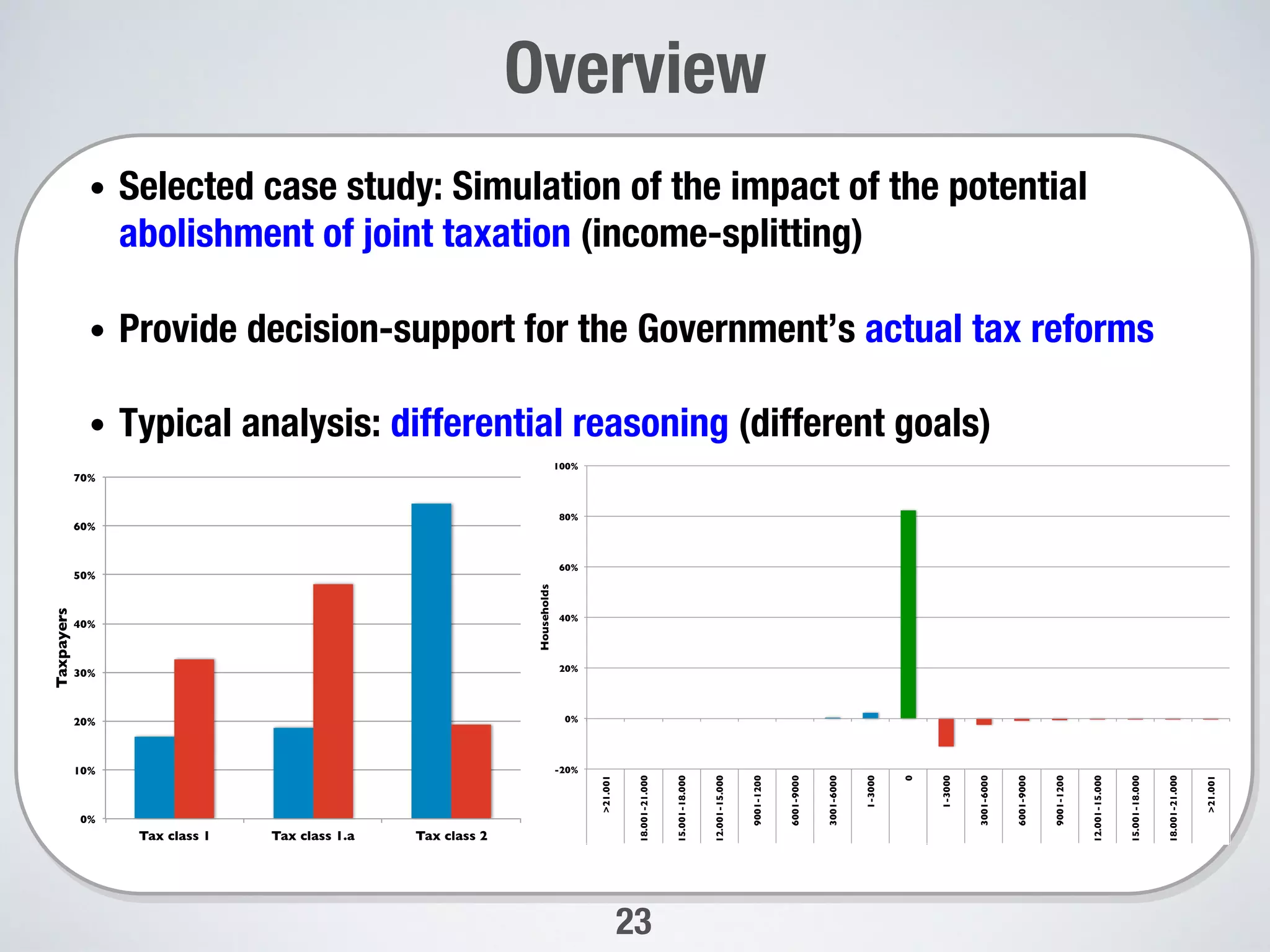

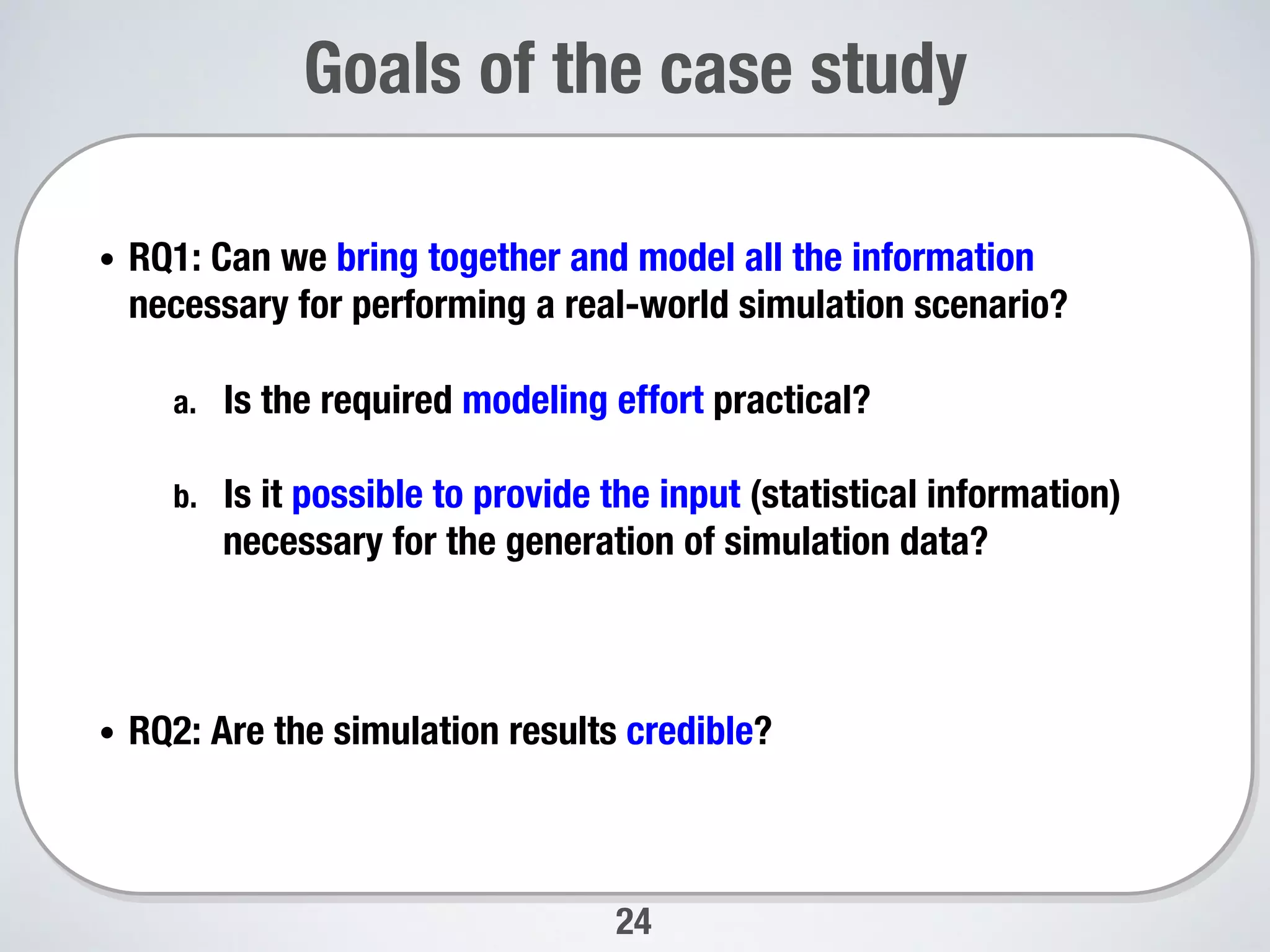

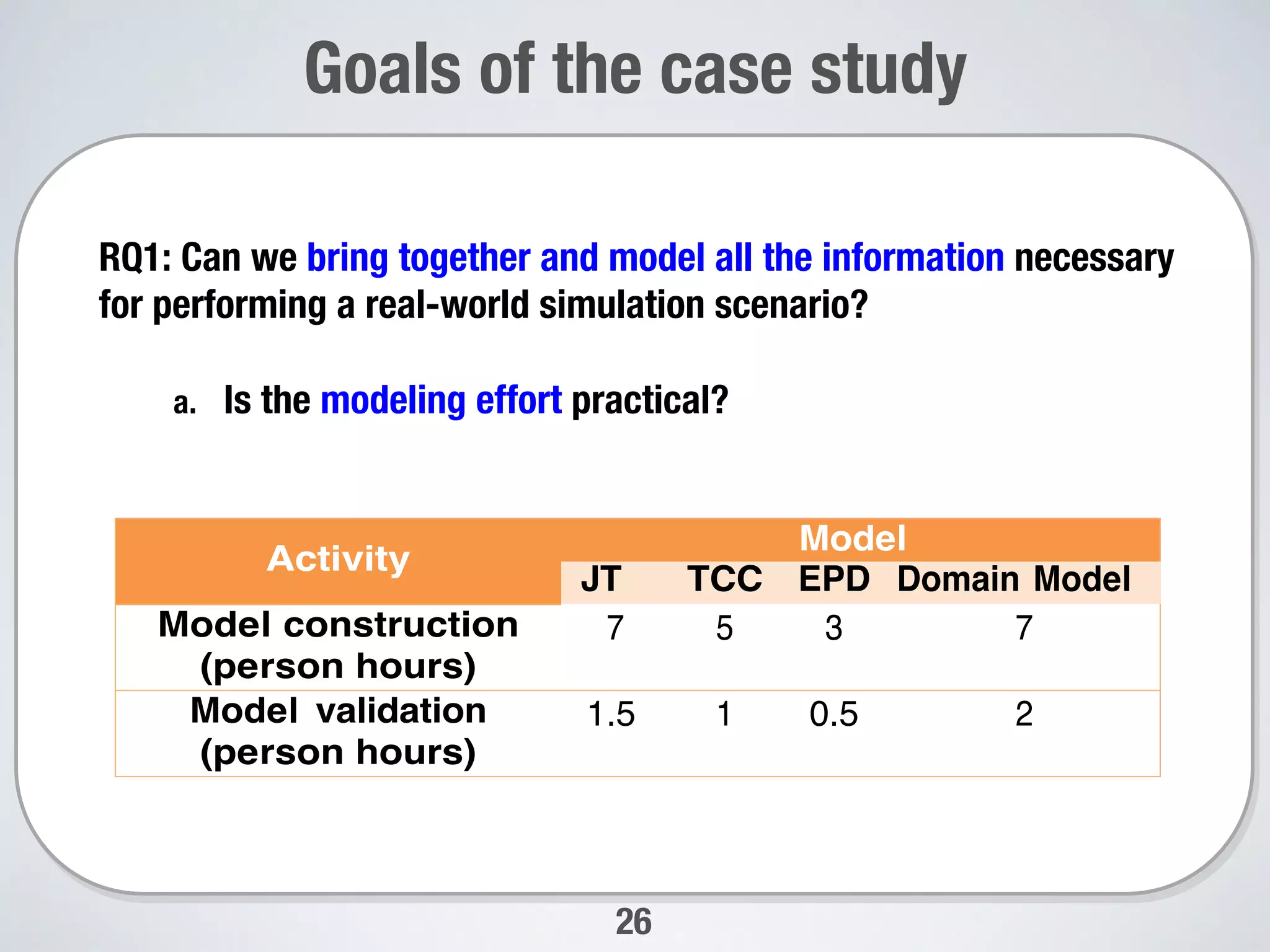

