New base 17 december 2017 energy news issue 1115 by khaled al awadi-ilovepdf-compressed

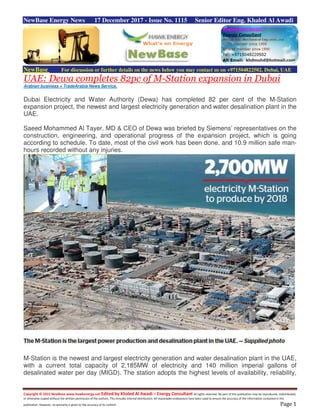

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 17 December 2017 - Issue No. 1115 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE: Dewa completes 82pc of M-Station expansion in Dubai Arabian business + TradeArabia News Service, Dubai Electricity and Water Authority (Dewa) has completed 82 per cent of the M-Station expansion project, the newest and largest electricity generation and water desalination plant in the UAE. Saeed Mohammed Al Tayer, MD & CEO of Dewa was briefed by Siemens’ representatives on the construction, engineering, and operational progress of the expansion project, which is going according to schedule. To date, most of the civil work has been done, and 10.9 million safe man- hours recorded without any injuries. M-Station is the newest and largest electricity generation and water desalination plant in the UAE, with a current total capacity of 2,185MW of electricity and 140 million imperial gallons of desalinated water per day (MIGD). The station adopts the highest levels of availability, reliability,

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 and efficiency, using the most advanced technologies in the world. The station’s total capacity will reach 2,885MW when the expansion project is completed in Q3 of 2018. The station includes the provision of new power generating units, adding 700MW to the installed generation capacity of M-Station. The expansion project includes the addition of two dual-fuel gas turbine generators, two heat-recovery steam boilers, and a steam turbine that is 90 per cent-fuel- efficient. This will increase the plant’s thermal efficiency from 82.4 per cent to 85.8 per cent, which is one of the highest thermal-efficiency rates in the world. Since 2015, Dewa has been working with Siemens on the Jebel Ali M-Station expansion, as the combined total cost of M-Station construction and expansion is Dh11.5 billion ($3.1 billion). M- Station is equipped with the latest smart devices and sophisticated heavy-duty technological systems. It was built at a cost of Dh10.15 billion. Dh6.2 billion were invested to generate 2,185MW of electricity from 6 gas turbines (F-model) from Siemens, with a capacity of 255MW for each unit, 6 boilers for waste-heat recovery and 3 steam turbines, with a capacity of 218MW each. The project has been implemented in phases since mid-2010. Water desalination systems costing Dh3.95 billion use 8 desalination units, deploying Multi-Stage Flash (MSF) distillation technology, each with a capacity of 17.5 MIGD and totalling 140 MIGD, two dual-fuel-fired auxiliary boilers of 390 tonnes per hour, and 16 fuel-oil storage tanks, each with a capacity of 20,000 cubic metres, with total fuel-oil storage of 320,000 cubic metres. Dewa works tirelessly to build a robust infrastructure to enhance its total production capacity, which is currently 10,200MW of electricity and 470 MIGD. –

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudia: Schlumberger to build land rigs at Saudi King Salman Energy Park & wins drilling contract … REUTERS/Richard Carson The new center will manufacture products for drilling, exploration and production, as well as midstream . Schlumberger plans to develop an industrial manufacturing center within the King Salman Energy Park in Saudi Arabia. The oilfield services contractor made the disclosure at a ground-breaking ceremony at the site that is developed and operated by Saudi Aramco. Schlumberger will be an anchor tenant at the park. “The new industrial manufacturing center will collocate our upstream and midstream manufacturing in the Kingdom and complements the footprint Schlumberger has built over many years,” said Schlumberger Chairman Paal Kibsgaard. Multinational companies operating in Saudi Arabia are increasingly seeking ways to add local manufacturing capacity in order to align with economic diversification goals aimed at creating more jobs for Saudis and making the country less reliant on oil. The new center will manufacture products for drilling, exploration and production, as well as midstream, Schlumberger said in a statement. The industrial manufacturing center will be developed over 500,000 square meters on land allocated for energy-related industries. The first phase is planned to be completed by the end of the second quarter next year, which will bring Schlumberger land rig manufacturing to the Kingdom. Schlumberger wins big Saudi Aramco drilling contracts State oil giant Saudi Aramco said it has awarded Schlumberger, one of the world's leading oil services company, two lump sum contracts for drilling rigs and services for oil and gas wells. Under the contracts, Schlumberger Integrated Drilling Services (IDS) will provide drilling rigs and services for up to 146 gas wells and up to 128 oil wells over three years. The contracts are designed to provide an integrated service to deliver wells, which will increase efficiency levels and improve cost-effectiveness, while maintaining the highest safety standards, it stated.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 In developing the agreements, Saudi Aramco and Schlumberger focused on enhanced processes and the latest technology to ensure safe and efficient operations at all times, remarked Mohammed Qahtani, the senior VP for Upstream at Saudi Aramco after signing the deal with Paal Kibsgaard, the chairman and CEO of Schlumberger on the sidelines of Saudi Aramco’s In- Kingdom Total Value Add (IKTVA) Forum held in Khobar, Saudi Arabia. The signing ceremony was attended by Khalid Al Falih, Saudi Arabia’s Minister of Energy, Industry and Mineral Resources and chairman of the Saudi Aramco board of directors along with Prince Saud bin Nayef Al Saud, Emir of the Eastern Province; Amin Nasser, the president and CEO of Saudi Aramco and other officials. Qahtani pointed out that both Saudi Aramco and Schlumberger were key partners who, under these contracts, will be able to bring innovative technologies to the field, and deploy them in its large-scale operations. "We have a great history of success with Schlumberger throughout our 75 year partnership in Saudi Arabia, and we have now set the scene for even greater achievements in the future," he stated. On the contract win Kibsgaard said: "Schlumberger is proud and humble to be trusted with delivering lump sum gas and oil wells within the kingdom." "Through our committed teams, advanced technology and Integrated Drilling Services we are looking forward to working in close collaboration with Saudi Aramco to successfully deliver these oil and gas wells," he added

