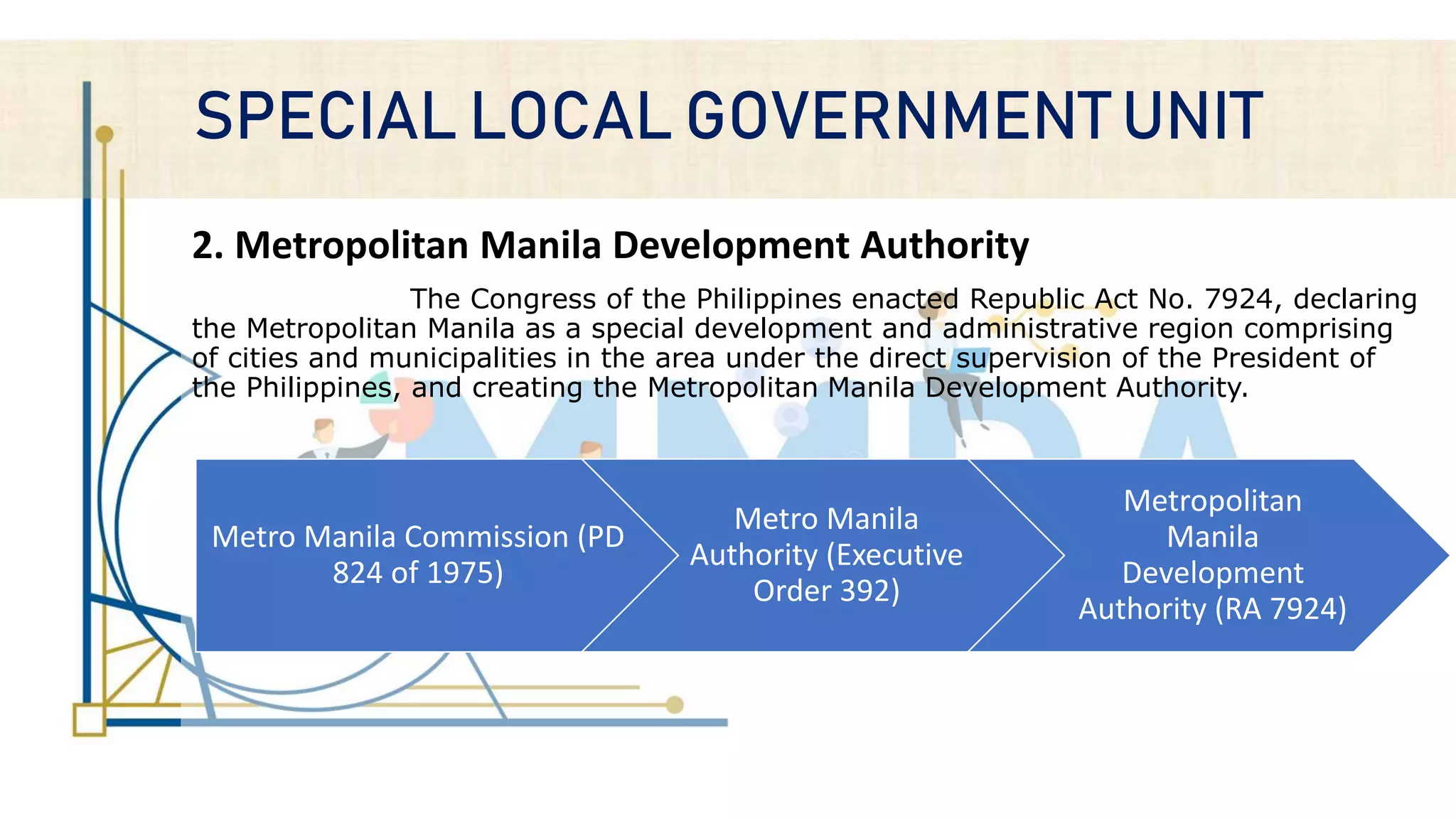

The document discusses the structures and functions of local government units (LGUs) in the Philippines. It states that the national government creates, merges, or abolishes LGUs through law. It outlines the criteria for land area, income, and population needed to create provinces, cities, municipalities, and barangays. It also discusses the officials, basic services, and revenue sources of LGUs. The document summarizes the Supreme Court's Mandanas-Garcia ruling, which increased LGUs' tax base and strengthened fiscal decentralization. It impacts LGUs by providing more funding through increased internal revenue allotments.