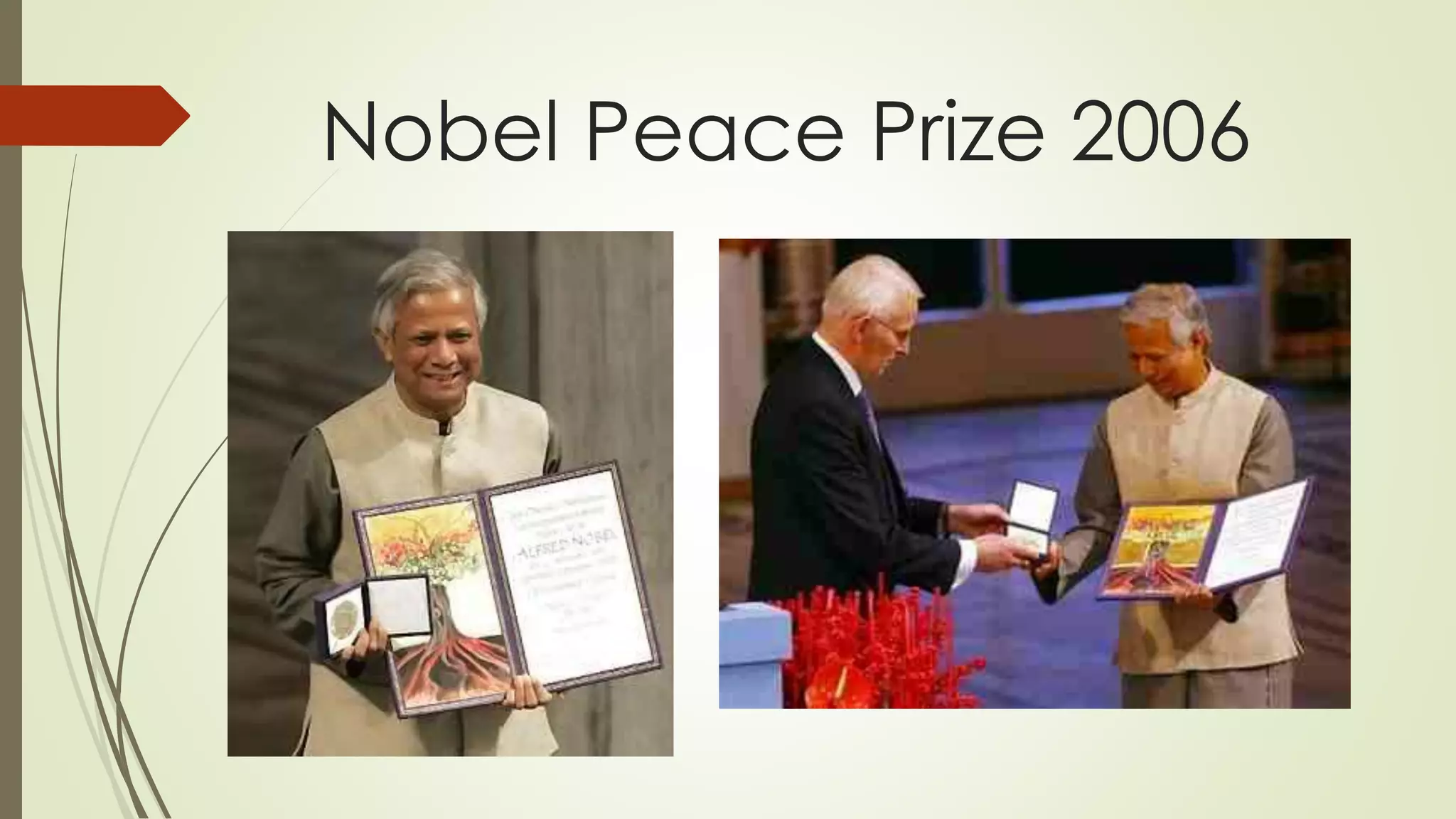

Muhammad Yunus saw a need to provide loans to poor people in Bangladesh and started small experiments lending money that was repaid. This grew into the Grameen Bank in 1983, which pioneered microloans between $27-500 that allowed the poor to start businesses and pull themselves out of poverty. By 2008, Grameen Bank had loaned over $6 billion to 7.5 million borrowers, mostly women. Based on its success, over 250 other organizations in 100 countries now operate microlending programs based on Grameen Bank's model. Yunus and Grameen Bank won the Nobel Peace Prize in 2006 for their work in creating economic and social development through microfinance.