vision of Sheikh Mohammed, who launched the Dubai Clean Energy Strategy 2050 in November 2015. The strategy aims for 7 per cent of Dubai’s energy to be provided by clean sources by 2020, 25 per cent by 2030 and 75 per cent by 2050. -

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Oman looks to cut consumption with restructuring of electricity tariff .. ArabianBusiness - Baset Asaba Oman has stepped up its plan to cut down electric power subsidies in a move widely expected to scale down power consumption in the Sultanate. “Yes there are plans. There are studies already done on how to restructure the electricity tariff to make the customers more incentivised to reduce their consumption,” Mohammad Bin Abdullah Al Mahrouqi, chairman Public Authority for Electricity and Water told Times of Oman. Asked what percentage of the subsidy could be slashed, he said, “It is the restructuring of the tariff rather than a percentage of reduction on subsidies. It’s not decided yet when to implement it,” he said. The Sultanate has adopted a range of restructuring on spending and revenues after the fall in oil prices. Last month officials of government-owned Oman Power and Water Procurement Company (OPWP) said the demand for power in Oman is expected to grow by almost 10% per year until 2019. “We are forecasting that this year we will still continue to grow (the power demand) at 8 per cent. We are a little bit cautious... we have lowered the forecast, given that we have not seen changes in the subsidy policy yet,” Eng. Ahmed bin Saleh Al Jahdhami, CEO of OPWP, told a conference on water and energy in Muscat. In April Al Jahdhami also made a presentation on the government’s subsidy for electricity and water at Majlis Al Shura to acquaint members and staff of Shura of the services provided by the government in the areas of electricity, water and the extent of its contribution to the national economy.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Saudi Electricity invites interest in first renewables projects Arqaam Saudi Electricity Company (SEC) has invited companies to submit expressions of interest (EOI) to develop 50MW photovoltaic (PV) solar plants at Al-Jouf and Rafha in the northern part of the kingdom, a MEED report said. The projects – the country’s first major standalone renewable energy projects— will be developed under the independent power producer (IPP model), with SEC as the off-taker for all of the power produced from the plants. The EOI deadline has been set for June 20, and SEC plans to issue request for qualification (RFQ) documents by July 14. HSBC has been appointed as financial consultant, UK’s DLA Piper is the legal consultant and Netherland-based DNV is the technical consultant, the report said. The EOI invite comes after the kingdom revealed its Vision 2030 plan, which set out an initial target for 9.5GW of renewable energy.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Turkmenistan Allocates $45 mn for TAPI Work Natural Gas Asia Government of Turkmenistan has allocated more than $45 million to finance the initial phase of construction of the TAPI gas pipeline at the Afghan-Pakistan segment. A decree was signed by President Gurbanguly Berdimuhamedov on June 3 during a cabinet meeting, the government said in a statement. Currently, welding of pipes is in progress in Turkmenistan. The 214 kilometer Turkmen section is planned to be complete by the end of 2018. The $45 million allocated by Ashgabat is in accordance with an investment agreement signed by TAPI countries earlier this year. In April, Turkmenistan, Afghanistan, Pakistan and India (TAPI) agreed to invest $200 million in the next stage of the multibillion dollar TAPI pipeline project. The agreement was signed during 24th meeting of the steering committee of the TAPI pipeline project which was held in Ashgabat. Turkmengaz and Turkmen nebitgazgurlushyk are undertaking construction of the Turkmen section of the pipeline which will run from Galkynysh gas field to the Afghan border. In Afghanistan and Pakistan contractors will be chosen on the basis of international tenders. In recent weeks, Turkemnistan has held talks regarding financing of the project with international agencies such as Islamic Development bank, the Saudi Fund for Development and the Japanese government. These international entities are expected to participate in areas of trade, supply equipment, financing through provision of loans and investment in the TAPI project and in development of the Galkynysh gas field. ADB was appointed the transaction advisor for the TAPI gas pipeline project in November 2013. The TAPI pipeline will export up to 33 billion cubic meters of natural gas a year from Turkmenistan to Afghanistan, Pakistan, and India over 30 years.