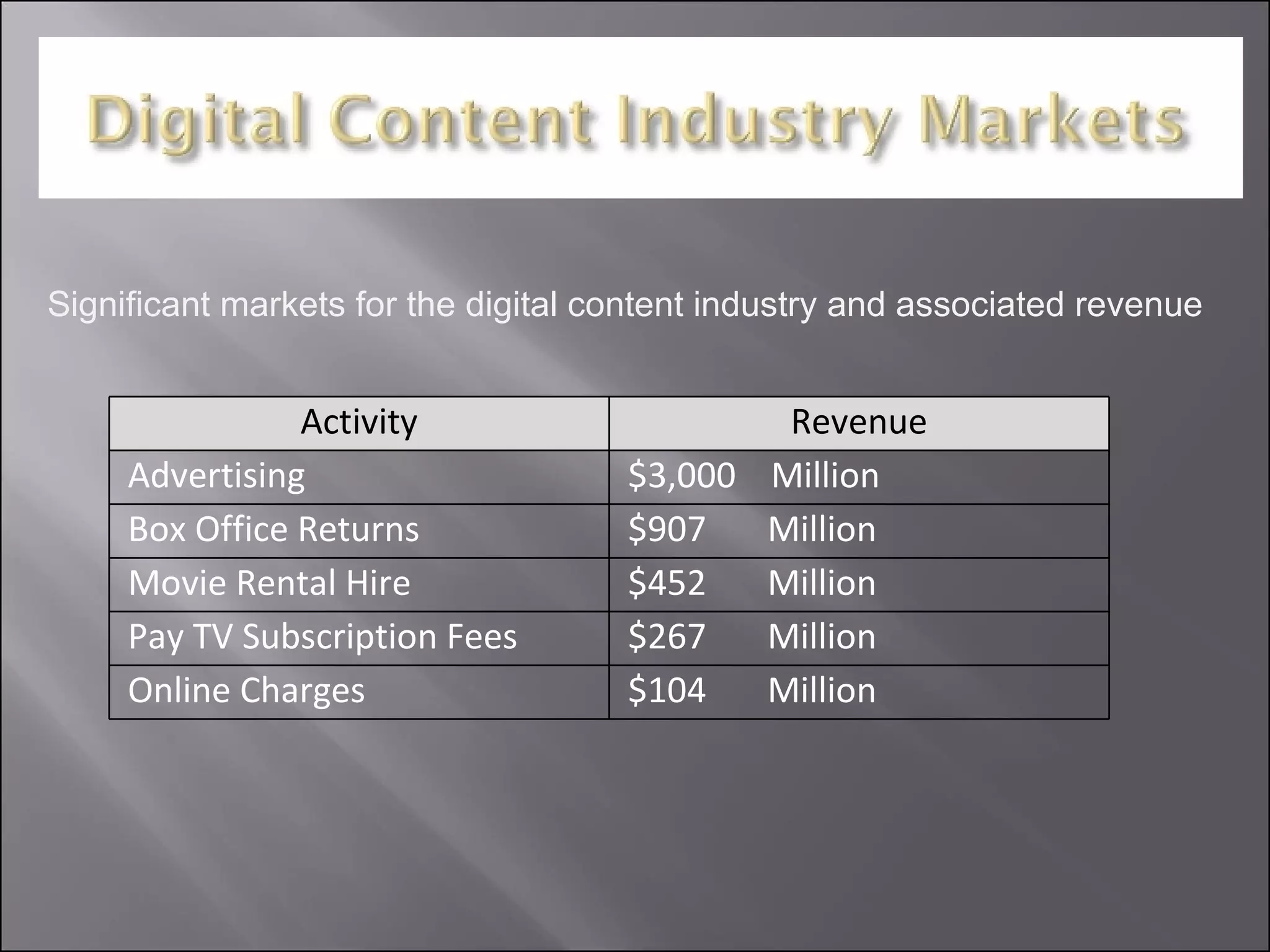

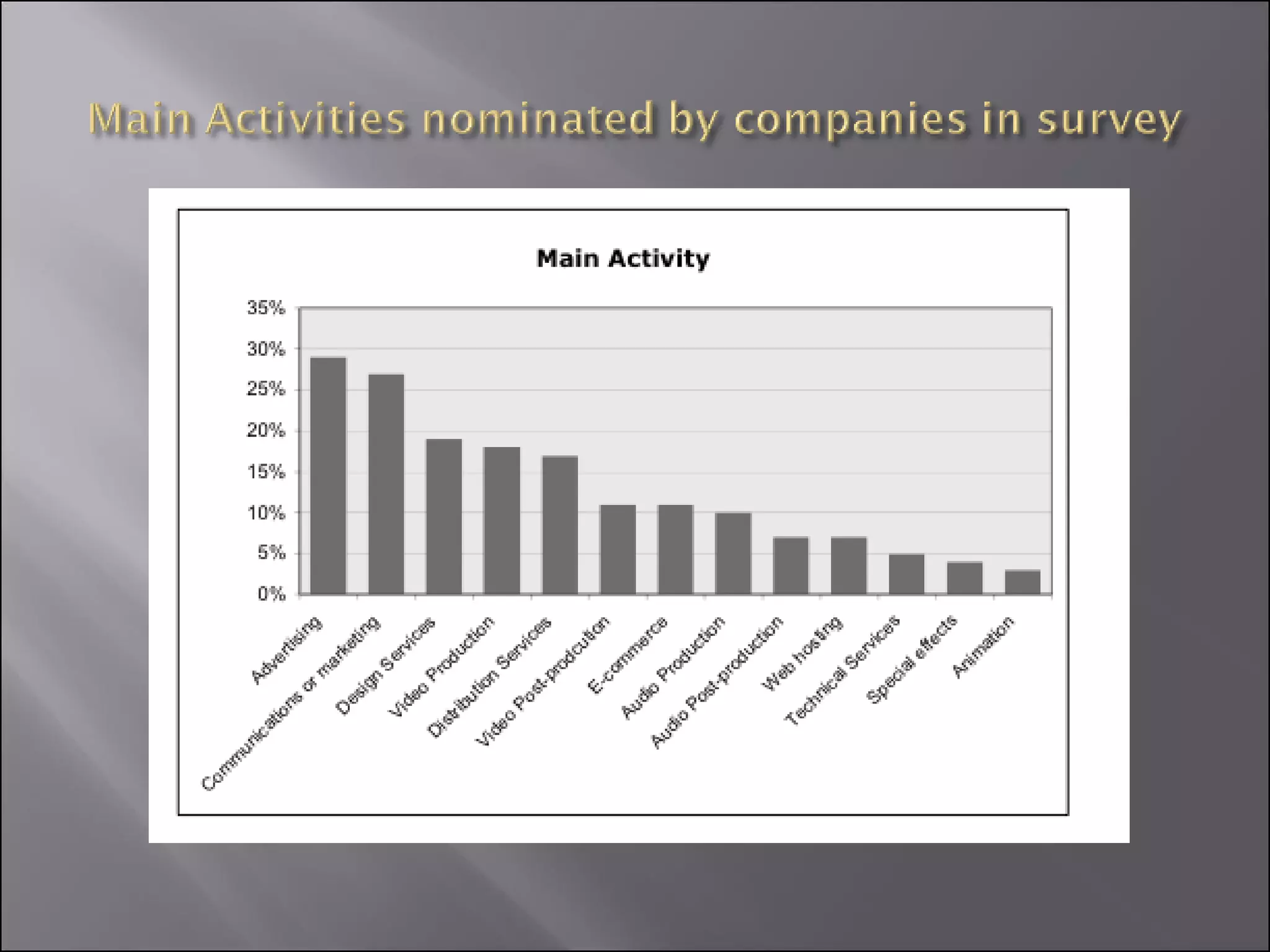

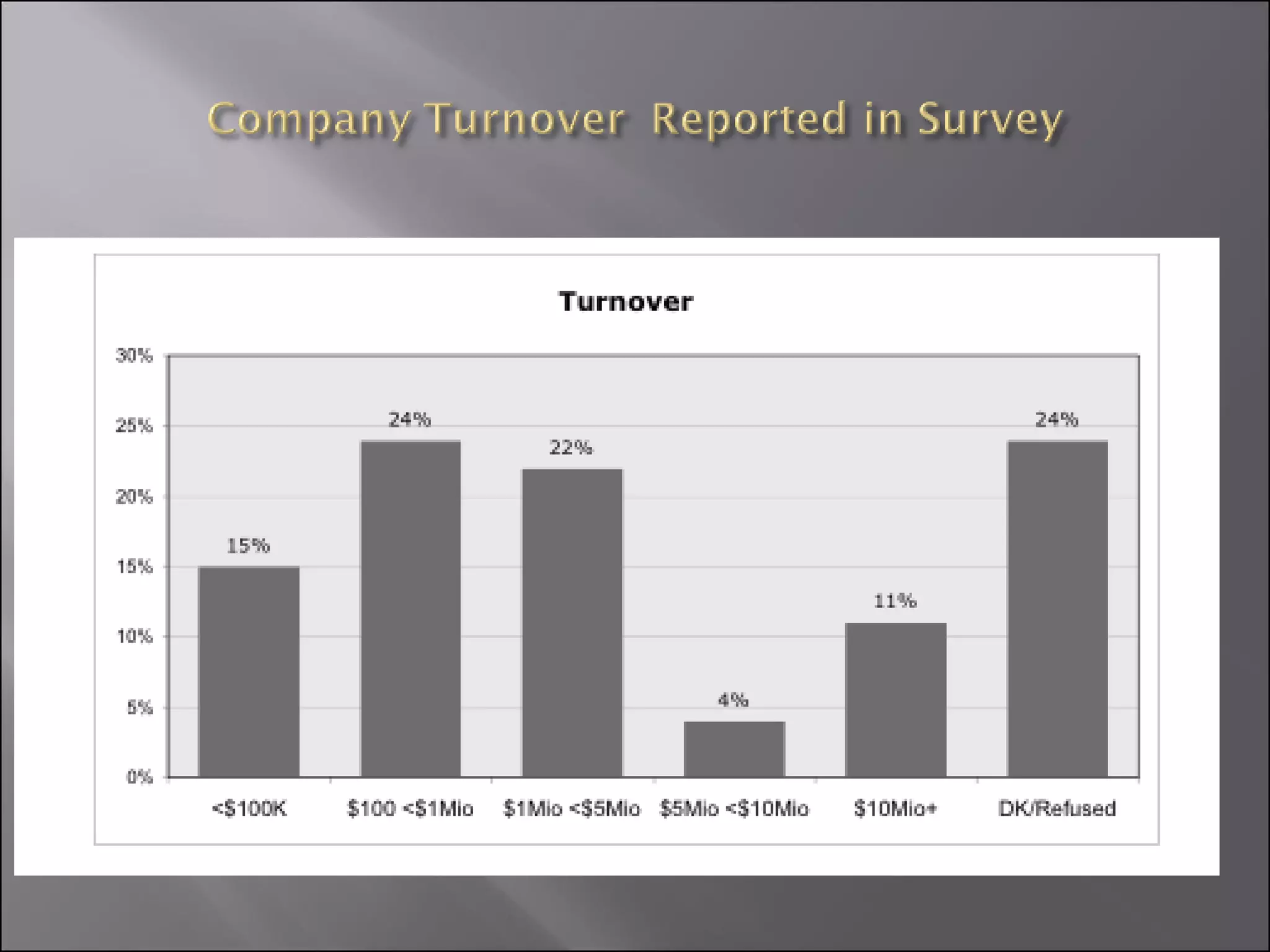

