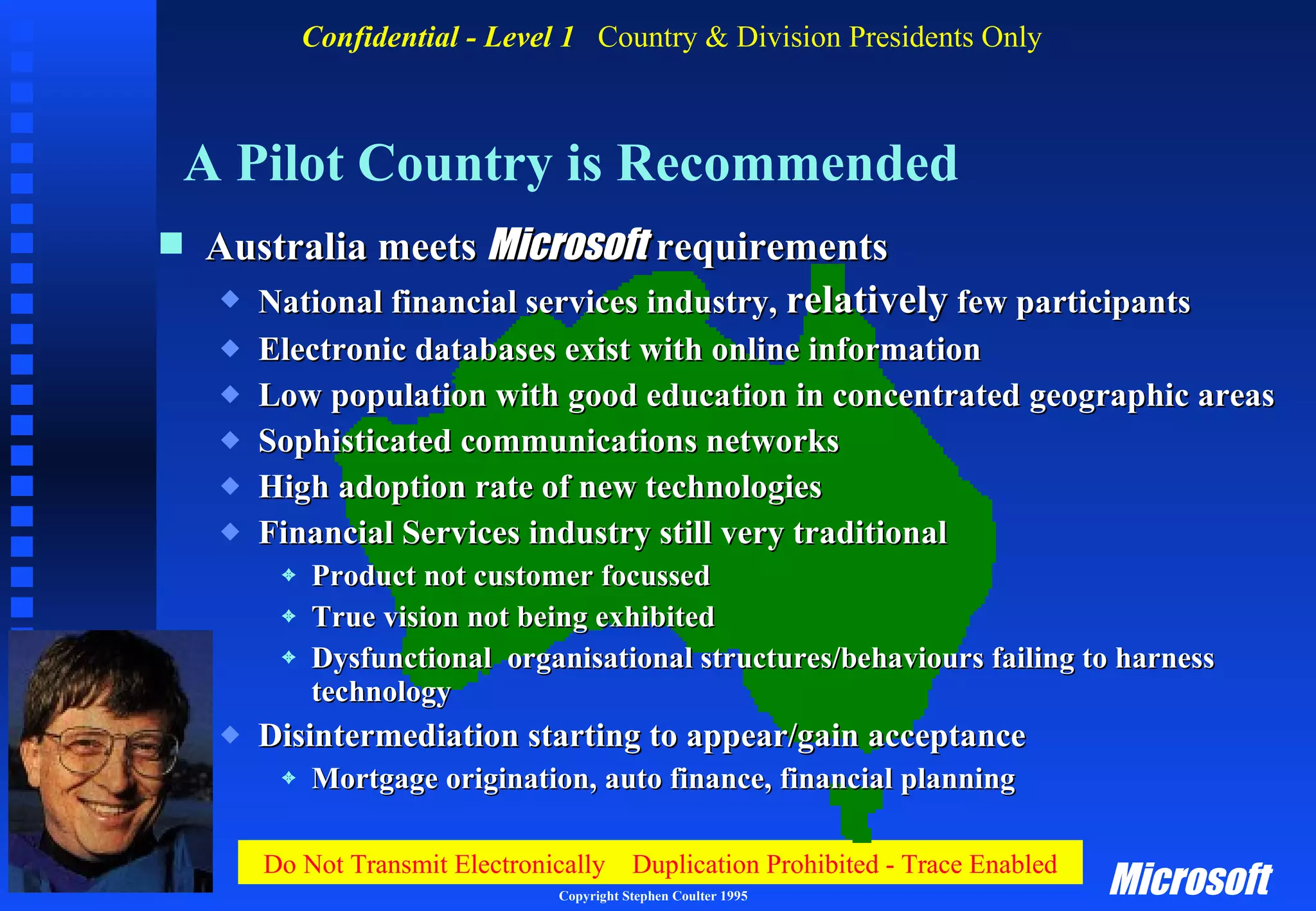