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 NewBase 06 June 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Stumbling dollar, Nigeria sabotage push Brent to $50 per barrel Reuters +Bloomberg +NewBase Brent crude oil prices rose to $50 a barrel on Monday, lifted by a plunge in the U.S.-dollar that could spur demand, just as ongoing attacks on oil infrastructure in Nigeria tighten supplies. International Brent crude futures LCOc1 were trading at $50.03 per barrel at 0139 GMT (09:39 p.m. EDT), up 39 cents or 0.8 percent from their last settlement. U.S. West Texas Intermediate (WTI) crude futures were up 49 cents or 1 percent at $49.11 a barrel. Traders said that the higher oil prices were a result of a sharp fall in the dollar on Friday, when the greenback lost over 1.5 percent intra-day against a basket of other leading currencies .DXY. The drop followed soft U.S. jobs data that sparked concerns over the state of the world's biggest economy, but a weaker dollar is seen as supporting fuel demand in the rest of the world as it makes dollar-traded oil imports cheaper. "The weaker U.S.-dollar drove commodity prices higher," ANZ bank said on Monday. The beginning of the Muslim holy month of Ramadan on Monday is also seen as supportive of prices as driving demand picks up in most Muslim dominated countries. Traders said frequent attacks on oil infrastructure in Nigeria, which has already pulled the country's output to over 20-year lows and which rebels said could fall to zero soon, were also supporting oil prices. Oil price special coverage

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 So far, supply cuts like those in Nigeria or Libya, have been met by rising output in the Middle East, especially Iran, which has been ramping up its output following the end of international sanctions against it in January. But Iran's is returning to international oil markets more quickly than expected - including using international tanker operators to ship its crude - and is fast hitting its maximum capacity. This means that further disruptions in global supplies might not be compensated by rising Iranian output. The price rally, however, was capped on signs of increased output. U.S. energy firms this week added rigs drilling for oil for the second time this year, energy services company Baker Hughes Inc (BHI.N) said on Friday, as producers cautiously upped activity following months of rising prices. Drillers added nine oil rigs in the week to June 3, bringing the total rig count up to 325, compared with 642 a year ago, Baker Hughes said in its closely followed report. OPEC Unity Keeps OPEC meetings aren’t what they used to be. Far from sending the oil market into gyrations, the run-up to last week’s OPEC meeting kept oil pinned near $50 a barrel and sent hedge funds to the sidelines. Speculators cut their total long and short positions on West Texas Intermediate crude to the lowest since January 2015 and one measure of market volatility fell to a 10-month low before the Organization of Petroleum Exporting Countries’ June 2 meeting. Ministers emerged from the gathering voicing unity and continuing a policy of no production limits. U.S. data released the same day showed oil supplies are dropping, a sign that the supply glut that sent prices plummeting this year is finally dissipating. "It’s very clear that OPEC is less relevant than U.S. production data," Rob Thummel, a managing director and portfolio manager at Tortoise Capital Advisors LLC, who helps oversee $14.1 billion. "We’re going to trade near $50, plus of minus five bucks for quite a while," though higher prices are inevitable, he said in a phone interview.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Prices rallied from a 12-year low to reach $50 a barrel as consumers burned through a supply glut. OPEC has rejected a production freeze, in part because Iran has said it will continue to boost output after the removal of international sanctions in January. The group estimated it pumped 32.4 million barrels a day in April. That supply has been balanced by disruptions in Canada, Libya, Nigeria, and Venezuela. WTI rose by 1 percent to $49.10 a barrel on New York Mercantile Exchange during the CFTC report week, before closing at $48.62 June 3. Implied volatility on near-term options fell May 27 to the lowest since July. Cutting Back Money managers reduced their short positions on WTI, or wagers that prices will fall, to 53,377 futures and options during the CFTC’s report week, the lowest level since May 2015. Long positions, or bets that prices will rise, declined 2.9 percent to 294,105 contracts, the lowest since March. Stockpiles in the U.S. fell 1.37 million barrels