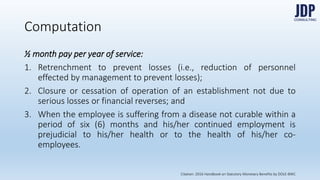

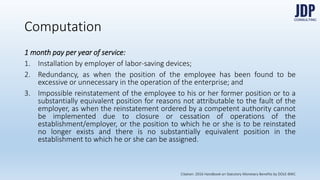

The document outlines the authorized causes for separation pay, including retrenchment, redundancy, and disease, detailing the computation methods and requirements for termination notices. It emphasizes the importance of procedural due process in terminations, especially related to disease, and provides legal citations to support these guidelines. Additionally, it clarifies that separation pay shall include regular allowances and is exempt from taxation in certain cases.