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Egypt: Lekela wins deal to build 250MW wind project in Egypt TradeArabia News Service Lekela, a leading renewable power generation company, has signed a power purchase agreement (PPA) with the Egyptian Electricity Transmission Company (EETC) and Egypt’s Minister of Energy to develop a 250MW wind farm in the Gulf of Suez. The project forms part of the Egyptian Government’s Build, Own, Operate (BOO) framework, and is situated approximately 30 km North-West of Ras Ghareb. The location benefits from a strong wind resource which will deliver high capacity factors and allow the wind farm to sell competitively priced power to its customer, EETC. Demand for electricity in Egypt is growing at 6 per cent per year and is predicted to continue to grow at this rate for the next decade. Currently, 86 per cent of Egyptian power generation is from gas-fired power plants and there is therefore an incentive for Egypt to draw on its diverse natural resources and move towards more renewable generation. Extensive environmental and technical studies have already been carried out on the site, generating positive results. The next stage of the project, financial close followed by the commencement of construction, is expected to take place in 2018. “The initialling of the PPA marks an important step for Lekela and its partners. This is part of our long-term strategic plan to deliver renewable energy to Egypt and support the diversification of its generation capacity at a highly competitive price,” said Chris Antonopoulos, chief executive officer of Lekela. “Our progress in Egypt mirrors our development efforts across the African market. Generating clean, renewable and competitively priced power continues to be a priority in many countries across the continent and we are looking forward to further announcements in South Africa, Ghana and Senegal in due course,” he added. –