for the week ended May 27, according to Energy Information Administration data released June 2. Nationwide production declined to 8.74 million barrels a day, the lowest level since September 2014. Still, the number of active U.S. oil rigs rose by nine to 325 last week, the largest gain of the year, according to Baker Hughes Inc. “There’s been a lot of big news and little movement,” said Rob Haworth, senior investment strategist in Seattle at U.S. Bank Wealth Management, which oversees $128 billion in assets. “Slightly higher prices could bring back U.S. shale producers.” In other markets, speculators remained bullish on U.S. ultra low sulfur diesel as net-long contracts rose by 16 percent to the highest level since July 2014. Net longs on Nymex gasoline declined by 24 percent to 16,128 contracts, with bullish bets falling to the lowest level since October 2013. "There was long liquidation in the week spanning the Memorial Day holiday, which is the traditional start of the driving season," in the U.S., Tim Evans, an energy analyst at Citi Futures Perspective in New York, said in a phone interview. Speculators "are not looking for gasoline price strength this summer," he said. Abu Dhabi Sees $60 Crude on Shrinking Surplus Oil advanced as Abu Dhabi forecast prices could climb as high as $60 a barrel amid a glut that’s shrunk quicker than projected. Futures rose as much as 1.1 percent in New York and 0.9 percent in London. The global surplus is down to 1.2 million to 1.5 million barrels a day and has contracted faster than expected, said Ali Majed Al Mansoori, chairman of Abu Dhabi Department of Economic Development. U.S. drilling increased from the lowest level in more than six years, according to data from Baker Hughes Inc.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Oil has surged about 85 percent from a 12-year low earlier this year on disruptions and falling U.S. output under pressure from the Organization of Petroleum Exporting Countries’ policy of sustaining production. Members of the group rejected a proposal to adopt a new output ceiling last week, with outgoing Secretary-General Abdalla El-Badri saying that it’s difficult to find a target as Iranian supply rises and significant Libyan volumes are halted. “At the moment, there does seem to be steady support above the $45 level,” Angus Nicholson, a markets analyst in Melbourne at IG Ltd., said by phone. “The biggest concern for prices going forward is whether the rig count will continue to pick up over the next few weeks.” West Texas Intermediate for July delivery gained as much as 54 cents to $49.16 a barrel on the New York Mercantile Exchange and was at $49.04 at 10:32 a.m. Hong Kong time. The contract slid 55 cents to $48.62 on Friday, capping a 1.4 percent weekly decline. Total volume traded was about 34 percent below the 100-day average. Oil Recovery Brent for August settlement increased as much as 45 cents to $50.09 a barrel on the London- based ICE Futures Europe exchange. Prices slipped 40 cents to close at $49.64 on Friday. The global benchmark crude was at a 44-cent premium to WTI for August. The market recovery is on track and a price range of $55 to $60 is possible this year, Mansoori said in a Bloomberg television interview. Abu Dhabi controls most of the oil reserves in the United Arab Emirates, OPEC’s fourth-largest producer. The U.A.E. holds about 6 percent of world crude deposits.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Saudi Aramco Raises Most Asia Oil Pricing Amid Robust Demand Bloomberg - Anthony Dipaola Saudi Arabia, the world’s largest crude exporter, raised pricing on most oil grades for sale to Asia and the U.S. in July after the nation’s energy minister said demand was robust. State-owned Saudi Arabian Oil Co. increased its official selling price for Arab Light crude by 35 cents a barrel to 60 cents more than the regional benchmark for sales to Asia, it said in an e- mailed statement. The company, known as Saudi Aramco, was expected to raise the premium for shipments of Arab Light crude by 40 cents a barrel to 65 cents a barrel more than the benchmark for buyers in Asia, according to the median estimate in a Bloomberg survey of five refiners and traders in the region last week. Oil has rallied about 80 percent since January, making ministers of the Organization of Petroleum Exporting Countries confident that their two-year strategy of trying to win market share is working. OPEC agreed on Thursday to stick to its policy of unfettered production with ministers united in their optimism that oil markets are improving. The July pricing sets Aramco’s light crude grades at the highest levels for Asia since at least September 2014, before OPEC adopted its market share