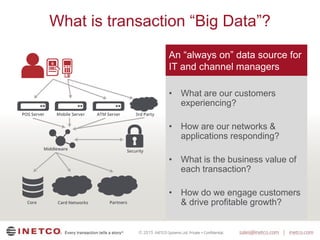

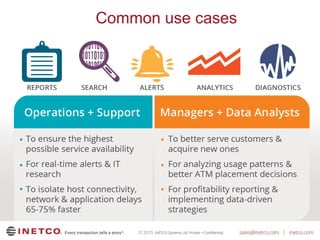

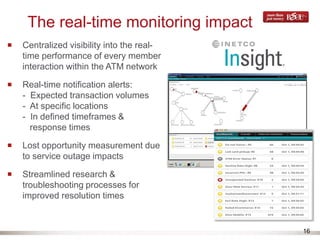

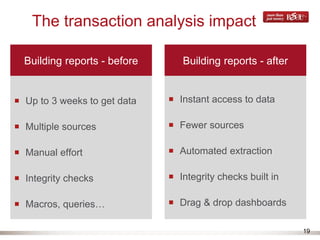

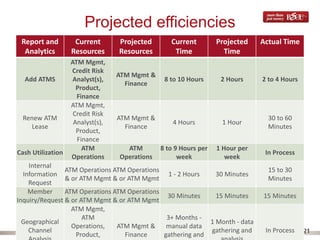

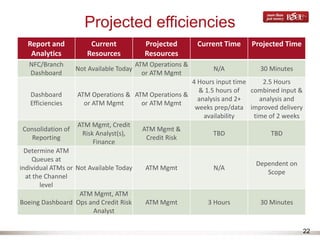

This document summarizes a presentation about using transaction data analytics to gain insights into customer experiences and optimize the ATM channel. It discusses how BECU implemented INETCO's transaction monitoring and analytics software to reduce the time to analyze member transaction data from weeks to minutes, allowing faster decision making. The software provides real-time notifications and dashboards with insights like transaction mixes, cash levels, and queueing issues at each ATM. This helped BECU improve processes like troubleshooting, reporting, and ATM placement.