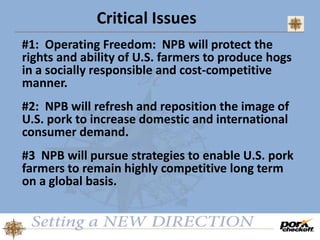

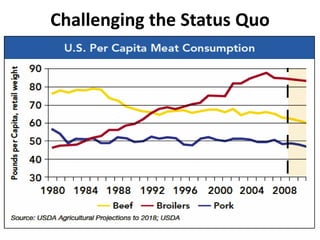

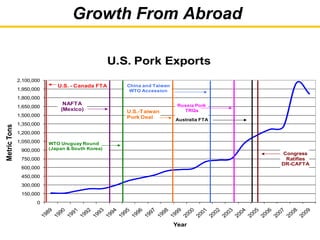

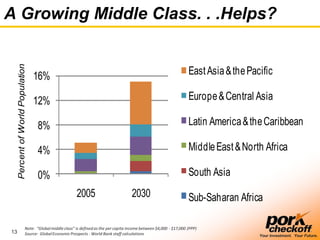

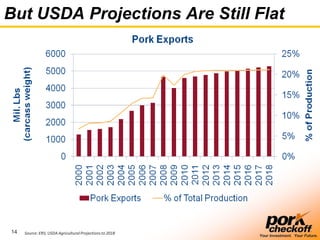

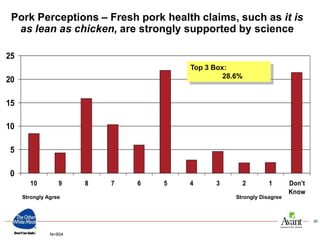

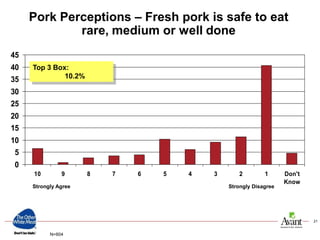

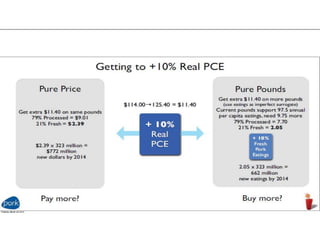

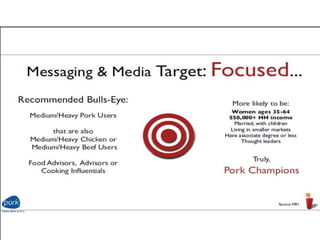

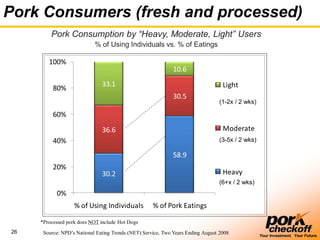

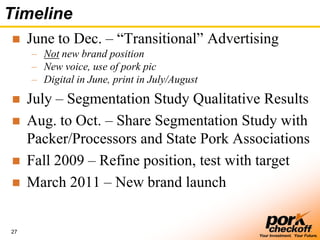

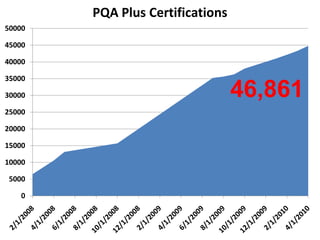

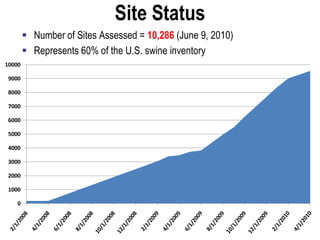

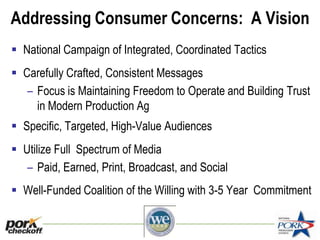

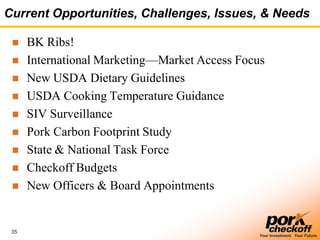

The document summarizes a presentation by Chris Novak, the CEO of the National Pork Board, at the 2010 Pork Management Conference. Novak outlined the Board's new strategic plan, which focuses on protecting farmers' operating freedom, enhancing demand for pork domestically and internationally, and maintaining US pork's competitiveness globally. He discussed research showing consumers' negative perceptions around pork safety and cooking. Novak also provided updates on the Board's branding and marketing efforts, including a new ad agency and target audience segmentation. Finally, he briefly touched on other current issues and opportunities facing the pork industry.