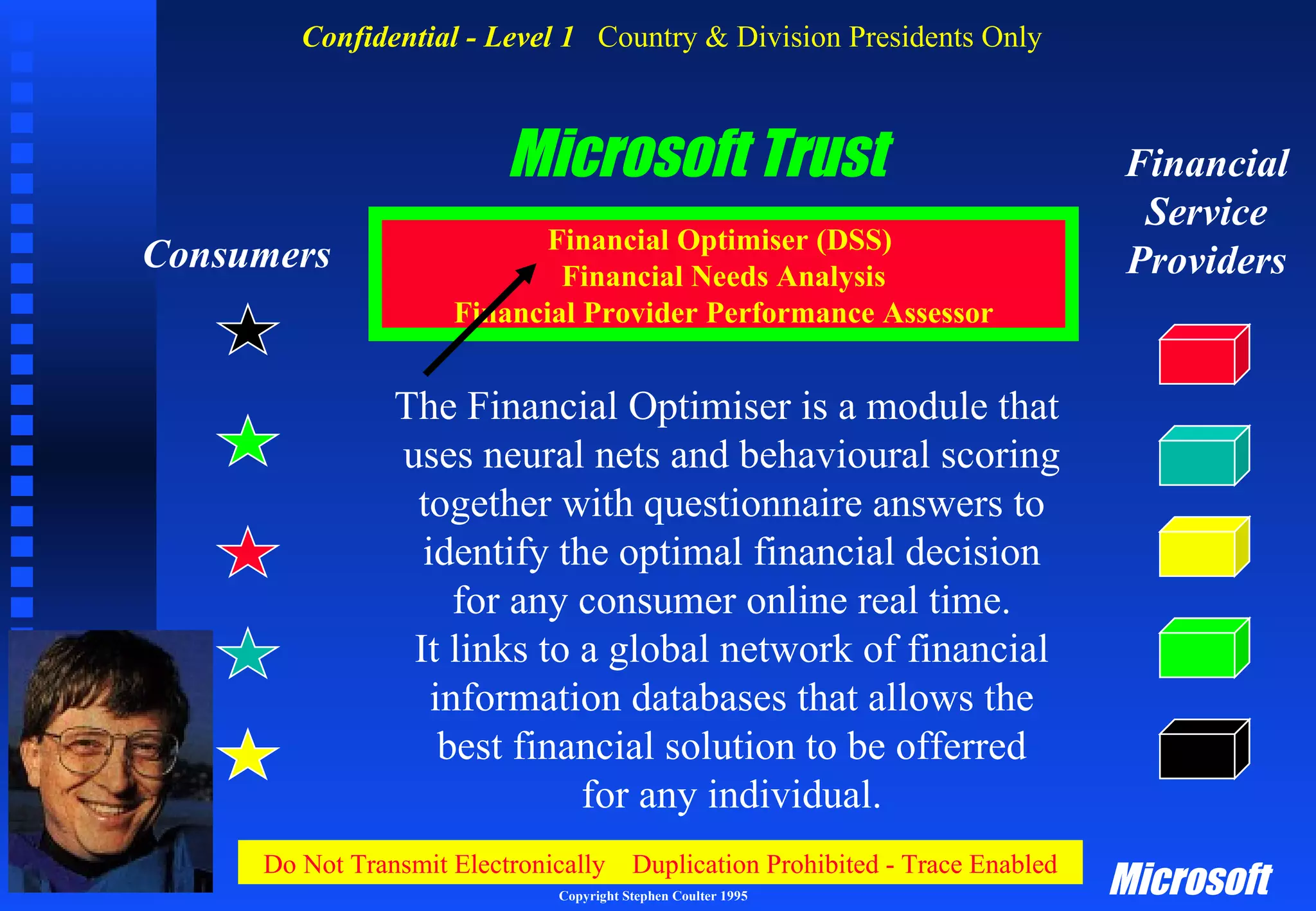

