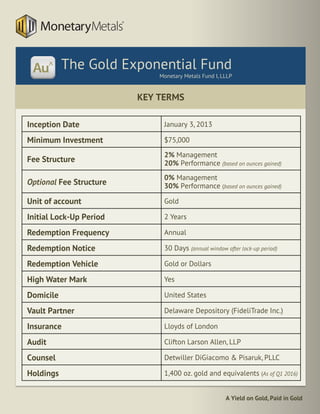

The Gold Exponential Fund is a private investment fund that aims to generate returns for investors by trading their gold for silver when silver is outperforming, and converting it back to gold at other times, without using derivatives. The Fund uses a proprietary fundamental analysis of supply and demand factors, rather than technical analysis, to determine when to execute trades to own the more undervalued of the two metals. It vaults investors' gold outside the banking system to avoid counterparty risk, and seeks to increase the total ounces of gold owned by investors over time.