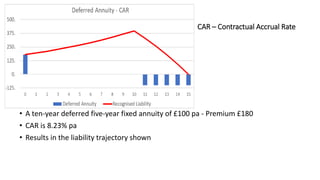

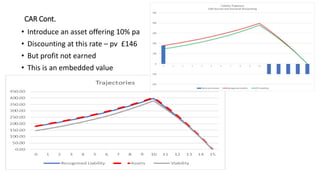

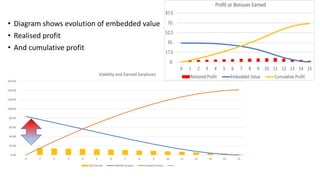

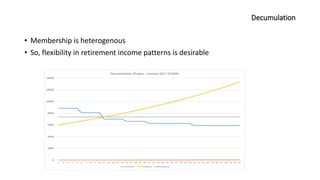

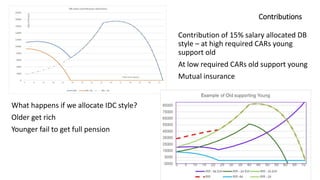

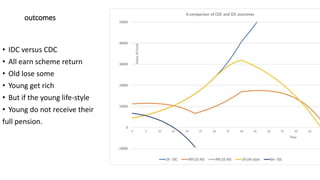

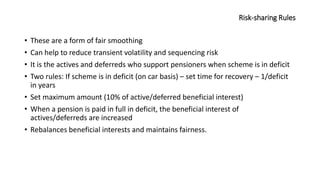

This document discusses Collective Defined Contribution (CDC) pension schemes. It explains that CDC schemes offer pensions like defined benefit schemes but are not guaranteed, relying on their own resources. Risk is pooled across members through longevity and investment horizon pooling. Fairness is prioritized through equal cuts if needed. Contributions are allocated like defined benefit to provide mutual insurance. Decumulation flexibility is desirable. Valuations assess viability and earned surpluses to determine if cuts are required based on contractual accrual rates and risk-sharing rules minimize volatility and sequencing risk. Simulations show cuts occur infrequently and are small under 5% of current pensions.