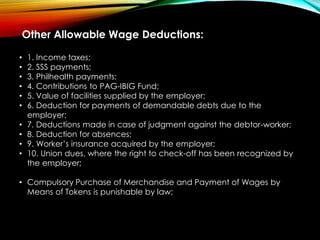

This document summarizes key provisions around wages, salaries, minimum wage rates, and payment of wages according to Philippine labor law. It defines wages and salary, noting wages are paid for manual work while salary is paid at regular intervals. Minimum wage rates are set by Regional Tripartite Wages and Productivity Boards on a regional basis. Payment of wages must be in legal tender except under certain customary or stipulated exceptions. Wages must be paid at least once every two weeks and at or near the workplace, with some exceptions. The document outlines allowable and prohibited deductions from wages.