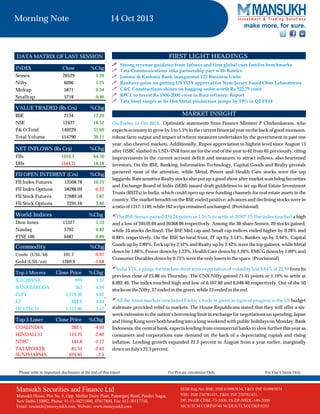

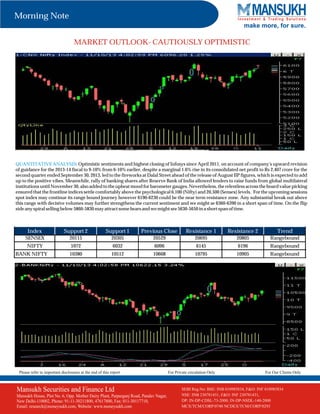

The Indian stock market indices ended higher with the Sensex gaining 1.26% and Nifty rising 1.25% on optimism over economic growth prospects and measures taken by the government and central bank. Key factors such as optimistic comments from the Finance Minister on GDP growth, rupee appreciation, and draft guidelines for real estate investment trusts by SEBI boosted market sentiment. However, analysts remain cautiously optimistic about the market trend in the near term, noting the indices may continue to see range-bound movement.