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Lebanon: Total, Eni, Novatek win Lebanon’s first offshore licenses Bloomberg Lebanon granted its first offshore energy rights to a group comprising Total SA, Eni SpA and Novatek PJSC, joining a regional race to find and develop oil and natural gas wealth in the eastern Mediterranean after years of delay. The cabinet awarded two licenses in its first offshore bidding round, allowing the companies to jointly explore blocks 4 and 9, Wissam Chbat, a member of the Lebanese Petroleum Administration, said Thursday by phone. The group has one month to prepare legal, administrative and technical paperwork before signing production- sharing contracts with the government in January, Chbat said. Drilling is expected to begin in 2019, he said. France’s Total, Italy’s Eni and Russia’s Novatek filed their bids to explore the two blocks in October — the only proposals the government received. The licensing round has encountered setbacks since 2013 amid political disputes over block delineation and government paralysis, leaving Lebanon trailing Cyprus, Egypt and Israel in exploring the eastern Mediterranean. This year, bidding was pushed back to give companies more time to understand a new tax law. With a public debt amounting to around 150 per cent of its GDP, according to the International Monetary Fund, and its economy weighed down by the cost of supporting 1.5 million refugees from Syria’s war, Lebanon is counting on revenue and taxes from discoveries to shore up its finances. That could help bolster fragile political breakthroughs this year in a nation regularly caught in the middle of regional conflict. Israel dispute Block 9 is one of three that lie in an area contested by Israel. Lebanon is working with the US on resolving the dispute, according to Prime Minister Saad Hariri. Large gas reserves have been discovered in the eastern Mediterranean in recent years, including the giant Zohr deposit in Egyptian waters and the Leviathan and Tamar fields off the Israeli coast. Exploration work in both blocks will begin simultaneously and last five years, Energy Minister Cesar Abi Khalil said in a televised news conference Friday. The government will benefit from royalties, taxes and its share of production, which will range between 65 per cent and 71 per cent in block 4, and from 55 per cent to 63 per cent in block 9, he said. Lebanon is “determined to explore all our maritime waters, it’s our right,” Abi Khalil said. Surveyed assets The first revenues are some way off, said Carole Nakhle, director of London-based Crystol Energy. “Experience shows that gas discoveries, particularly offshore, take time to be brought on stream. In Lebanon, this is more so because of lack of infrastructure,” she said. Seismic surveys show the country has at least 96 trillion cubic feet of gas and 850 million barrels of oil, Gebran Bassil, who was then the country’s energy minister, said in 2013. The government is also studying a bill on onshore energy rights as parliamentarians try to draft a law governing Lebanon’s first sovereign wealth fund, which would soak up revenue from oil and gas.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Oman: Potential for 10 biogas plants around the Sultanate Oman Observer - Conrad Prabhu The prodigious quantities of bio-waste being generated daily around the Sultanate can feed as many as 10 biogas plants suitable for producing either electricity for local communities or thermal heat for industry. Alternatively, the bio-waste can also be processed to produce biofuel such as biodiesel or simply converted into compost for agriculture, according to a key executive of be’ah, the Sultanate’s waste management flagship. Suad Said al Hosni of Be’ah’s Strategic Development Department said the state-owned entity is currently fine- tuning a number of initiatives that would unlock the economic and commercial potential of recycling the massive volumes of organic and bio-waste currently ending up in landfills across the Sultanate. “Bio-waste management and bio-energy production are key components of be’ah ‘diversion’ strategy, which seeks to achieve the diversion of around 60 per cent of municipal solid waste away from landfills into recycling and recovery initiatives by the year 2030, rising to 80 per cent by 2040,” Suad told delegates on the second day of the Oman Waste and Environmental Services Conference & Exhibition (OWES) on Thursday. The two-day event was organised by leading events management firm Oman Expo in partnership with be’ah. Contributing to bio-waste generation in the Sultanate is a mix of green waste, organic waste collected from households, slaughterhouse waste, poultry and livestock waste, household sludge, food waste from restaurants, processing plants and commercial establishments, and fruit and vegetable waste from hypermarkets and the central market. For example, around a third of the estimated 2,100 tonnes of solid waste ending up in the Barka landfill daily is made up of bio- waste, according to Suad.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Based on the volumes of bio-waste being disposed of in landfills across the country, be’ah envisions the potential for at least seven medium to large-scale biogas plants to be established in Muscat, South Al Batinah and Dhofar governorates, where bio-waste generation is the highest, according to the executive. Capacities are expected to range from 1 to 2.5 megawatts (MW). Barka has been tipped to host the largest of these biogas plants in light of the copious quantities of bio-waste being generated locally. The potential for a further three small-scale biogas plants, of capacities ranging from 0.5 to 1 MW, has been identified in areas with a lower bio-waste footprint, said Suad. As feedstock for the biogas plants, the official explained, the bio-waste will be initially pre-treated in enclosed systems and then subjected to anaerobic digestion in a bio-reactor. Here, the raw material is processed under carefully controlled conditions to achieve the right biogas fuel specs. Material left over from the process can be used as organic fertilizer for agriculture or converted into compost. Citing examples of biogas use in countries like Austria and Germany, Suad said the environment- friendly fuel is widely used in ‘trigeneration’ systems for generating heating, cooling or electricity. Equally, bio-waste can be used in the production of compost as a local substitute to imports, which presently account for roughly 90 per cent of total compost consumption in the Sultanate. Moreover, local compost can be an environmentally safe alternative to the imported version, which is primarily made up of chemicals or organo-fertiliser. To showcase the potential for biogas generation from bio-waste, be’ah recently signed a deal with the German University in Oman (GUtech) for the establishment of a pilot plant at its campus in Halban. Set on an area of around 2,000 sq metres, the facility will process between 10 to 50 tonnes per day of organic waste received from the Al Mawaleh Central Market, augmented by supplies from other sources. Electricity output is envisaged at 0.6 MW, which will be used to power some of GUtech’s facilities. Fertiliser and compost generated as a byproduct will be utilised on the campus or marketed locally, she added.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 U.S biodiesel output still increasing despite expiration of tax credit Source: U.S. Energy Information Administration, Monthly Biodiesel Production Report Through the first nine months of 2017, U.S. biodiesel production levels were slightly higher than 2016 levels, despite the expiration of a federal biodiesel blender's tax credit at the end of 2016. Domestic biodiesel production may continue to increase because of changes to import policies such as those recently announced by the U.S. Department of Commerce on biodiesel imports from Argentina and Indonesia. Biodiesel production increased over time largely because of state and federal incentives. The federal biodiesel blender's tax credit, valued at $1 per gallon (gal), expired several times prior to 2016, most recently at the end of 2014. In those earlier years, Congress ultimately voted to reinstate the tax credit retroactively. Biodiesel qualifies as an advanced biofuel as part of the Renewable Fuel Standard (RFS), a program implemented by the U.S. Environmental Protection Agency (EPA) to promote the incorporation of biofuels into the nation’s fuel supply. To demonstrate compliance with the RFS, refiners and importers of petroleum products must either blend advanced biofuels such as biodiesel or buy credits called renewable identification numbers (RINs). Biodiesel is often combined with petroleum diesel in blends ranging from 5% to 20% biodiesel. On average, biodiesel accounted for about 4% of total diesel consumption in 2016. Similar to corn ethanol, biodiesel production is concentrated in the Midwest and delivered by rail and truck across the country.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Since 2014, foreign biodiesel imports—primarily from Argentina and Indonesia—have increased in the East Coast and Gulf Coast regions. In 2016, biodiesel imports from Argentina reached 449 million gallons and accounted for nearly 20% of U.S. biodiesel consumption. However, in April 2017, the U.S. Department of Commerce (DOC) initiated two investigations into whether biodiesel imports from Argentina and Indonesia put U.S. biodiesel producers at a disadvantage. The two investigations have focused on countervailing duties—when a foreign government provides subsidies for the production of a product—and antidumping—when a foreign government sells a product at less than its fair value. In November, the DOC issued an affirmative final determination on countervailing duties for Argentina and Indonesia, assigning rates ranging from 34% to 72%, based on the producer or importer of biodiesel. The U.S. International Trade Commission reached a similar finding in December, allowing for DOC to issue final countervailing duty orders. Depending on the outcome of the antidumping investigation, the combined effect of the final orders may more than double the price of biodiesel from these two countries. Source: U.S. Energy Information Administration, Monthly Biodiesel Production Report, Petroleum Supply Monthly In response to the investigations, new U.S. contracts for cargos of biodiesel from Argentina and Indonesia have slowed. Imports from Argentina remained relatively high through August 2017 because of contracts that were already in place prior to the investigations, but these imports ended as of September 2017. Biodiesel imports from Indonesia last occurred in December 2016. Imports from these countries are likely to remain low unless a settlement is reached or U.S. biodiesel prices rise to offset the final duties.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Source: U.S. Energy Information Administration, Monthly Biodiesel Production Report, Petroleum Supply Monthly U.S. biodiesel consumption in 2016 totaled 2,189 million gallons, of which 1,569 million gallons (72%) were produced domestically. U.S. biodiesel facilities ran at 69% of nameplate capacity during 2016. Annual production capacity at the beginning of 2016 totaled 2,270 million gallons. U.S. biodiesel production capacity has since increased slightly to 2,348 million gallons as of September 2017, but the pace at which biodiesel facilities might increase production to address possible supply shortfalls from reduced imports is unclear. Biodiesel is typically more expensive than petroleum-based diesel, so the loss of lower-cost imports from Argentina and Indonesia might further decrease its price competitiveness. During 2016, the average spot price of Gulf Coast biodiesel was $3.17/gal, which was $1.85/gal higher than its petroleum counterpart.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 BP Re-Enters Solar Power Market With $200 Million U.K. Deal Bloomberg -James Herron After a six year absence, BP Plc returned to the solar-energy business with a $200 million investment in a British company that develops and maintains photovoltaic farms in Europe. The move marks another step by the largest oil companies into renewable-energy technologies starting to disrupt the energy industry. BP’s rivals such as Royal Dutch Shell Plc and Total SA have made bigger ventures into offshore wind and solar-panel production in the past few years, reflecting a shift by governments to encourage cleaner forms of energy. BP’s purchase of a 43 percent stake in Lightsource Renewable Energy Ltd., a leading developer of renewables in Europe, is a step into managing and maintaining solar farms. That contrasts with its earlier ventures that BP closed in 2011, which involved making panels and other renewables. The oil company said it’s taking a quieter approach to new energy technologies than it has in the past. “While our history in the solar industry was centered on manufacturing panels, Lightsource BP will instead grow value through developing and managing major solar projects around the world,” Chief Executive Officer Bob Dudley said in the statement. “The combination of Lightsource’s expertise and experience with BP’s relationships and resources will propel this innovative business to even more rapid growth.” While oil companies dabbled in renewables after the 1970s oil shocks, most left the business in the 1980s when crude prices plunged. BP broke with the rest of the industry in 1997 when then CEO John Browne became the first leader of a oil major company to acknowledge that climate change is a risk and the industry should take steps to respond. BP built a wind and solar business, briefly branding itself as “Beyond Petroleum.” Oil Spill A major oil spill on BP’s Macondo prospect in the Gulf of Mexico in 2010 forced the company to slash costs, leading to the closure of its solar business the next year. In 2012, the oil and gas