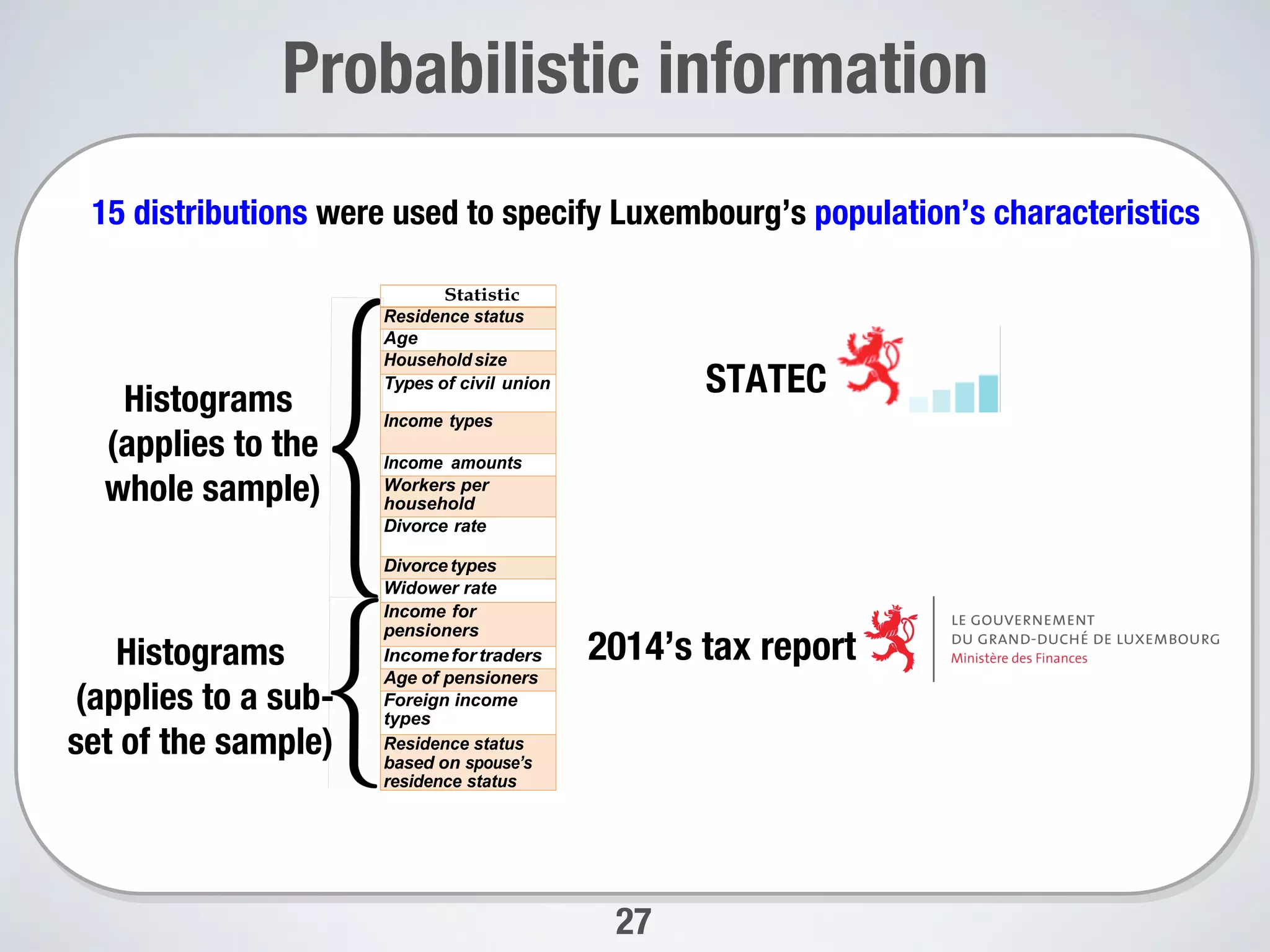

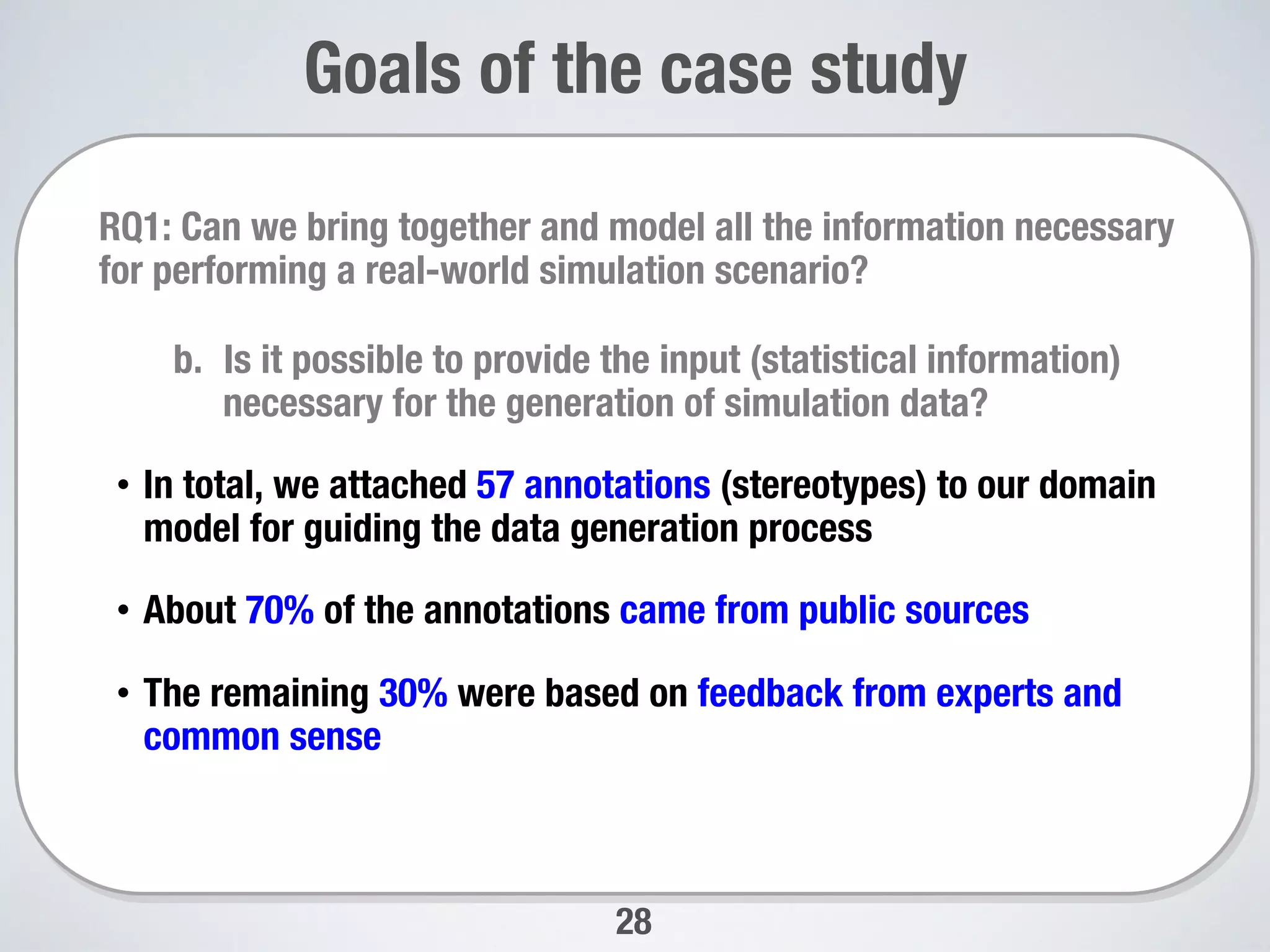

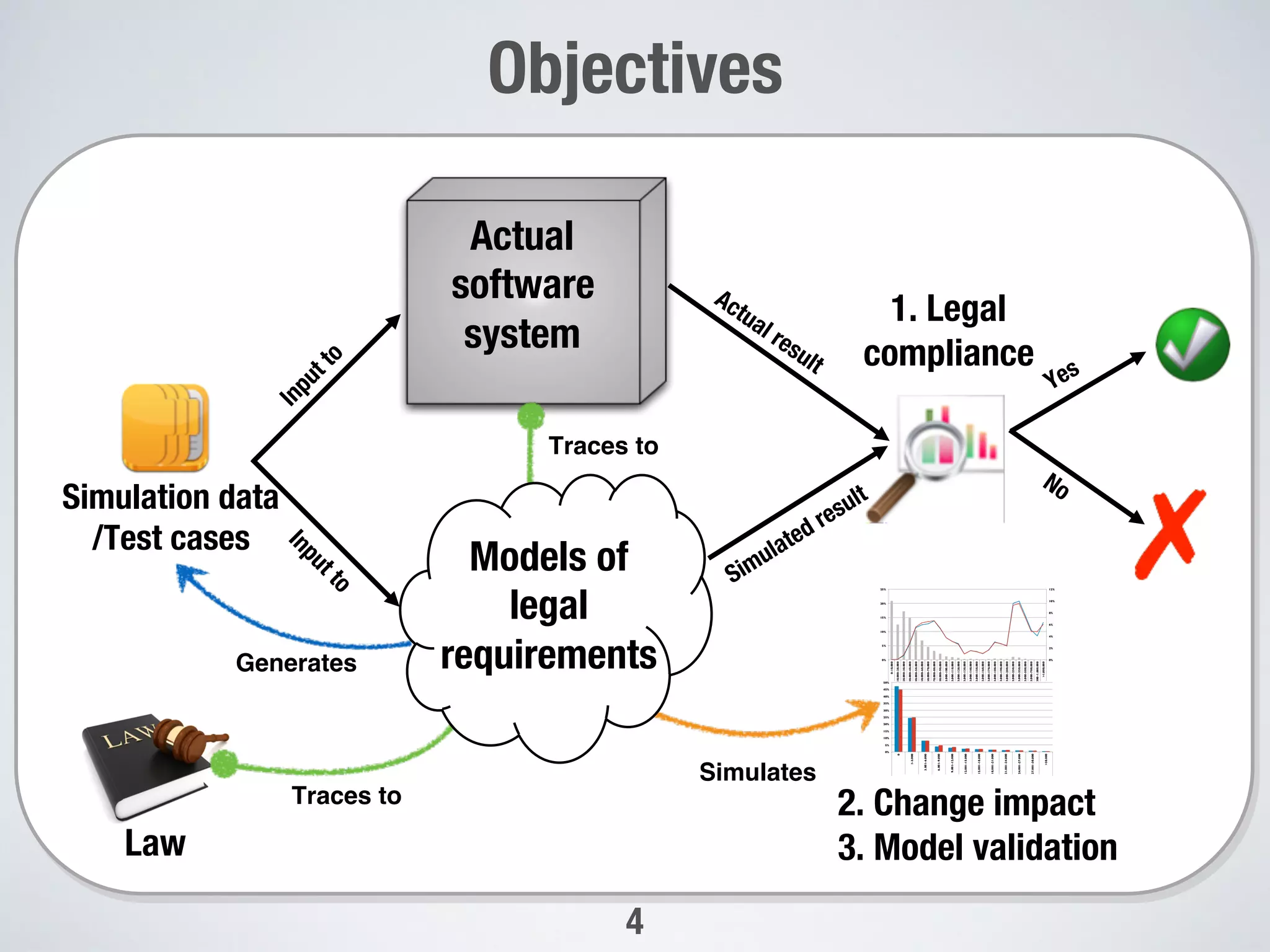

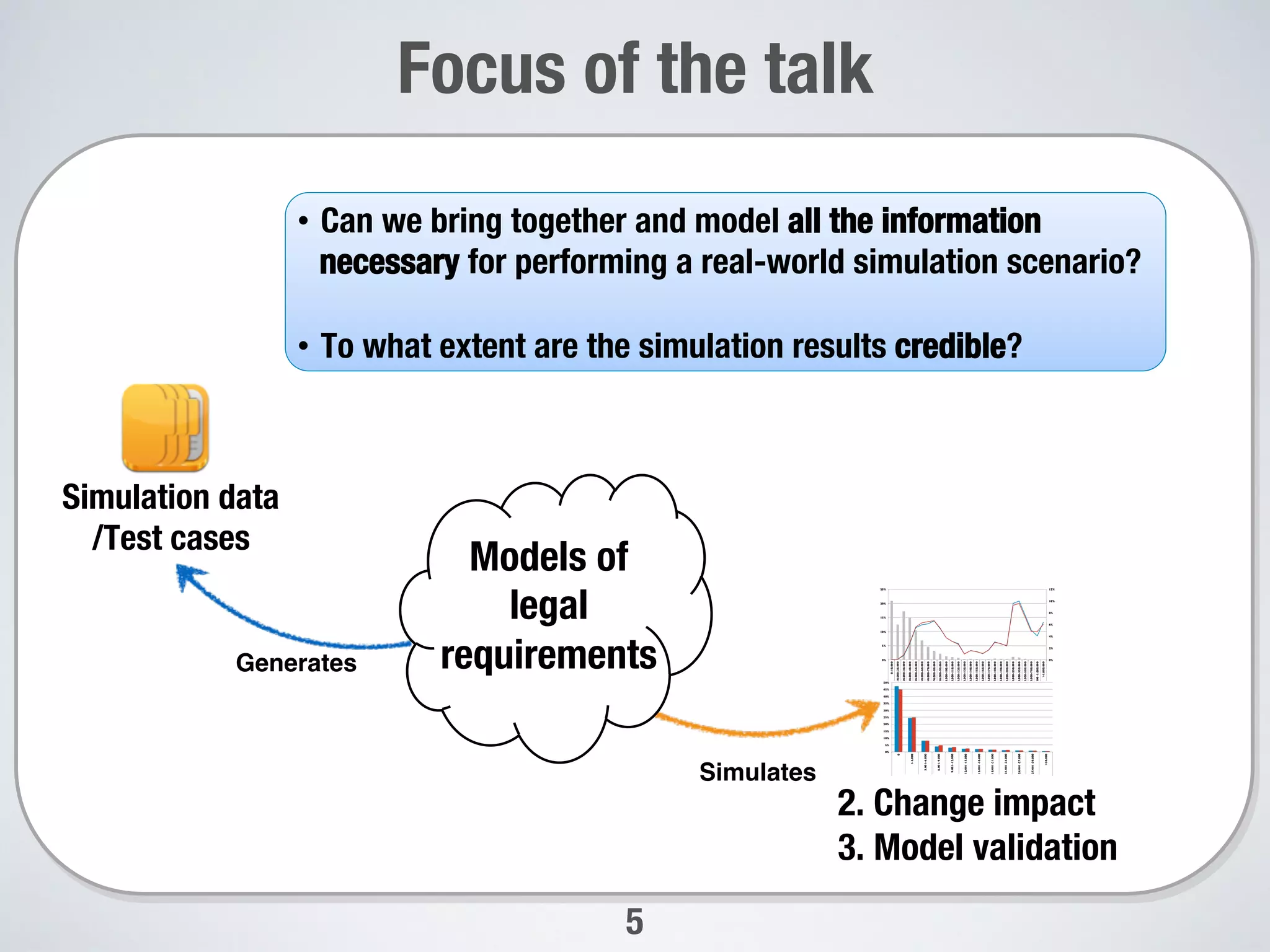