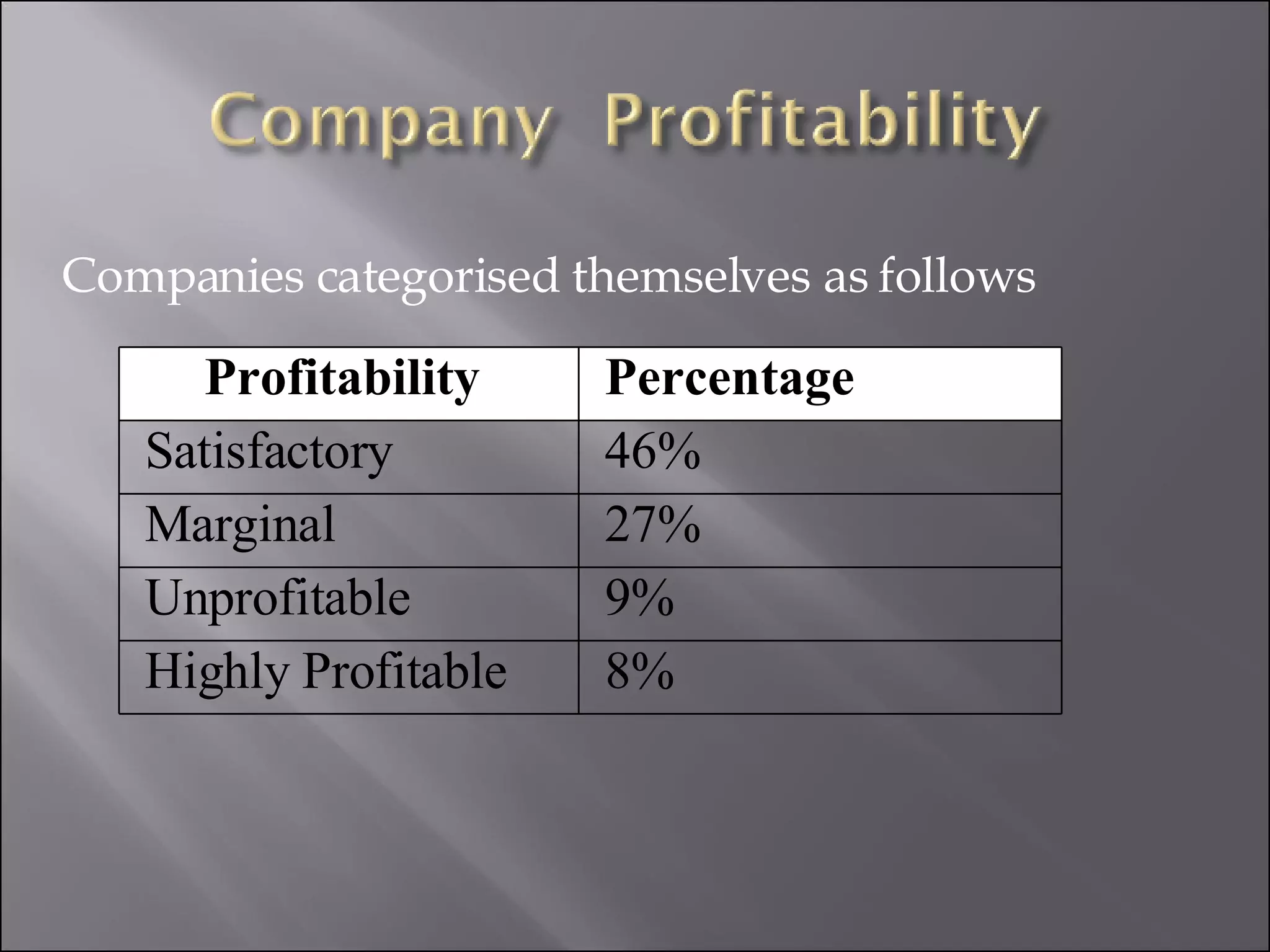

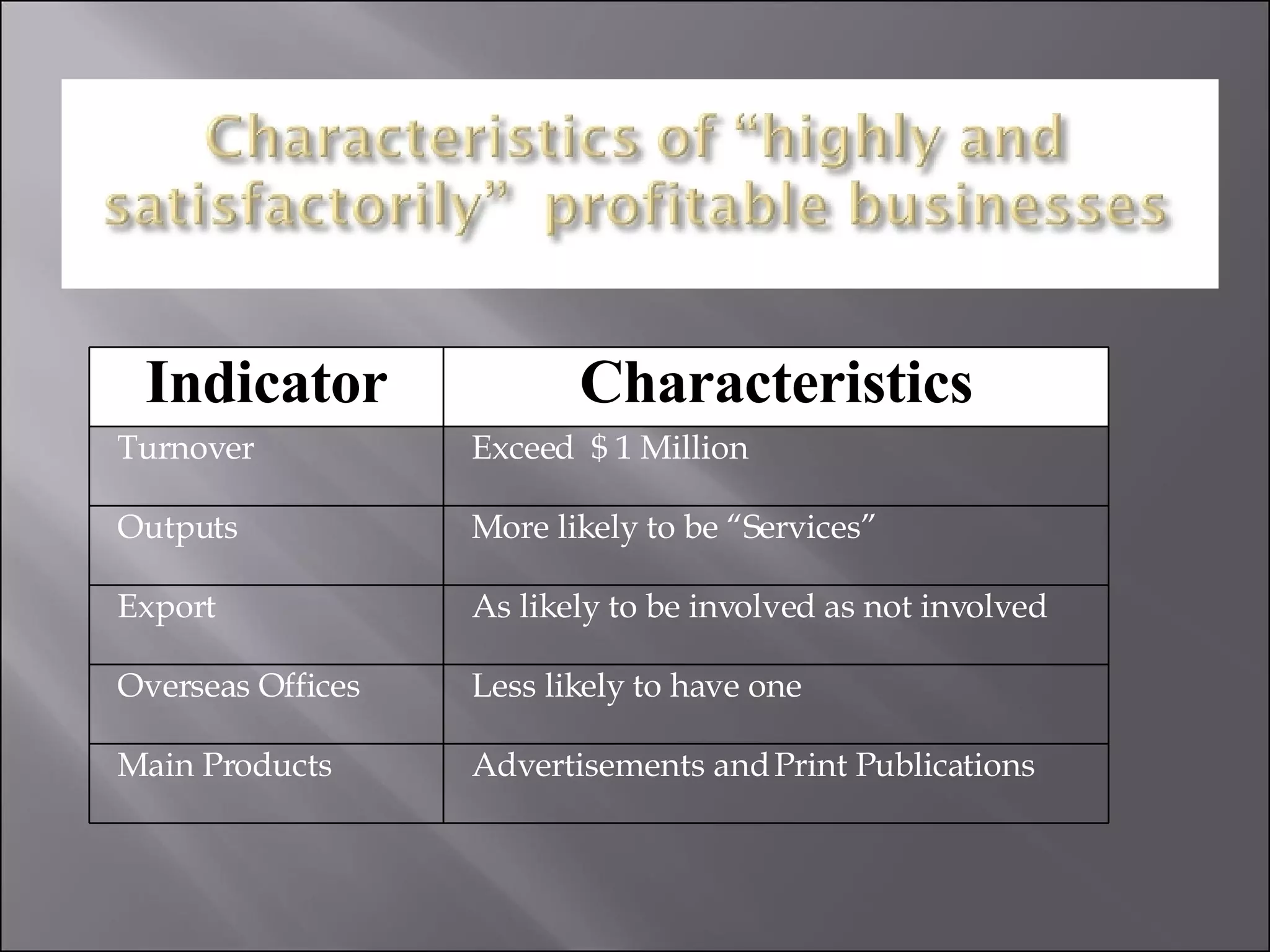