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 giant canceled a $300 million project in the U.S. to produce the transport fuel ethanol from non- food crops. A year earlier, it shut down its solar manufacturing unit as panel prices slumped amid competition from Chinese manufacturers. While BP and most other oil companies have built biofuels businesses to produce cleaner fuels, others have been more adventurous than BP in investing in renewables. Total took a majority stake in the California solar panel maker SunPower Corp., and Shell has made major investments in hydrogen fuel cells and offshore wind farms. The Lightsource deal is a “relatively cheap” way for BP to get involved in solar, said Jenny Chase, head of solar analysis for Bloomberg New Energy Finance. “Sometimes I think these big firms just make investments because they are curious and cannot see many other investment options.” Renewable Investment BP will now make smaller bets on renewable energy, including research on gasoline that helps engines operate more efficiently, new chemical-manufacturing processes that produce fewer emissions and producing more biofuels and biogas, Dudley said in October. Lightsource also plans to develop energy storage technology in the form of a battery in the U.K., a measure that would help its solar farms feed the grid after the sun sets. Lightsource plans to “piggy back” on BP’s existing relationships with governments and businesses that it doesn’t yet operate in to expand its development pipeline, Lightsource CEO Nick Boyle said in an interview. Lightsource has commissioned 1.3 gigawatts of solar capacity and manages another 2 gigawatts under long-term contracts -- enough to power over half a million homes, according to the statement. BP will have two seats on the company’s board of directors

