This document describes analyzing stock market index data over a 10 year period to identify potential "money multiplier" opportunities. It outlines:

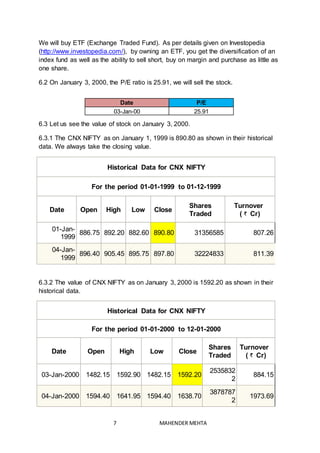

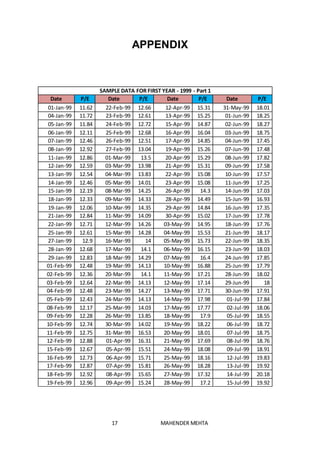

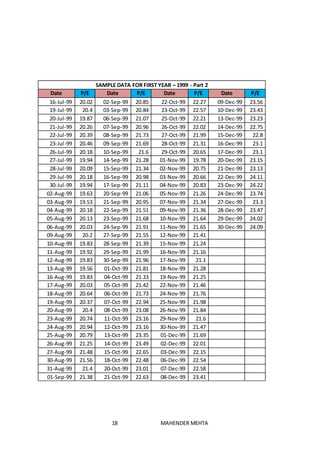

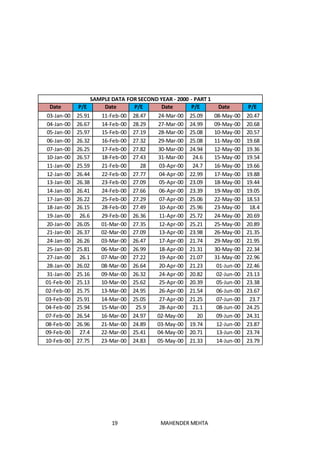

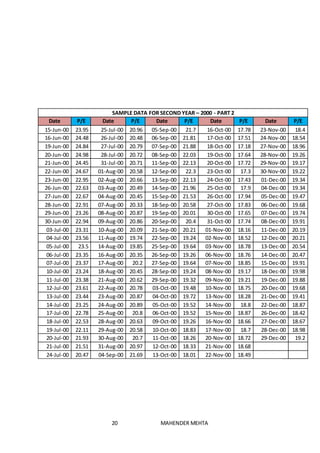

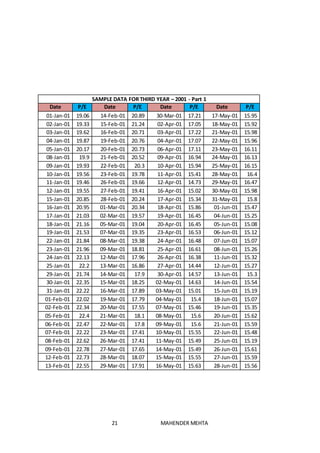

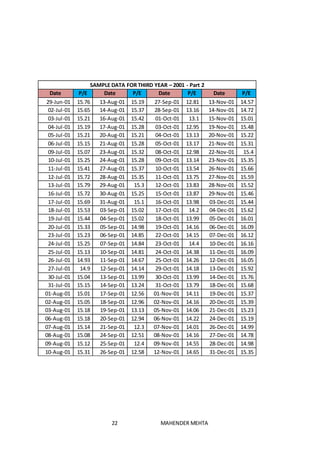

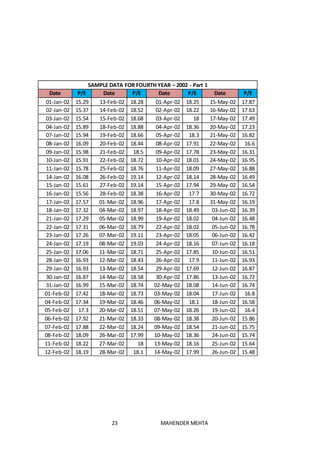

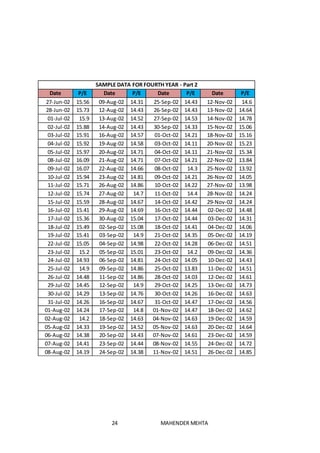

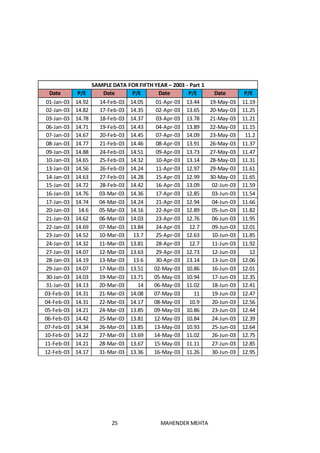

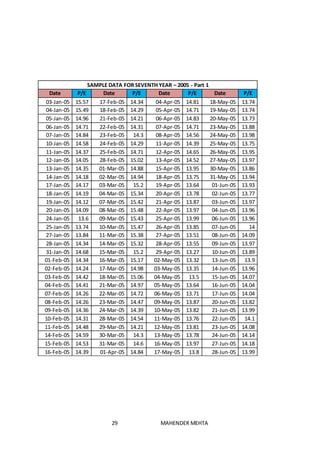

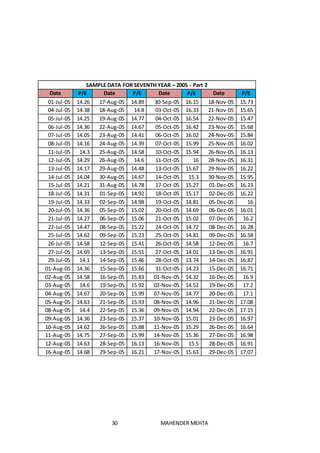

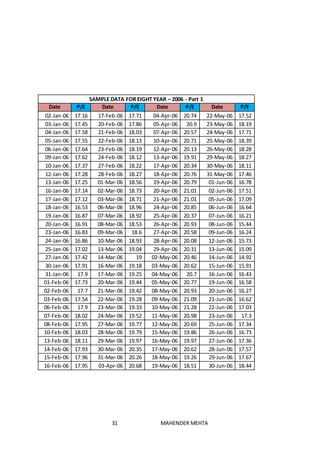

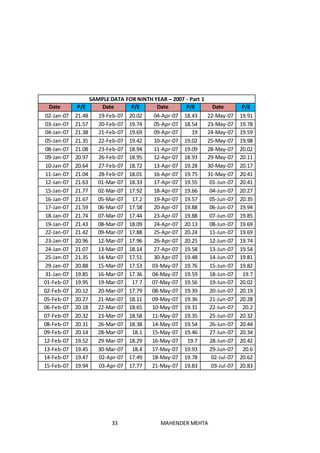