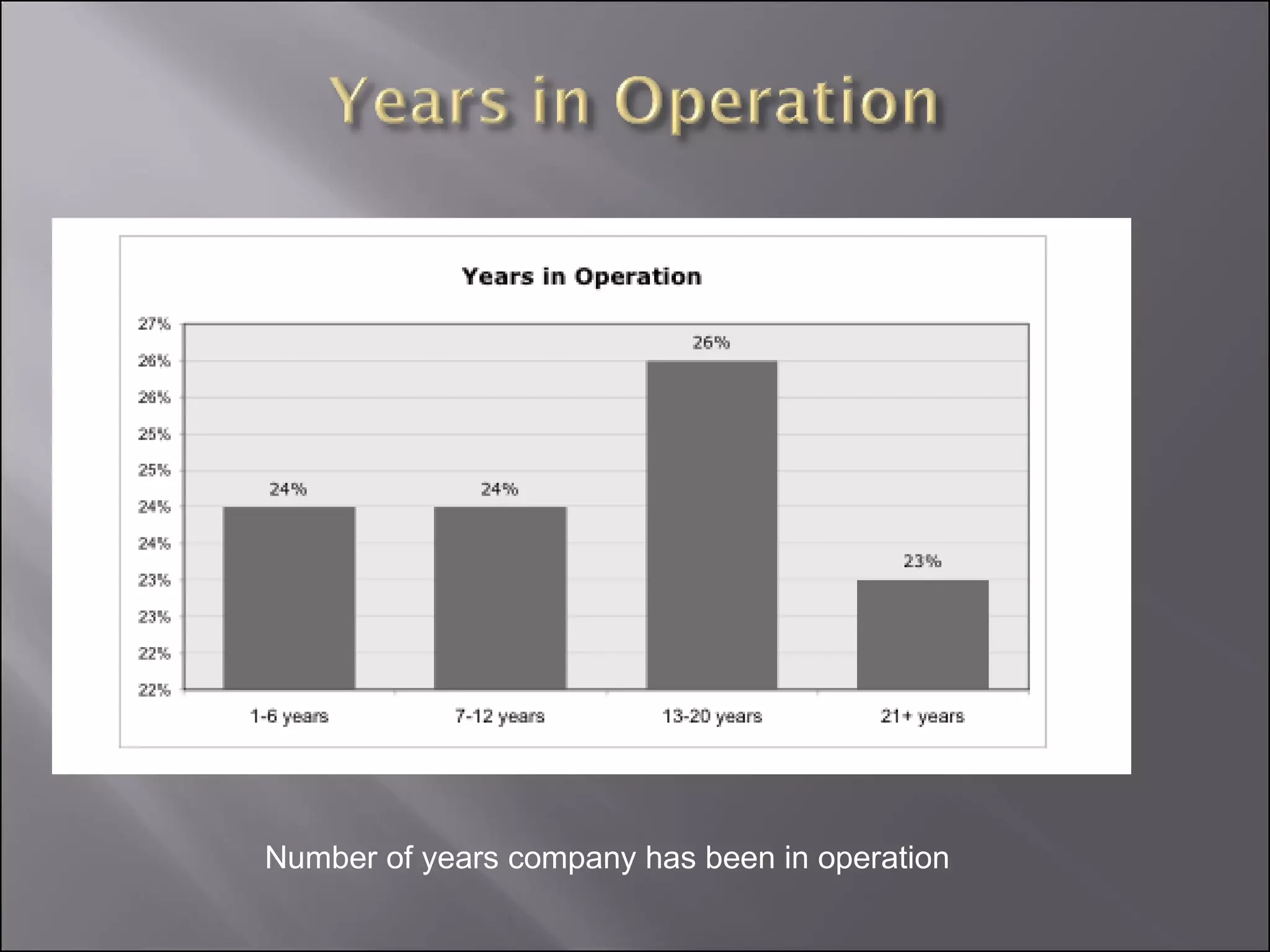

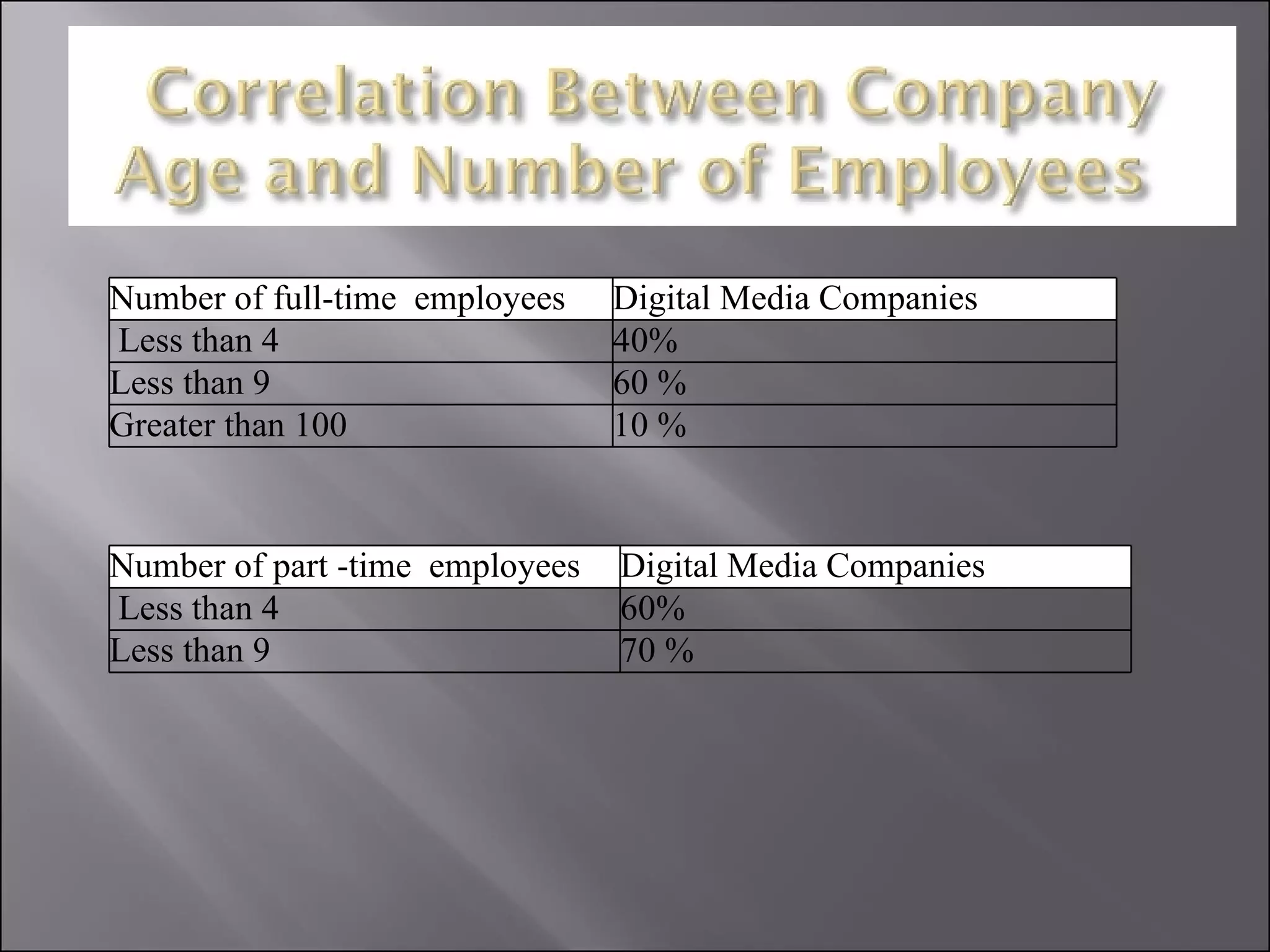

This section profiles companies in the digital content industry in Australia. Advertising is the largest market and source of revenue. Many companies classify themselves as part of the advertising industry even if their main product is designing websites for branding campaigns. The majority of companies are small, with over 60% having less than 9 employees. Profitability depends on company size, with larger companies being more profitable. The longest surviving companies evolve with technology trends.