This summary provides an overview of the document:

1) The document investigates the impact of monetary policy rate, interbank rate, and savings deposit on inflation rate in Nigeria from 2006-2014 using an autoregressive distributed lag model.

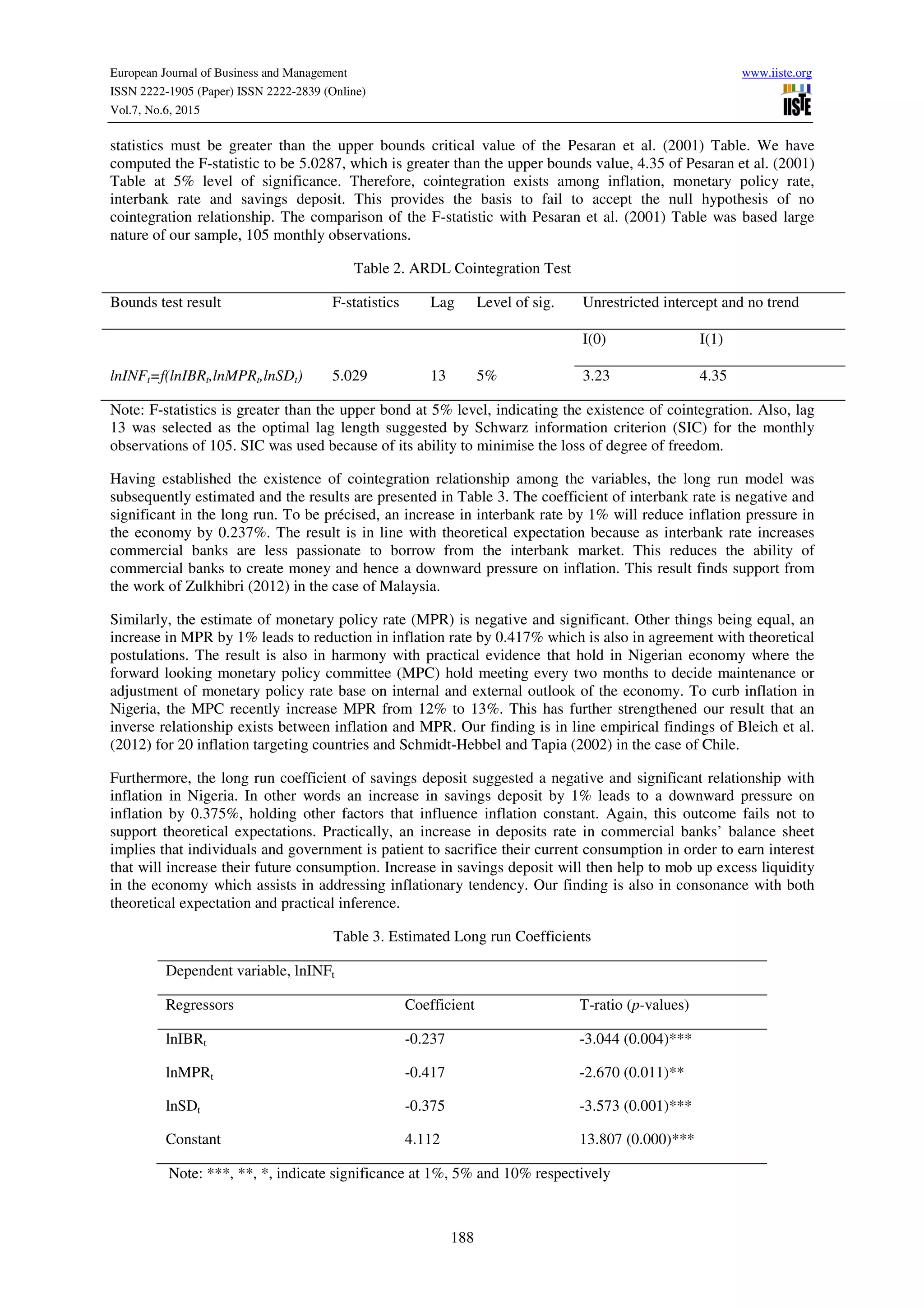

2) The results of the long-run model show that monetary policy rate, interbank rate, and savings deposit were all negatively and significantly affecting inflation rate during the period studied.

