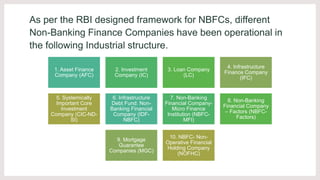

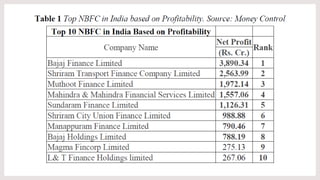

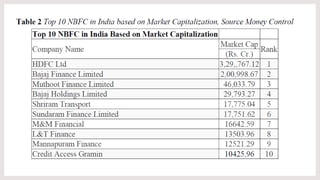

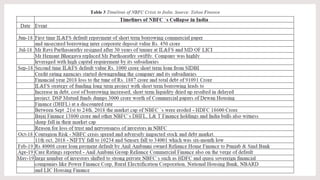

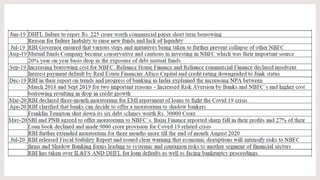

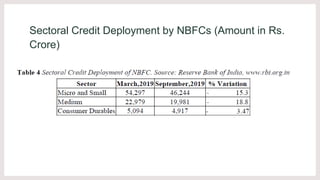

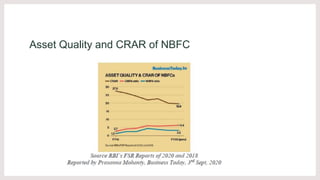

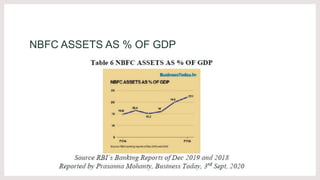

This document summarizes a study on the non-banking financial services crisis and risk management in India. It discusses the reasons for and impact of the NBFC crisis, including over-leveraging, excessive concentration of assets, and misconduct by some company promoters. It outlines the regulatory framework for NBFCs in India and steps taken to address the crisis, such as credit support from banks and the central bank. It concludes that the crisis highlighted shortcomings but will lead to better governance and regulation to support sustainable growth of the NBFC sector.