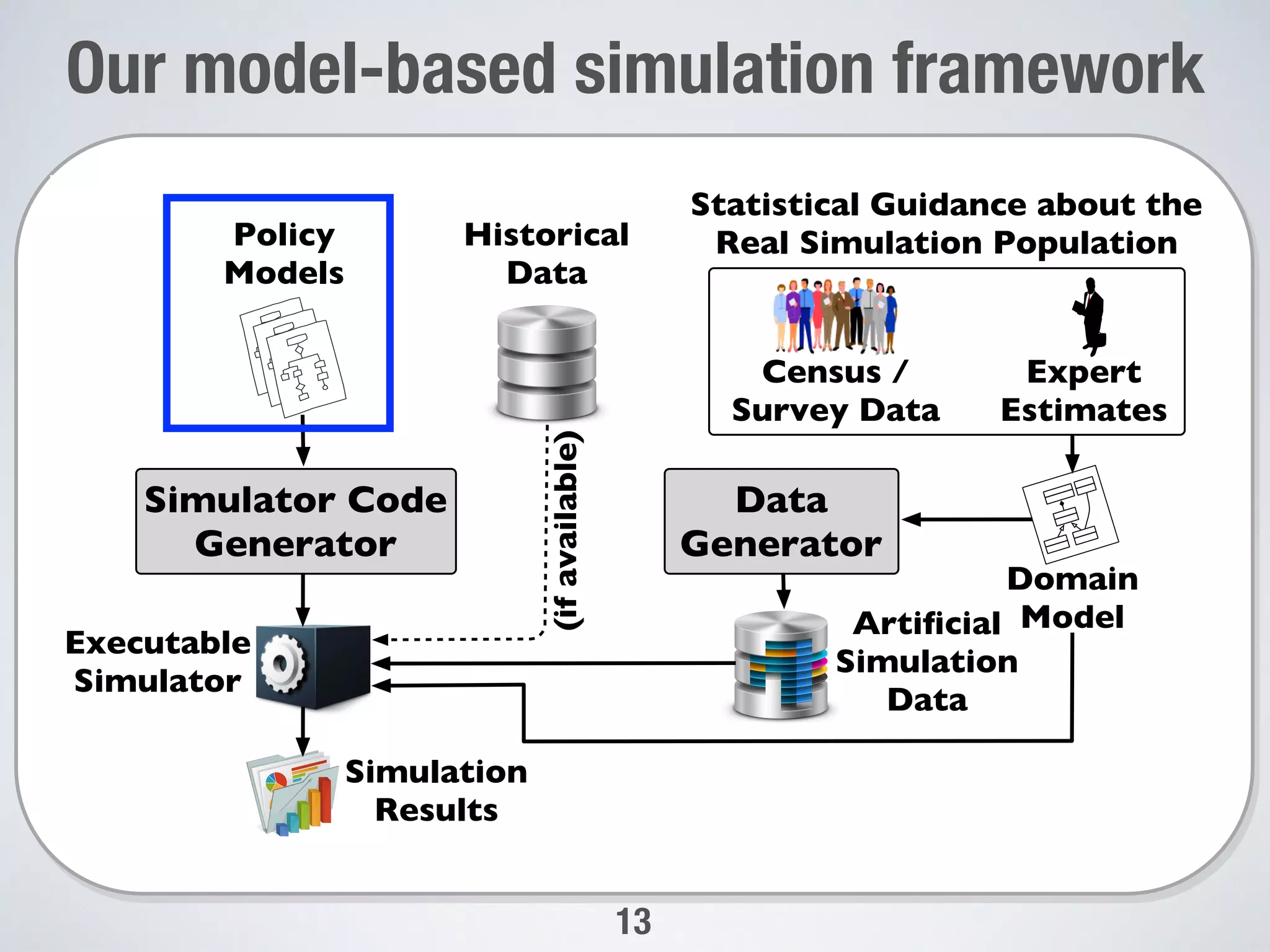

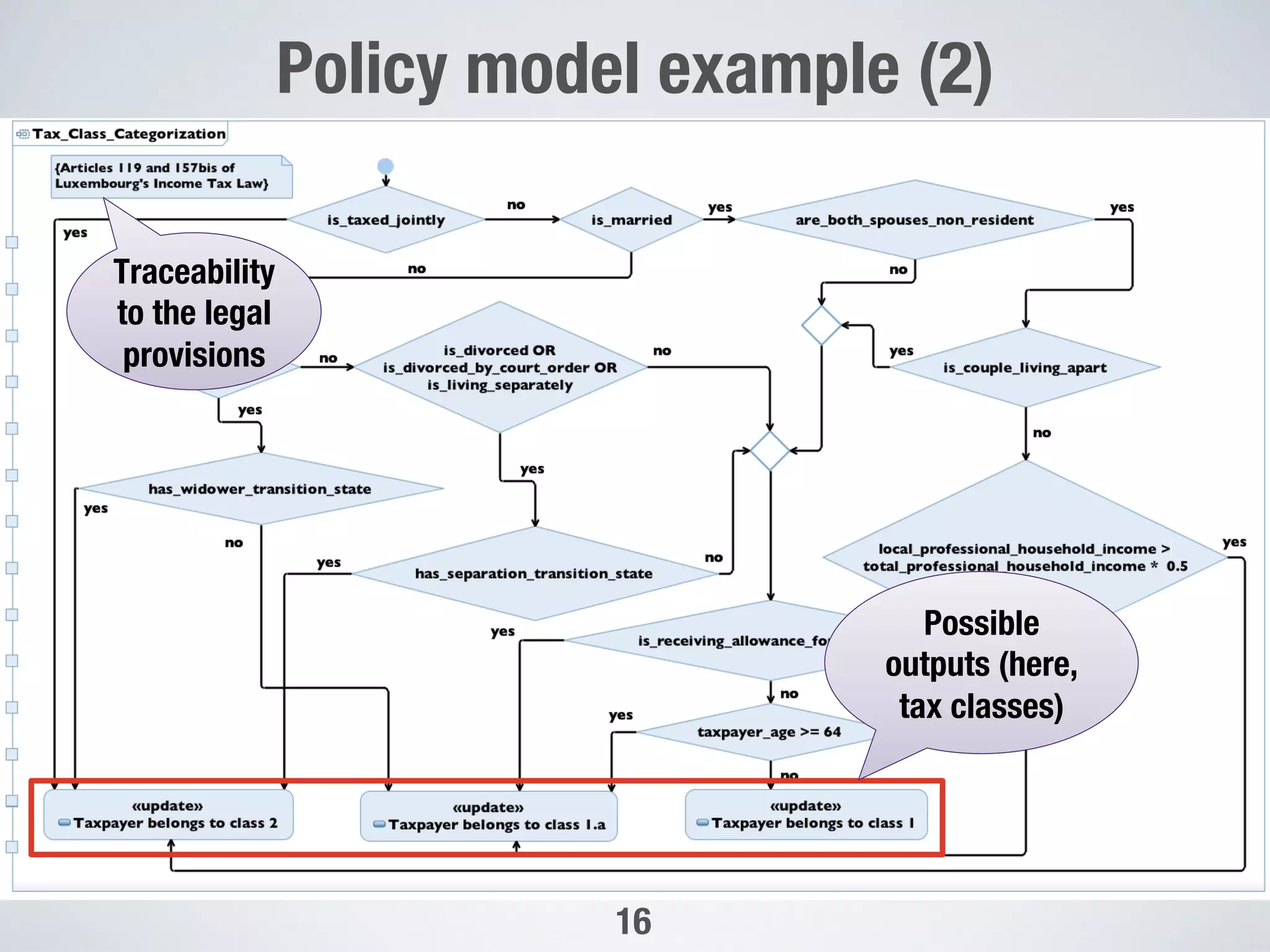

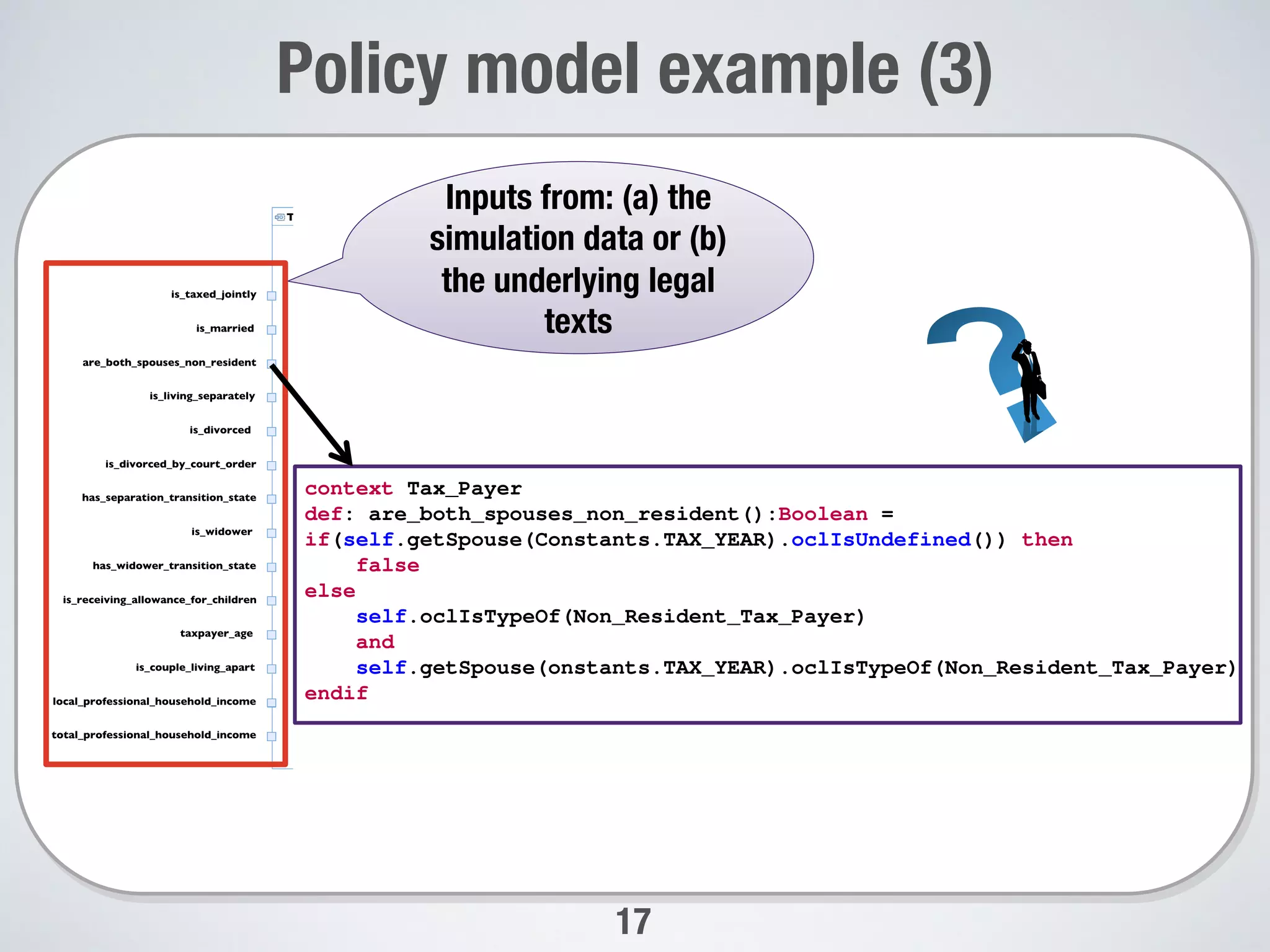

