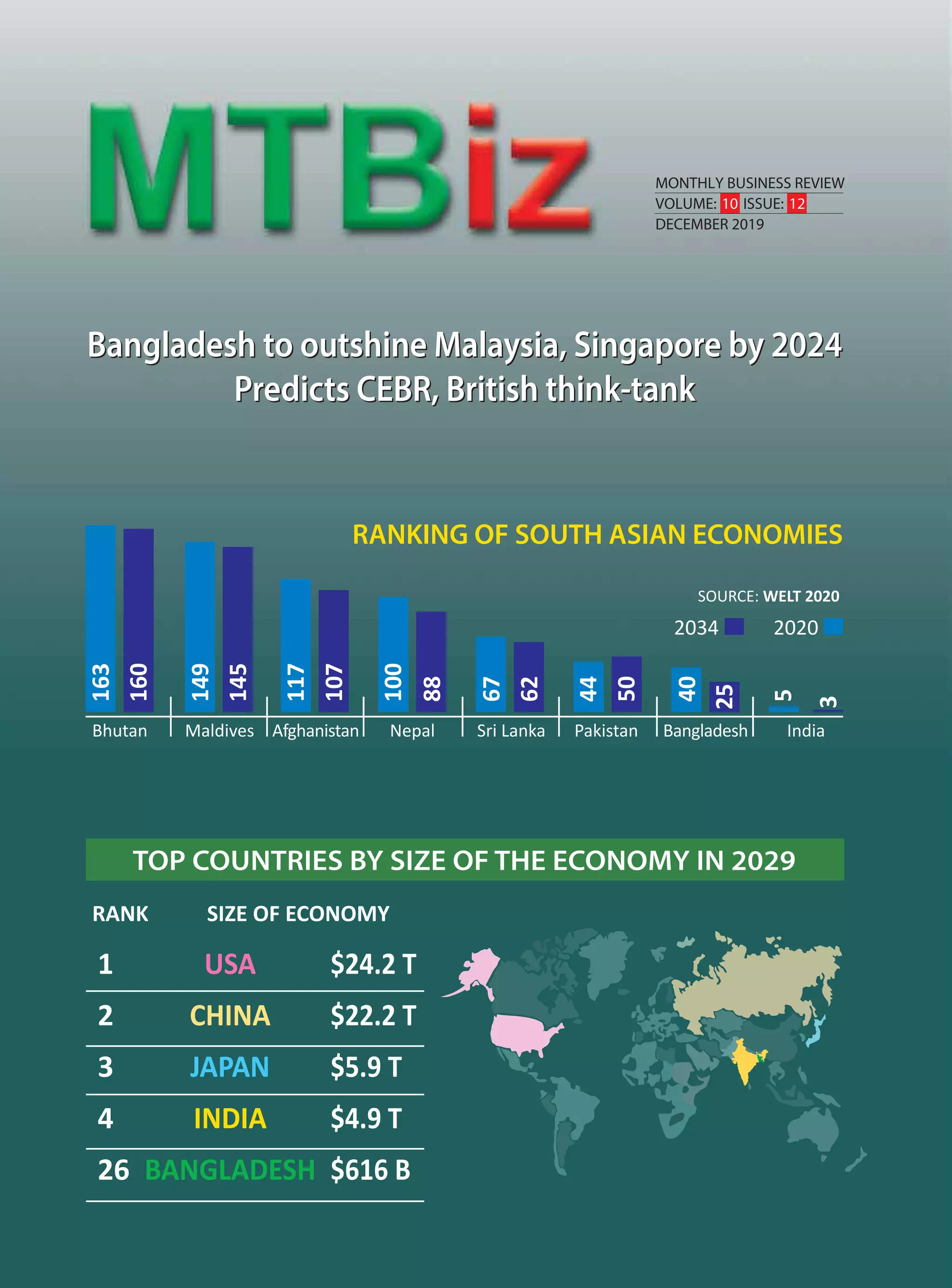

The December 2019 Monthly Business Review predicts that Bangladesh will become the 26th largest economy globally by 2029, outpacing Malaysia and Singapore by 2024, driven by strong economic growth and demographic factors. Despite a slight reduction in the World Bank's growth forecast to 7.2%, Bangladesh continues to maintain a strong economic trajectory, with an average growth of 7.39% over the past five years. The report highlights Bangladesh's move up the rankings among South Asian economies, second only to India, with important macroeconomic indicators showing positive trends.