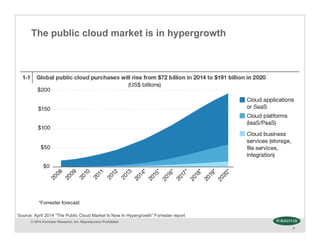

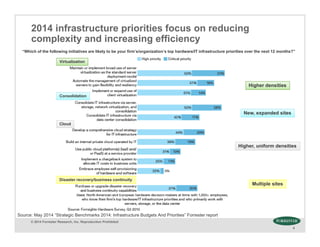

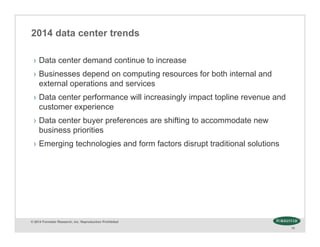

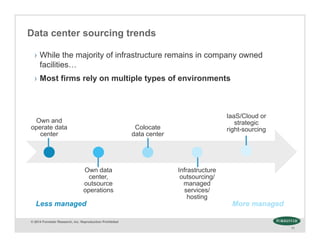

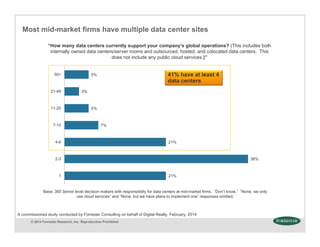

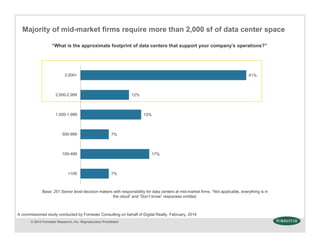

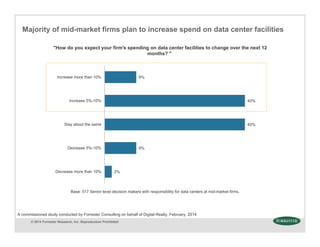

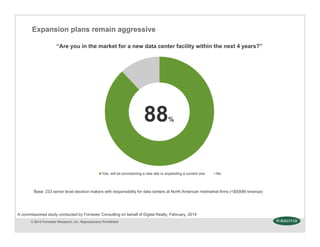

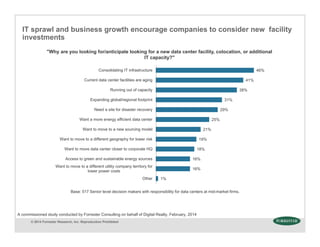

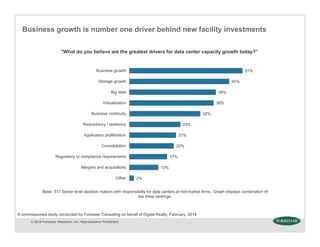

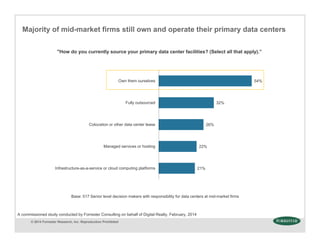

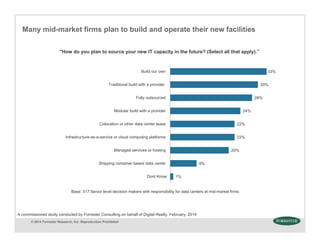

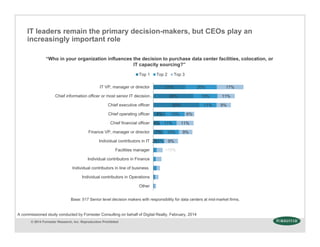

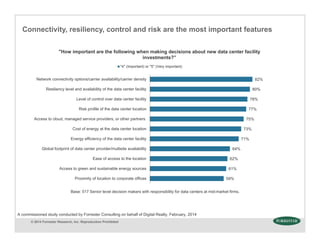

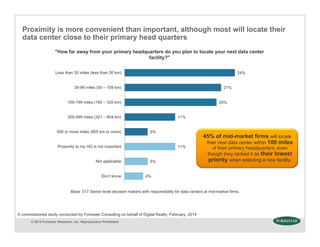

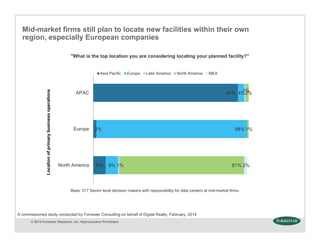

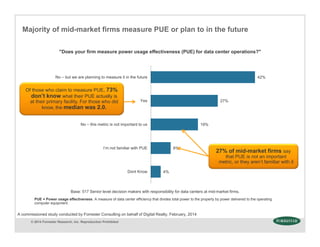

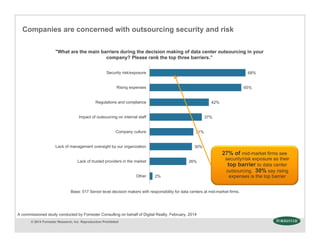

The document presents findings from a Forrester research study focusing on mid-market data center purchasing drivers, revealing that most firms prioritize network connectivity, resilience, and control in new facilities. Key drivers for capacity expansion include business growth and storage needs, while security concerns and rising costs are significant barriers to outsourcing. The majority of mid-market firms are utilizing a variety of sourcing strategies, combining owned, colocation, and cloud solutions.