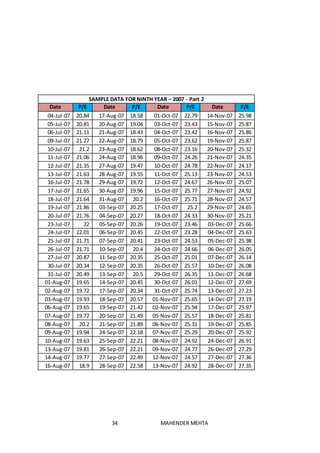

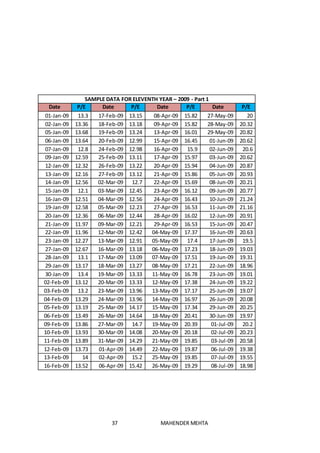

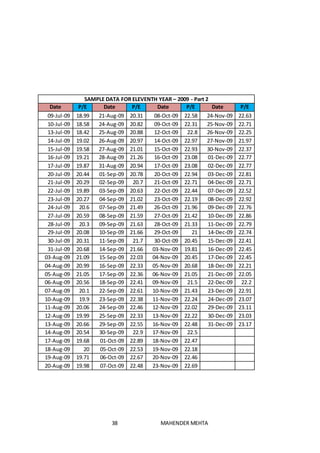

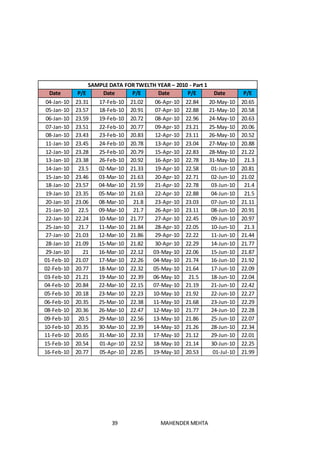

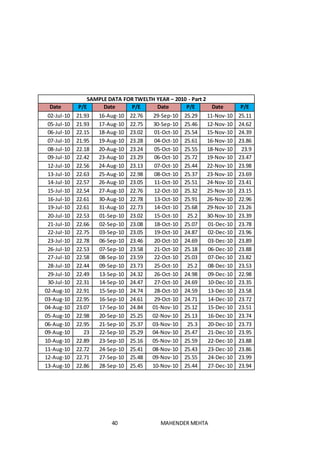

1) Collecting Price/Earnings (P/E) ratio data for the CNX Nifty and CNX Nifty Junior indices from 1999-2013.

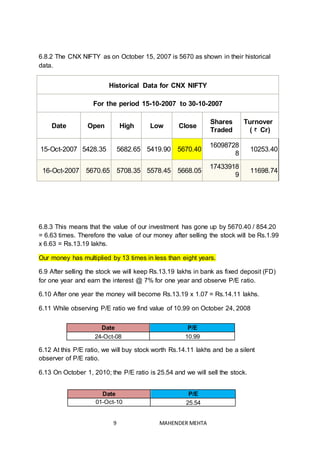

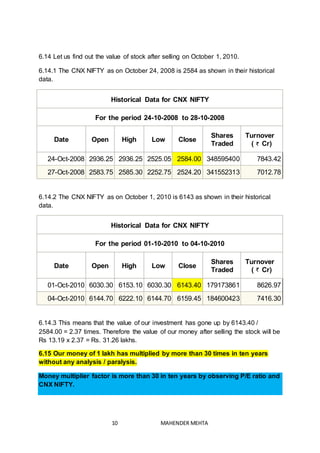

2) Identifying periods where P/E ratios were low (10-12) as buy points, and higher (26-28) as sell points.

3) Calculating the hypothetical returns if $100,000 had been invested at each buy point and sold at each sell point, showing returns increased over 30 times over 10 years through this strategy without extensive analysis.