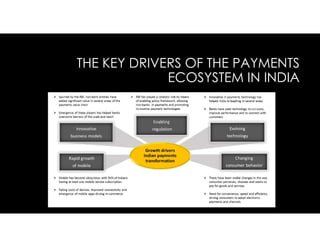

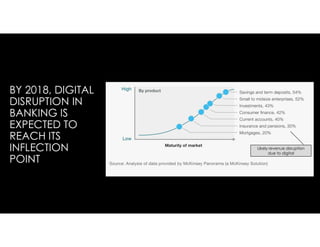

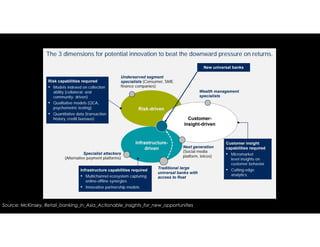

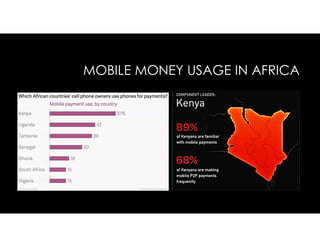

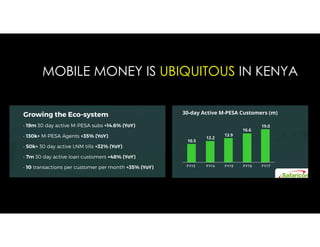

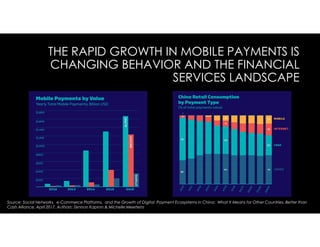

The document discusses the impact of 'TECs'—telecom, e-commerce, and social companies—on the mobile payments landscape, particularly in Asia and Africa. It highlights how countries like Kenya, China, India, and Vietnam are leveraging mobile payment systems to drive financial inclusion and economic growth. The rise of digital payment ecosystems is transforming traditional banking and financial services, presenting both opportunities and challenges for established players.

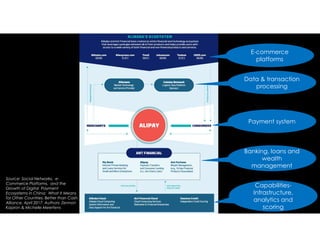

![EVOLUTION – ALIPAY AND WE CHAT

Alipay has 520 million monthly active users, who each spent

US$2,921 on average in 2015. By comparison, WeChat has >

900 million monthly active users who spent $1526 [in 2016] on

average.

Source: Social Networks, e-Commerce Platforms, and the Growth of Digital Payment Ecosystems in China: What It Means for Other Countries. Better than

Cash Alliance. April 2017. Authors: Zennon Kapron & Michelle Meertens](https://image.slidesharecdn.com/mobilepaymentspdfseamlessphilippinessept2017-171010044816/85/Mobile-payments-pdf-seamless-philippines-sept-2017-21-320.jpg)

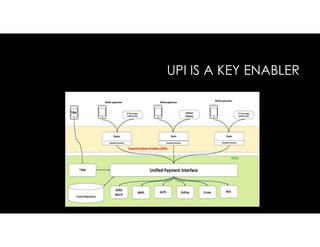

![INDIA – AN INTEGRATED ECOSYSTEM

The central bank [RBI] is playing a catalytical role by means of enabling policy

framework, by allowing non banks in payments and promoting innovative

payment technologies](https://image.slidesharecdn.com/mobilepaymentspdfseamlessphilippinessept2017-171010044816/85/Mobile-payments-pdf-seamless-philippines-sept-2017-25-320.jpg)