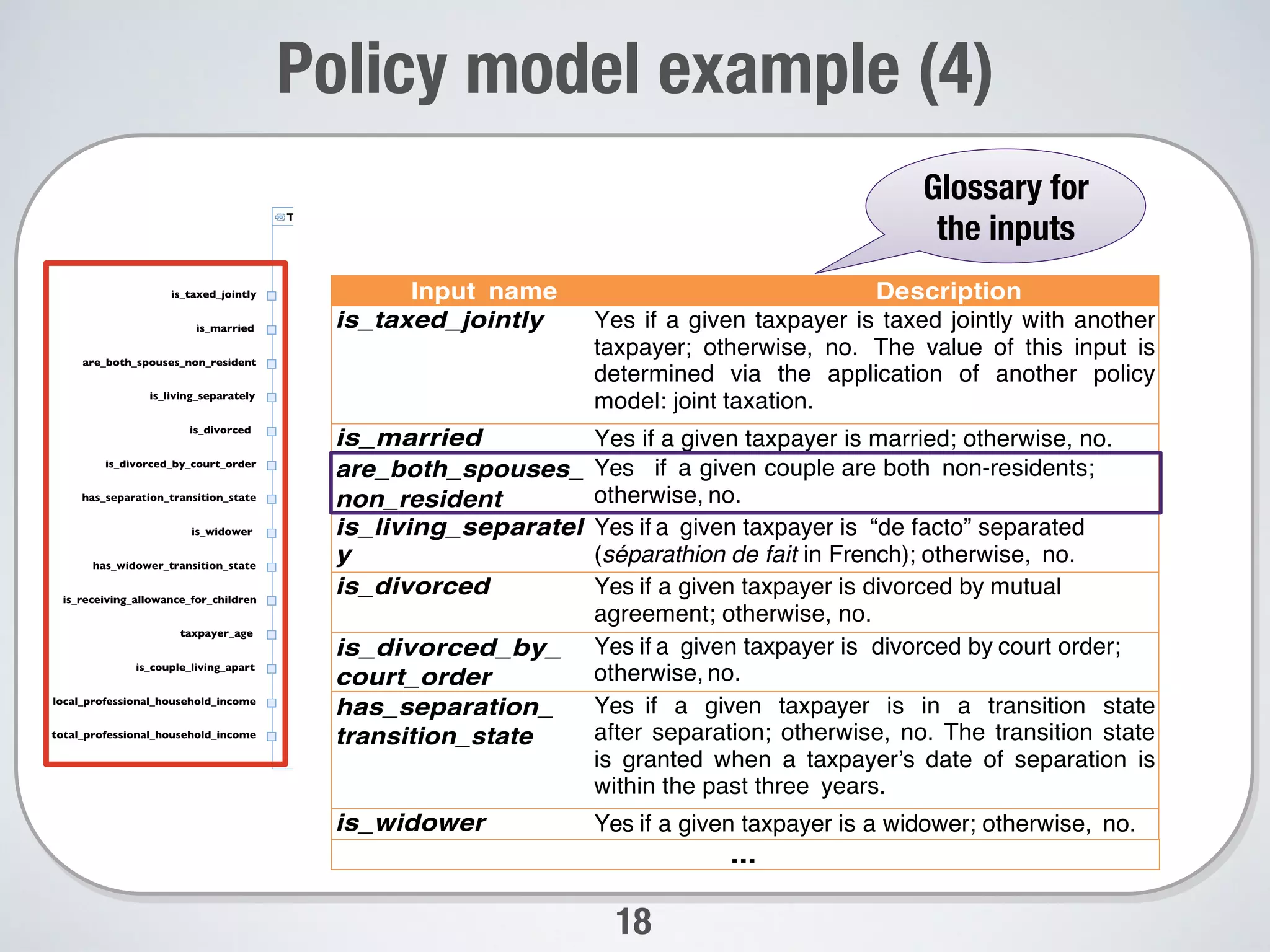

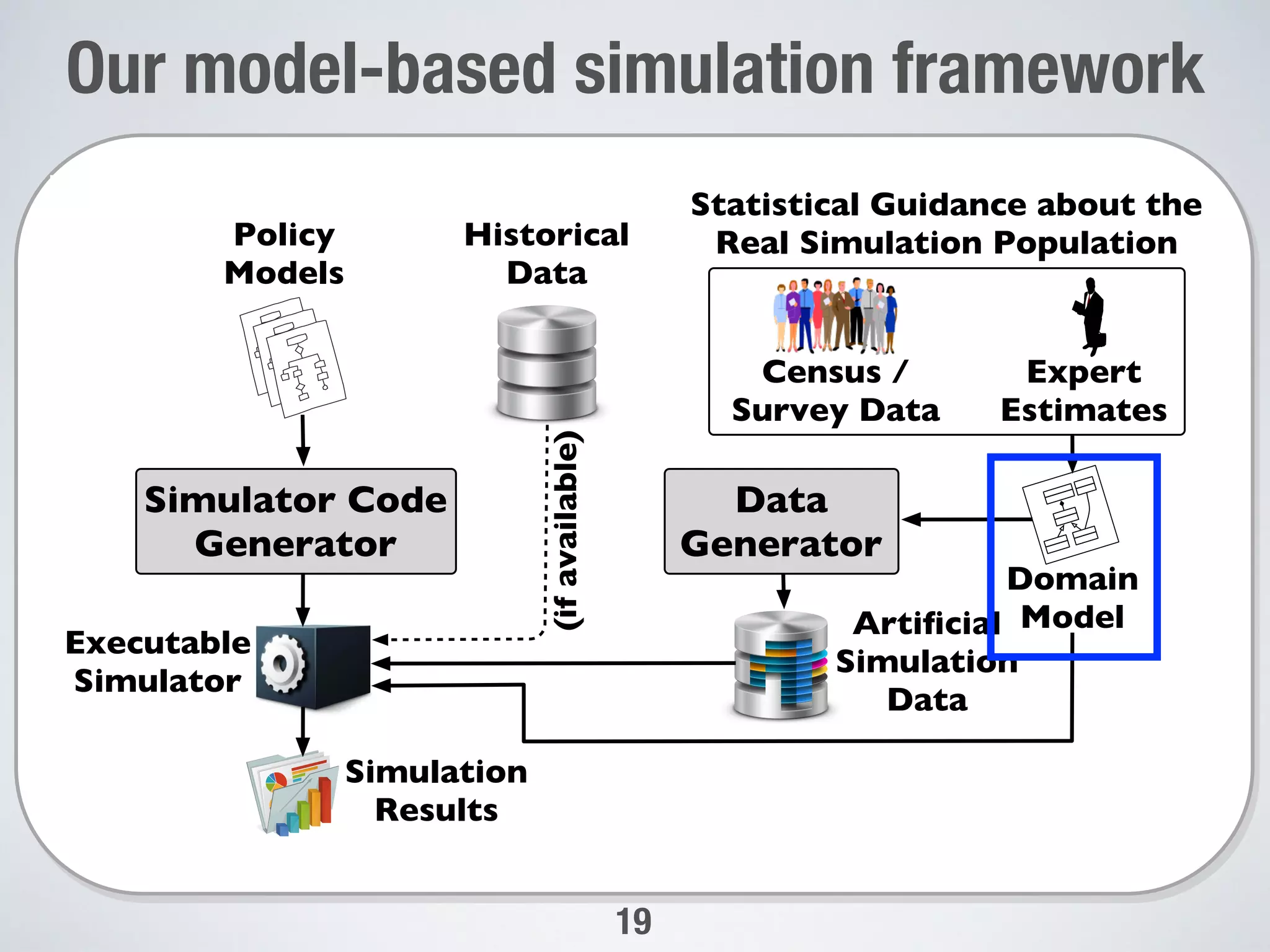

The document discusses a model-based simulation framework developed in collaboration with the government of Luxembourg to analyze the impact of new tax policies. It outlines how the framework simulates legal requirements, assesses legal compliance, and validates models while emphasizing the credibility of results without real data. The study provides insights into modeling effort, data generation, and communication between legal and IT experts, along with key lessons learned from the case study.