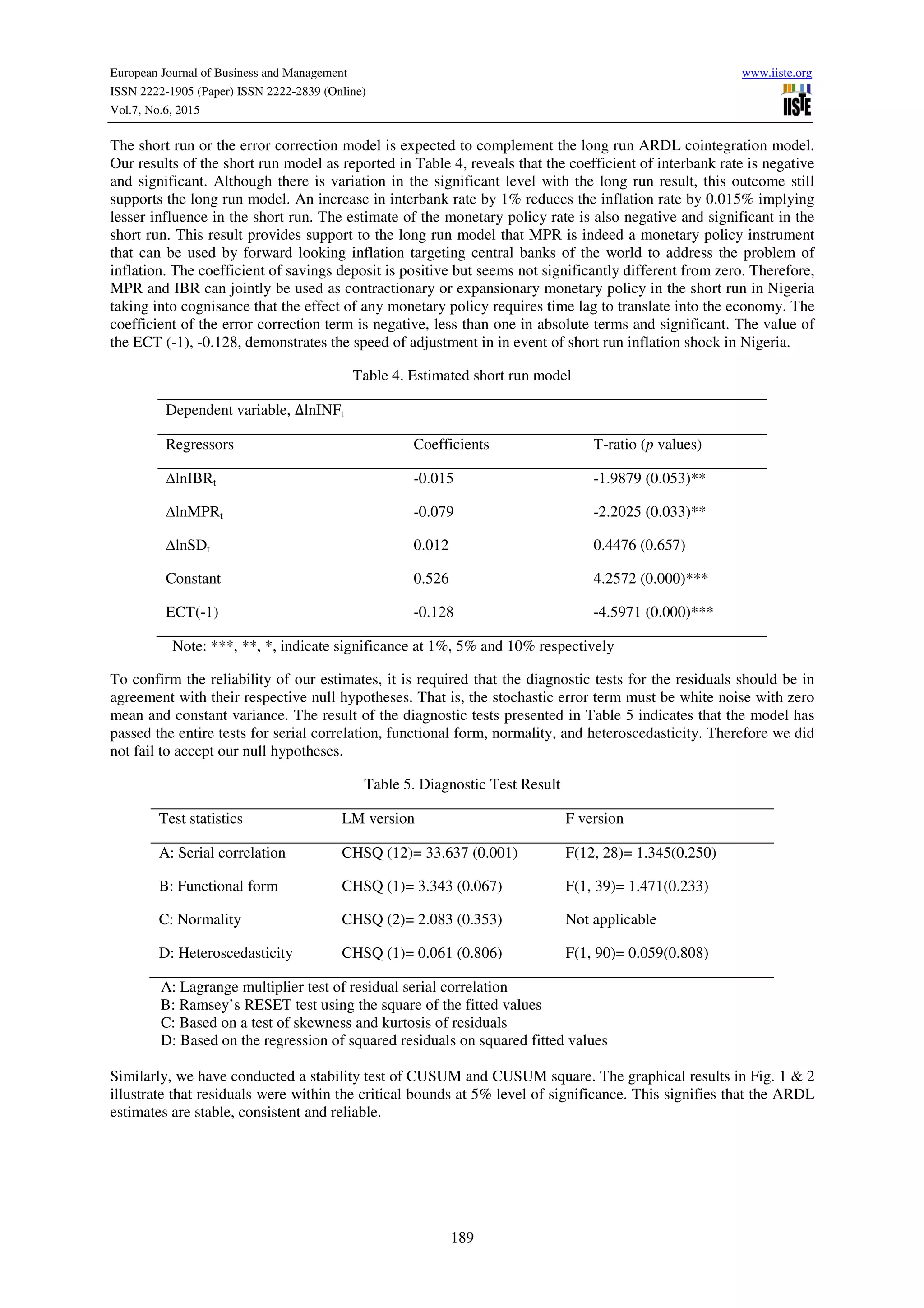

3) In the short-run, monetary policy rate and interbank rates were found to negatively and significantly determine inflation fluctuations, while savings deposit had a positive but insignificant impact.