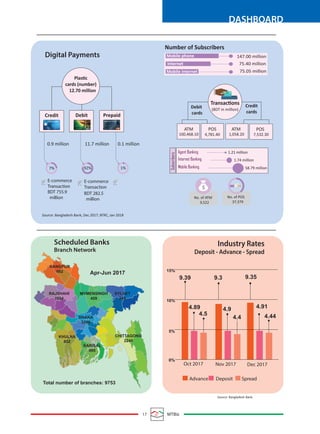

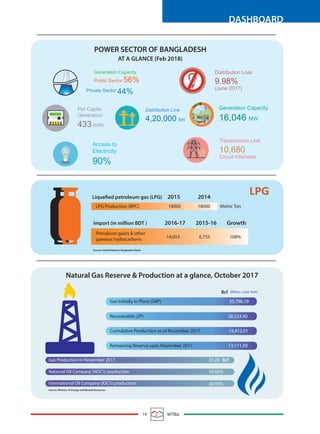

The March 2018 issue of the monthly business review discusses innovative banking models, including mobile banking solutions in rural areas, as traditional branches face closures due to shifting consumer behaviors. It also highlights Bangladesh's successful steps towards graduating from a least developed country to a developing country status, with significant economic growth projected for the fiscal year. Additionally, it addresses the trends in various sectors, including private sector credit growth, remittance inflow, and the increasing popularity of furniture exports.