![Our model-based simulation framework

12

Policy

Models

Executable

Simulator

Simulator Code

Generator

Historical

Data

Statistical Guidance about the

Real Simulation Population

Census /

Survey Data

Expert

Estimates

Data

Generator

Artificial

Simulation

Data

(ifavailable)

Simulation

Results

Domain

Model

Interpretations of the

legal text

(original + modified)

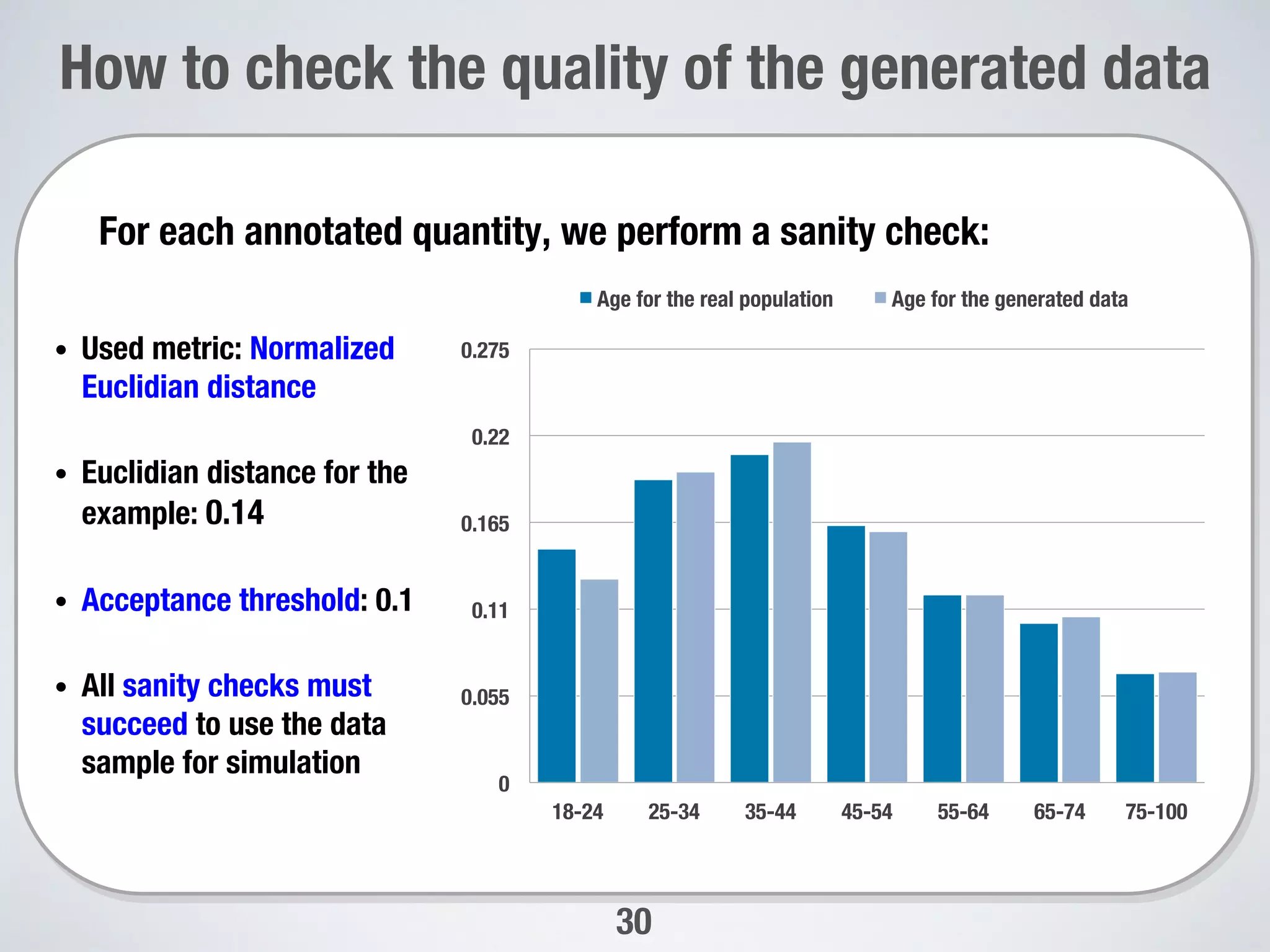

Main concepts and

relationships of the

simulated domain

[Soltana et al., SoSyM 2016]](https://image.slidesharecdn.com/ghanem-rex16-161021090127/75/Model-Based-Simulation-of-Legal-Requirements-Experience-from-Tax-Policy-SimulationSince-in-our-system-under-test-we-need-to-handel-dynamic-a-12-2048.jpg)

![• A legal policy model captures the procedure envisaged by law for

performing a certain activity

• Notation: Extended Activity Diagrams (ADs)

• Support for automated analysis and communication between legal and IT

experts

Expressive

Visual

Precise

Executable

ADs

Legal policy models

[Soltana et al., MODELS 2014]

14](https://image.slidesharecdn.com/ghanem-rex16-161021090127/75/Model-Based-Simulation-of-Legal-Requirements-Experience-from-Tax-Policy-SimulationSince-in-our-system-under-test-we-need-to-handel-dynamic-a-14-2048.jpg)

![20

Histograms

* Source: STATEC, Luxembourg

- «from histogram»

birthYear: Integer [1]

TaxPayer

[Soltana et al., SoSyM 2016]](https://image.slidesharecdn.com/ghanem-rex16-161021090127/75/Model-Based-Simulation-of-Legal-Requirements-Experience-from-Tax-Policy-SimulationSince-in-our-system-under-test-we-need-to-handel-dynamic-a-20-2048.jpg)

![21

* Source: STATEC, Luxembourg

1 taxpayer incomes 1..*

Income

TaxPayer (abstract)

«type dependency»

{relativeTo: Income;

condition: self.getAge() >= 60;

source: «from barchart»}

[Soltana et al., SoSyM 2016]

Conditional probabilities](https://image.slidesharecdn.com/ghanem-rex16-161021090127/75/Model-Based-Simulation-of-Legal-Requirements-Experience-from-Tax-Policy-SimulationSince-in-our-system-under-test-we-need-to-handel-dynamic-a-21-2048.jpg)