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase December 17 - 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil Prices edges up, though 2018 outlook cites ample supplies Bloomberg + NewBase + REUTERS Oil edged up on Monday, lifted by an ongoing North Sea pipeline outage and over signs that booming U.S. crude output growth may be slowing, although the outlook for oil markets cites ample supplies despite ongoing production cuts led by OPEC. U.S. West Texas Intermediate (WTI) crude futures were at $57.39 a barrel at 0447 GMT, up 9 cents or 0.2 percent from their last settlement. Brent crude futures, the international benchmark for oil prices, were at $63.37 a barrel, up 14 cents or 0.2 percent from their last close. Traders said the slightly higher prices came on the back of the North Sea Forties pipeline system outage, which provides crude that underpins the Brent price benchmark, as well as indicators that U.S. oil production growth may be slowing down. Oil price special coverage

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 "The shutdown of the Forties pipeline in the North Sea, combined with inventories hitting a two- year low, helped paint a positive (oil price) picture," ANZ bank said on Monday. In the United States, energy companies cut rigs drilling for new production for the first time in six weeks, to 747, in the week ended Dec. 15, energy services firm Baker Hughes said on Friday. Despite this dip in drilling, activity is still well above this time last year, when the rig count was below 500, and actual U.S. production has soared by 16 percent since mid-2016 to 9.8 million barrels per day (bpd). This means U.S. output is fast approaching that of top producers Saudi Arabia and Russia, which are pumping 10 million bpd and 11 million bpd respectively. The rising U.S. output also undermines efforts by the Organization of the Petroleum Exporting Countries (OPEC), which is de-fecto led by Saudi Arabia, and a group of non-OPEC producers including Russia to withhold production to tighten the market and prop up prices. Largely because of rising shale output from the United States, the International Energy Agency (IEA) said global oil markets would show a slight supply surplus of around 200,000 bpd during the first half of 2018. Data from the U.S. Energy Information Administration (EIA)showed a similar surplus for that period and still indicate a supply overhang of 167,000 bpd for all of 2018. Oil Rally Fizzles for Third Week With 2018 Outlook Still Cloudy Crude’s rally fizzled out for a third week, with prices stalled near $57 a barrel as concerns over excess supplies next year temper enthusiasm for OPEC’s extended production curbs. Futures in New York closed Friday just about where they started on Monday, with small gains over the past two days merely offsetting losses in previous sessions. While the halt of the Forties pipeline in the North Sea sent prices surging and the International Energy Agency said Thursday that OPEC and its allies had managed to reduce global stockpiles to the lowest level in two years, the agency also cautioned that supply growth would outpace global demand in 2018. But for the quarter, prices are up 11 percent.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 This week “you had some decent news to hold up the market, including the pipeline crack out of the North Sea,” Rob Haworth, who helps oversee $150 billion in assets at U.S. Bank Wealth Management in Seattle, said by telephone. Markets should remain relatively quiet “with traders comfortable and confident in their positions as long as oil isn’t breaking down below $55.” Crude has increased this year as the Organization of Petroleum Exporting Countries and its allies including Russia limited production to reduce global inventories. The group of producers agreed last month to extend curbs through the end of next year. Hedge funds boosted their net-bullish Brent crude bets to a record, according to weekly ICE Futures Europe data. West Texas Intermediate for January delivery gained 26 cents to settle at $57.30 on the New York Mercantile Exchange. Total volume traded was about 19 percent below the 100-day average. Brent for February settlement slipped 8 cents to $63.23 a barrel on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a premium of $5.90 to February WTI. See: The biggest voices in oil disagree on the outlook for 2018 The Forties halt forced Ineos Group Ltd., the operator of the pipeline, to declare force majeure, a contractual term that allows it to miss deliveries due to events beyond its control. That’s the first time in nearly 30 years that such a condition has been declared in the North Sea, according to Gary Ross, founder of PIRA Energy, now part of S&P Global Platts. Meanwhile, the IEA report indicated that the market will be “closely balanced” next year. “The IEA report wasn’t overwhelmingly negative” and the non-OPEC supply forecast “is not set in stone,” Ashley Petersen, lead oil analyst at Stratas Advisors in New York, said in a telephone interview. The Forties pipeline shutdown also “definitely helped support prices.”

