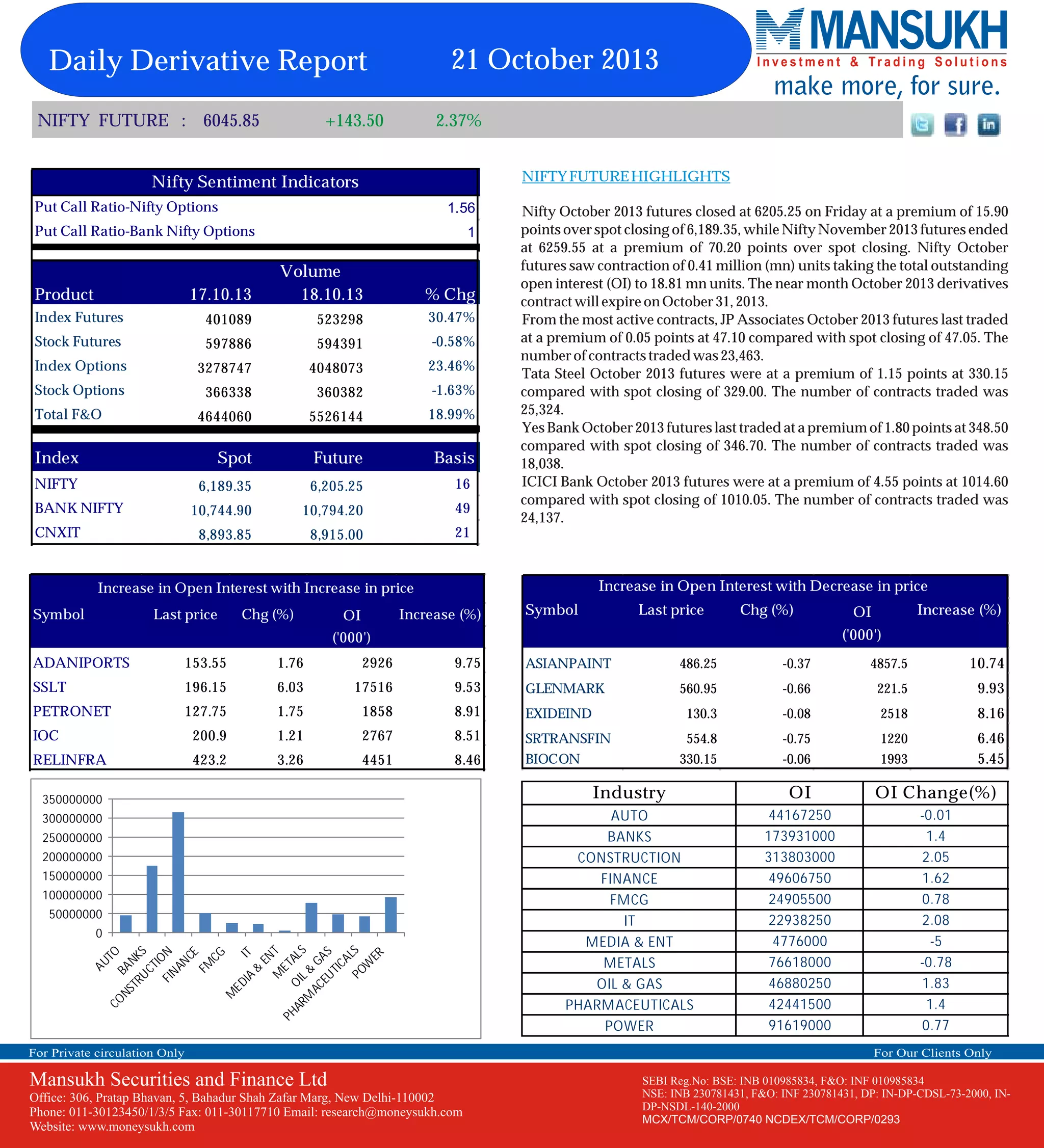

The Nifty futures closed at 6045.85, up 2.37% from the previous day. Trading volumes increased across various derivative segments like index futures, stock futures, index options and stock options. The put call ratios for Nifty and Bank Nifty options were 1.56 and 1 respectively. Open interest increased for several stocks as their prices declined, while open interest rose for some stocks when their prices increased. Overall open interest increased most for sectors like construction, finance, IT and pharmaceuticals. The document provides analysis of most actively traded stock options and calls and puts on the Nifty. It also includes a proposed options strategy and tracker of past strategies.