strategy. “This shows that they’re getting more bullish on demand,” Robin Mills, chief executive officer at consultant Qamar Energy in Dubai and a non-resident fellow at the Brookings Institution in Doha, said Sunday by phone. “India is showing a lot of strength and we’re still seeing very robust demand from China.” Aramco raised pricing on most grades for sale to Asia, leaving only the Extra Light blend unchanged, according to the statement. It raised the premium for Super Light crude by 10 cents, to $4.05 a barrel more than the benchmark. Medium crude will sell at a $1 a barrel discount in July, 30 cents higher than in June, according to the statement. The company also increased pricing for U.S. buyers on all grades except Extra Light. Arab Light crude for U.S. buyers increased by 20 cents a barrel, to 55 cents more than the regional benchmark, according to the statement. Aramco deepened discounts for all grades to buyers in Europe, it said in the statement. For an interview with Al-Falih on the success of OPEC’s strategy, click here. Saudi Arabia pumped 10.27 million barrels a day in April, according to data compiled by Bloomberg. It produced a record average of 10.2 million barrels daily last year, it said in its annual review last month.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Saudi Arabia’s Energy Minister Khalid Al-Falih, who is also chairman of Saudi Aramco, told reporters in Vienna on Thursday that demand is robust and that non-OPEC supply is declining. Global demand is expected to expand by 1.2 million barrels a day this year after growing 1.5 million barrels a day last year, according to OPEC’s final press statement on Thursday. Middle Eastern producers are competing increasingly with cargoes from Latin America, North Africa and Russia for buyers in Asia, its largest market. Producers in the Persian Gulf region sell mostly under long-term contracts to refiners. Most of the Gulf’s state oil companies price their crude at a premium or discount to a benchmark. For Asia the benchmark is the average of Oman and Dubai oil grades and for North America the marker is the Argus Sour Crude Index.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase Special Coverage News Agencies News Release 06 June 2016 Chart: Here’s why oil prices may be headed up CNBC - Daryl Guppy The trend breakout in NYMEX oil, first signaled by the Guppy Multiple Moving Average indicator (GMMA), has been confirmed. This is a significant trend change. Oil established a pattern of longer-term trend reversal with price oscillation around the $38 level, which formed a base for the rally to the next resistance level near $48. The next upside target is near $58. Two barrier features on the chart acted to slow the rally from developing into a trend change. The first resistance feature is the historical resistance level near $48. This resistance feature was strengthened by the proximity to the upper edge of the long-term GMMA which is also near $48 when the rebound rally commenced. Both of these barriers have now been overcome. The upper edge of the long-term GMMA fell to near $46 and price has now moved above this level. Price has also moved above $48. Traders are now watching for a retest of these two resistance features to act as support features for any retreat. The separation in the long-term GMMA is compressing and turning upwards. A change in trend direction is confirmed when the long-term GMMA group of averages first develop compression and then later turn upwards. The width and direction of the long-term GMMA confirms that

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 investors will buy into any future retreat and drive oil prices up towards the historical resistance level near $58. The resistance level near $58 is the most significant resistance level for any trend change. A successful breakout above $48 can move quickly to the historical resistance level near $58. This offers good short-term trading opportunities. We continue to use the ANTSYSS trade method to extract good returns from these price movements. When the oil price fell, the downside targets were calculated by taking the width of the trading band and projecting in downwards below each new support level. The trading bands for oil are around $10 wide. This was particularly useful for describing the fall of the oil price between $108 and $38. The same method is used to calculate the upside targets for any future new uptrend in oil. The breakout above $38 has a target near $48. The breakout above $48 has a target near $58. C R E D I T : R E Z A / C O N T R I B U T O R

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 06 June 2016 K. Al Awadi

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16