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Oil Traders Snap Up Bullish Options for $80 Brent Next Year Oil traders are increasingly betting that Brent crude will climb to $80 a barrel from the middle of next year, as OPEC and its allies prepare for a second year of output cuts amid simmering geopolitical tensions. More than 32,000 option contracts giving traders the right to buy Brent at $80 for June 2018 onward traded in the last week, when the market was also shaken by the shutdown of a major North Sea pipeline. That’s the equivalent of 32 million barrels, with a total cost of about $9 million. One-in-five Brent contracts traded on Thursday were $80 calls, according to ICE Futures Europe data. With OPEC committing to extend output cuts through 2018, oil bulls argue that shrinking inventories mean that any supply disruptions may provoke sharp price gains. Those risks have increased in recent months as tensions ratcheted up between key oil producers Saudi Arabia and Iran, alongside political turmoil in Venezuela and conflict between Iraq’s federal government and its semi-autonomous Kurdish region. Those factors fueled a surge in option buying to profit from potential price spikes. “They seem cheap with inventories still drawing and geopolitical risks high,” said Mark Maclean, managing director at Commodities Trading Corporation Ltd. in London, which advises on hedging strategies. “There is a very small margin for error for balances in 2018 to tip to over- or under-supply. Add geopolitical risk and the trade doesn’t look too bad.” The pattern has been developing for several weeks. Throughout November, volumes on Brent $80, $90 and $100 calls for 2018 and 2019 surged to the extent that the most-held December 2018 contract was the $100 call. Even with the Paris-based International Energy Agency cautioning that OPEC may be too optimistic in predicting the elimination of excess oil inventories, those wagers contributed to money managers amassing a near-record number of bullish bets in the Brent crude market.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Outright long positions total the equivalent of 595 million barrels, according to the most recent ICE Futures Europe data. The latest positioning data were due out later on Friday. “The call buying points to how sentiment has changed over the past year to more bullish,” Maclean said. The Biggest Voices in Oil Disagree About 2018 The two most critical forecasts of global oil markets offer contrasting visions for 2018: one in which OPEC finally succeeds in clearing a supply glut, and another where that goal remains elusive. In the estimation of the Organization of Petroleum Exporting Countries, production curbs by the cartel and its allies will finally eliminate the excess oil inventories that have depressed crude prices for more than three years. But in the view of the International Energy Agency, which advises consumers, that surplus will barely budge. “Both cannot be right,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank A/S in Copenhagen. “Whichever way the pendulum swings will have a significant impact on the market.” OPEC and Russia have eliminated almost two-thirds of a global glut this year as the former rivals jointly constrict their crude production to offset a boom in U.S. shale oil. At the heart of the clash between the 2018 forecasts is whether the alliance can deplete the rest of the overhang without triggering a new flood of American shale. Late last year, OPEC and Russia set aside decades of rivalry and mistrust to end a slump in global oil markets that has battered their economies. Defying widespread skepticism, they cut oil supplies as promised, and resolved on Nov. 30 to persevere until the end of next year. Brent crude climbed this week to a two-year high above $65 a barrel, although prices had slipped to $63.37 as of 11:32 a.m. in London. Both the IEA and OPEC agree that the coalition’s cuts are working. The surplus oil inventories in developed nations -- OPEC’s main metric for gauging success -- fell to 111 million barrels in

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 October, from 291 million last November, according to the Paris-based IEA, established in 1974 in the wake of the Arab oil embargo. Happy New Year? Where they diverge is on what happens next. OPEC predicts the re-balancing will be complete by late next year as those stockpiles plunge by about 130 million barrels in 2018. By contrast, the IEA sees inventories remaining steady as new supply growth surpasses gains in demand. It warned OPEC on Thursday that it may be deprived of a “Happy New Year.” Although both institutions project that demand for OPEC crude will be about 32.3 million barrels a day on average in the first half of 2018, their views drift apart as the year progresses. OPEC expects it will need to pump about 34 million barrels day in the second half, while the IEA sees a requirement of just 32.7 million a day. “They live in the same world for the first half of 2018, but divorce into separate universes for the second half,” said Olivier Jakob, managing director at consultants Petromatrix GmbH in Zug, Switzerland. “OPEC believes in strong growth of oil demand; the IEA believes in strong growth of non-OPEC supplies.” Diverging Views While OPEC expects rival supplies to expand by 1 million barrels a day next year, the IEA forecasts non-OPEC to grow by 1.6 million a day. The difference partly lies in their conflicting views of the supply source that unleashed the glut OPEC is now battling to clear: U.S. shale oil. OPEC boosted estimates for U.S. crude production this week and now sees an expansion of 720,000 barrels a day next year. Still, the IEA’s forecast is about 20 percent higher. “The uncertainty surrounding shale oil production for next year has resulted in very differing views on the 2018 fundamental picture,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London. When OPEC officials invited a range of experts to brief them on the U.S. shale outlook days before their Nov. 30 meeting, they were dismayed by the divergence of opinions, people familiar with the matter said. One of those experts, veteran crude trader Andy Hall, cited the unpredictability of shale as one reason for shuttering his flagship hedge fund this summer. Shale Limits Saudi Arabian Minister of Energy and Industry Khalid Al-Falih, speaking at the OPEC meeting in Vienna, rejected the IEA’s outlook for 2018 as excessively pessimistic. There are signs that the U.S. shale boom is slowing. Drillers may have reached the limitsin terms of cutting costs and boosting productivity, and investors are finally insisting that profits are shared out rather than funneled back into supply growth. Yet analysts from Citigroup Inc. to Goldman Sachs Group Inc. and Commerzbank AGwarn that OPEC continues to underestimate the magnitude of the shale revolution. American producers are rushing to lock in revenues as U.S. crude approaches $60 a barrel, enabling them to finance a new wave of drilling, data compiled by Bloomberg New Energy Finance show. “The U.S. alone can achieve almost all of the supply growth that OPEC forecasts globally in 2018,” said Carsten Fritsch, an analyst at Commerzbank in Frankfurt. “So, without question, the IEA’s forecast is more convincing.”

