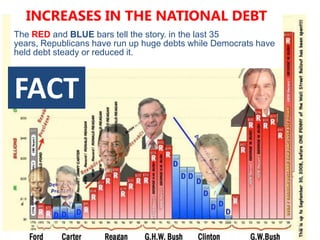

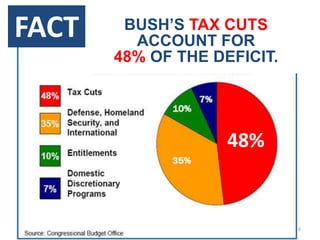

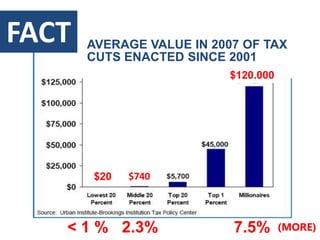

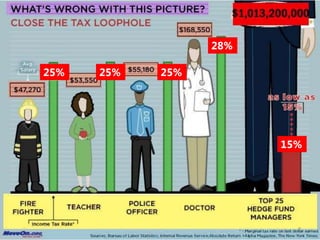

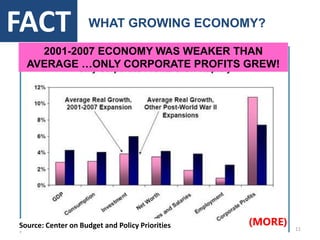

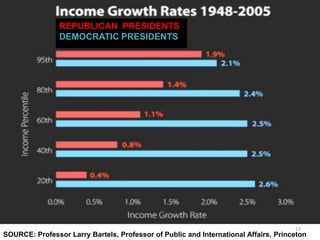

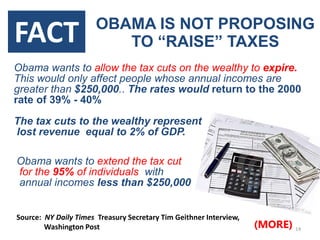

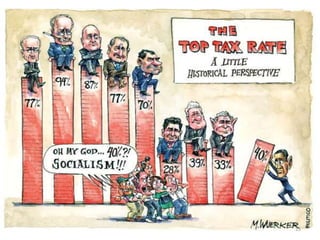

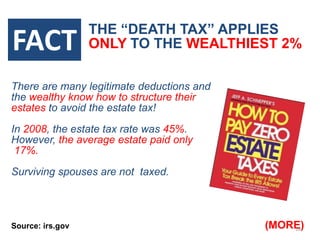

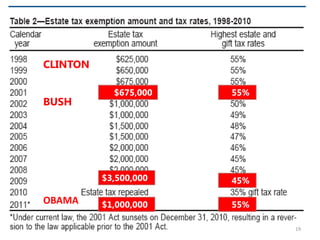

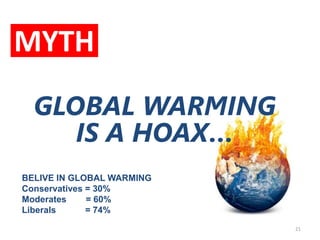

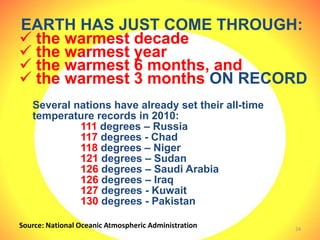

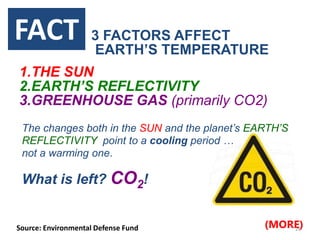

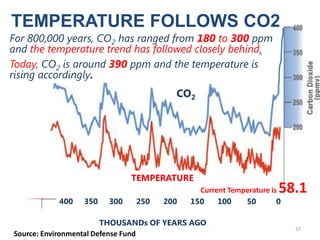

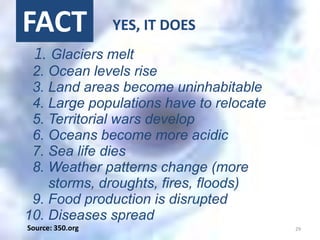

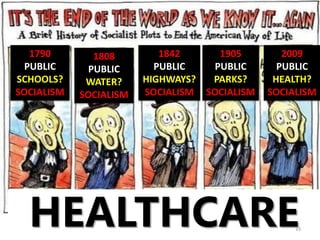

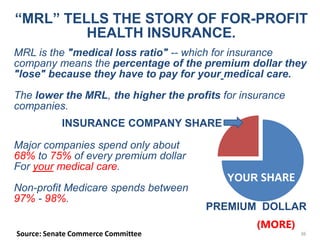

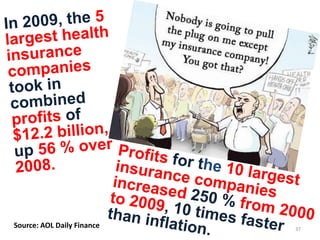

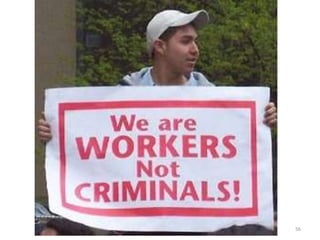

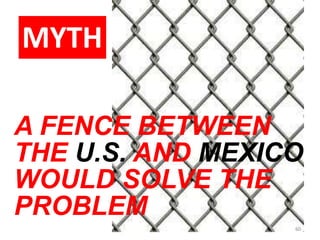

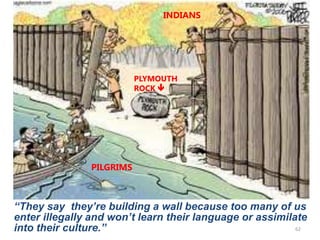

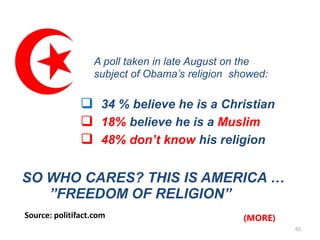

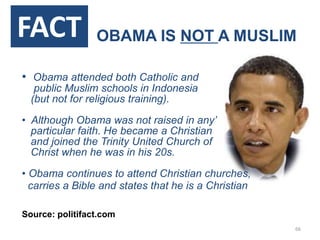

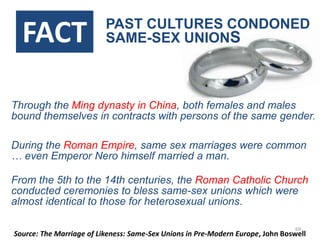

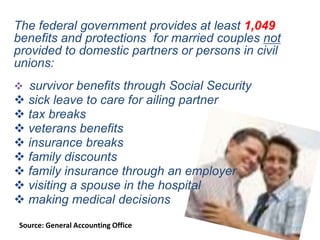

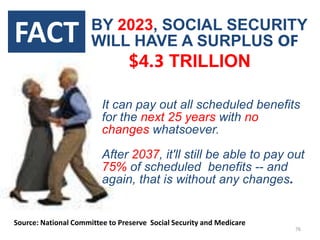

This document contains a series of myths and facts about various political and social issues. It aims to dispel common misconceptions with factual information from research studies and data. Some key topics addressed include the impact of tax cuts, causes of global warming, health care reform, immigration, and same-sex marriage. For each myth, supporting facts are provided from sources like the Center on Budget and Policy Priorities, the Environmental Defense Fund, and the National Immigration Forum.