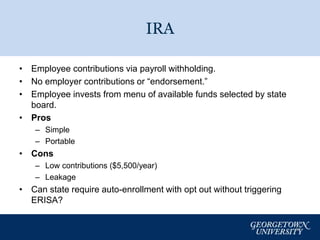

The document discusses the challenges of America's retirement crisis, highlighting the shortcomings of traditional pension plans and low retirement savings among workers. It suggests state initiatives to create user-friendly retirement programs while navigating federal laws like ERISA that regulate retirement plans. It emphasizes that states have the option to implement various retirement plan models, each with distinct advantages and disadvantages, while encouraging action to alleviate the retirement savings issue.