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 US shale recovery will leave OPEC with a difficult 2018, IEA says The IEA said that there were signs that the rise in U.S. crude oil supply was likely to continue into 2018 and upset rivals who are cutting back. order to boost global oil prices and rebalance markets put out of kilter in 2014 by a glut in supply and lackluster demand. One of the main beneficiaries of these cuts is the producers' major competitor, U.S. shale oil. U.S. oil producers are staging a dramatic comeback amid a recovering oil price that has allowed many of them to restart operations. The IEA forecast that non-OPEC supply — which includes the U.S. — was set to rise by 600,000 barrels a day in 2017, and 1.6 million barrels a day in 2018. It also noted that global oil supply rose 200,000 barrels a day in November to 97.8 million barrels a day (mb/d), adding that this was "the highest in a year, on the back of rising U.S. production." OPEC agree to extend In November at a meeting in Vienna, OPEC and non-OPEC members agreed to extend their oil output cuts until the end of 2018, giving markets a further boost. At the same time, U.S. crude oil output was rising, the IEA noted. "Just as the OPEC oil ministers were sitting down in Vienna, our colleagues at the U.S. Energy Information Administration released data showing that for September U.S. crude oil output increased month-on-month by 290,000 b/d to reach 9.48 million barrels a day, the highest monthly average since April 2015 and 928,000 b/d above a year ago," the IEA said. "Preliminary weekly data suggests that U.S. production increased further into early December. Recently, U.S. drilling activity and well completion rates have picked up again, suggesting higher production to come in a few months … Consequently, we have raised our annual growth forecast for total U.S. crude oil to 390,000 b/d this year and 870,000 b/d for 2018," the IEA added.

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 NewBase Special Coverage News Agencies News Release December 06-2017 Aker BP submits development plans for 3 fields offshore Norway Source: Aker BP Aker BP has submitted the Plans for Development and Operations (PDOs) for the Valhall Flank West, Aerfugl (formerly Snadd) and Skogul (formerly Storklakken) fields to the Norwegian Ministry of Petroleum and Energy, on behalf of the respective partnerships. CEO Karl Johnny Hersvik handed over the PDOs to the Minister of Petroleum and Energy, Terje Søviknes, on 15 December 2017. 'This is a great milestone for Aker BP and our partners, and demonstrates our strong commitment to the Norwegian continental shelf as well as to the Norwegian society', Hersvik says. 'Investments to increase the value creation from our core areas is a vital part of our growth strategy. The Valhall Flank West, Ærfugl and Skogul developments will substantially strengthen Aker BP’s reserves and production from our operated field centres at Valhall, Skarv and Alvheim', Hersvik adds. Reduced investments estimates 'The PDOs submitted today clearly demonstrate Aker BP’s ability to deliver in accordance with our promises. Our ambition is to be recognized as the cost and capital leading offshore E&P company, and I am very proud to announce that the projects have improved significantly in this respect', Hersvik says. Total investments for the Ærfugl development are estimated to NOK 8.5 billion – a reduction of approx. NOK 2 billion compared to previously communicated estimates – while recoverable reserves have increased substantially. For the Valhall Flank West development, total investments are now

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 estimated to NOK 5.5 billion, which also represents a reduction of more than NOK 1.5 billion compared to previous estimates. The smaller Skogul project is estimated to cost NOK 1.5 billion. (All NOK amounts are in real terms.) See separate PDO press releases for further details. Positive economic impact Over the lifetime of the fields, the three projects are estimated to generate total oil and gas revenues of NOK 100 billion (in real terms), based on an oil price of USD 60 per barrel. Net of investments and operating costs, this will result in a total value creation of NOK 70 billion, of which taxes to the Norwegian state amount to NOK 52 billion. The impact on employment is estimated to approx. 14 000 full-time equivalents, according to benchmark data from DNV GL. PS: In November 2017, the Ministry of Petroleum and Energy approved new names for both Ærfugl (formerly Snadd) and Skogul (formerly Storklakken). Submitting PDO for Ærfugl (formerly Snadd) The PDO covers the full-field development and includes the resources in both the Ærfugl and Snadd Outer fields which are planned to be developed in two phases. The first phase includes three new production wells in the southern part of the field tied into the Skarv FPSO via a trace heated pipe-in-pipe flowline, in addition to the existing A-1 H well. Production is planned to begin in late 2020. The second phase is subject to further maturation, but the reference case includes two additional wells in the northern part of the field and one in Snadd Outer also tied into the Skarv FPSO with

- 23. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 an estimated production start late 2023. Other alternatives will be looked at to select the optimized concept. Highly attractive and robust development The total remaining reserves for the full-field development are estimated at approximately 275 million barrels of oil equivalents. Total investments in the Ærfugl project are estimated at NOK 8.5 billion (real terms) with NOK 4.5 billion in the first phase and NOK 4.0 billion in the second phase (reference case) respectively. The Ærfugl development represents a significant opportunity with highly attractive and robust economics. In addition, the Ærfugl development will extend the economic field life of the Skarv FPSO and allow for increased recovery from the Skarv field itself. SURF and SPS contracts awarded On 11th December, Aker BP, on behalf of the Ærfugl partners, entered into Ærfugl field development contracts with Subsea 7 for Subsea Umbilical Riser Flowline (SURF) and with Aker Solutions for Subsea Production System (SPS). The contracts’ cover Phase 1 of the project with an option for the Phase 2 scope. The Ærfugl partnership awarded the contracts to Subsea 7 and Aker Solutions based on the implementation of new technology and safe, cost-effective solutions. The Ærfugl project will be organized and executed as a part of Aker BP’s alliance model. Both contracts were awarded following the approval by the MPE for making early project commitment, and subject to the final approval of the PDO. Joint Venture partners in Ærfugl (Skarv Unit) are Aker BP ASA (operator, 23.835%), Statoil Petroleum AS (36.165%), DEA Norge AS (28.0825%) and PGNiG Upstream Norway AS (11.9175%). Partners in Snadd Outer (PL 212 E) are Aker BP ASA (operator, 30%), Statoil Petroleum AS (30%), DEA Norge AS (25%) and PGNiG Upstream Norway AS (15%). Submitting PDO for Valhall Flank West Valhall is a giant oil field in the southern part of the Norwegian sector in the North Sea. The Valhall Flank West project aims to continue the development of the Tor formation in Valhall on the western flank of the field, with startup of operation in fourth quarter 2019.

- 24. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24 Valhall Flank West will be developed from a new Normally Unmanned Installation (NUI), tied back to the Valhall field centre for processing and export. • First oil in fourth quarter 2019 • Targeting the Tor formation in the Valhall West Flank • Drainage by natural depletion, with option for future water injection • Six producers with option to convert two producers into water injectors • Normally Unmanned Installation (12 well slots) with helideck access The wellhead platform at Valhall Flank West will be fully electrified, and will be designed to minimize the need for maintenance activities. The platform will be remotely operated from the Valhall field centre. Recoverable reserves for Valhall Flank West are estimated to be around 60 million barrels of oil equivalent. Total investments for the development are estimated to NOK 5.5 billion in real terms. Joint venture owners in Valhall are Aker BP AS (35.95%) and Hess Norge AS (64.05%). Aker BP ASA has entered into an agreement to acquire Hess Norge AS, and approval for submittal of the PDO to the MPE is conditional upon closing. Furthermore, Aker BP ASA (“Aker BP”) has entered into an agreement with Pandion Energy AS (“Pandion Energy”) to divest 10 percent interest in the Valhall and Hod fields. Both transactions are subject to customary conditions for completion, including approval by the Ministry of Oil and Energy, Ministry of Finance and relevant competition clearance. The effective date of the transactions will be 1 January 2017, and closing is expected by the end of 2017.

- 25. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 25 Submitting PDO for Skogul (formerly Storklakken) The Skogul field is located 30 kilometers north of Alvheim FPSO, and will be developed as a subsea tieback to Alvheim via Vilje. Recoverable reserves are estimated to around 10 million barrels of oil equivalents. Total investments are estimated to NOK 1.5 billion in real terms, and production start is planned for first quarter 2020. The production well at Skogul will be subsea production well number 35 in the Alvheim area, and represents Aker BP’s continuous effort to maximize value and extend economical field life to the benefit of the company and its partners. Joint venture partners in Skogul are Aker BP ASA (operator 65%) and PGNiG Upstream Norway AS (35%).

- 26. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 26 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE The Editor :”Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 27 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase December 2017 K. Al Awadi

- 27. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 27

- 28. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 28