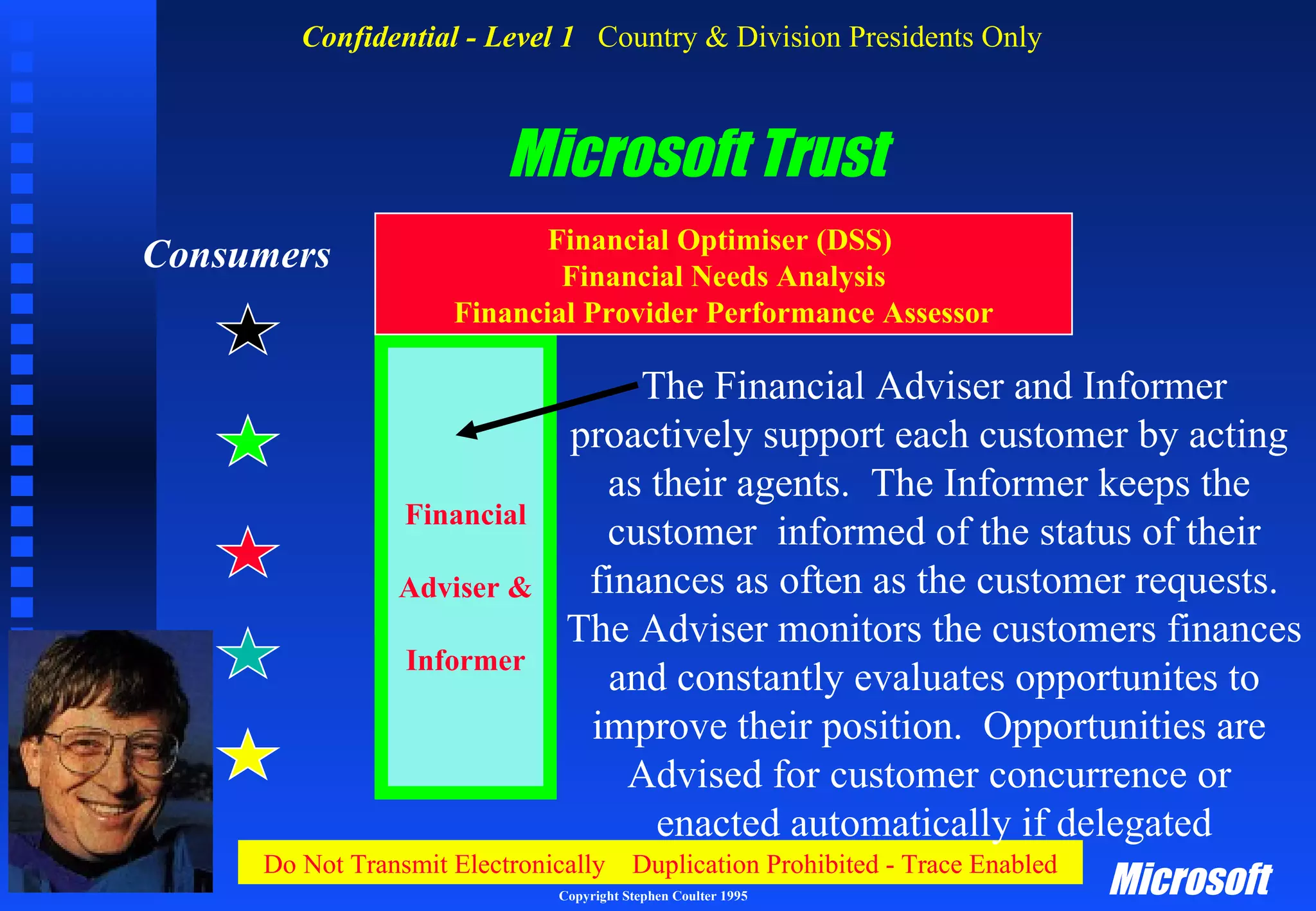

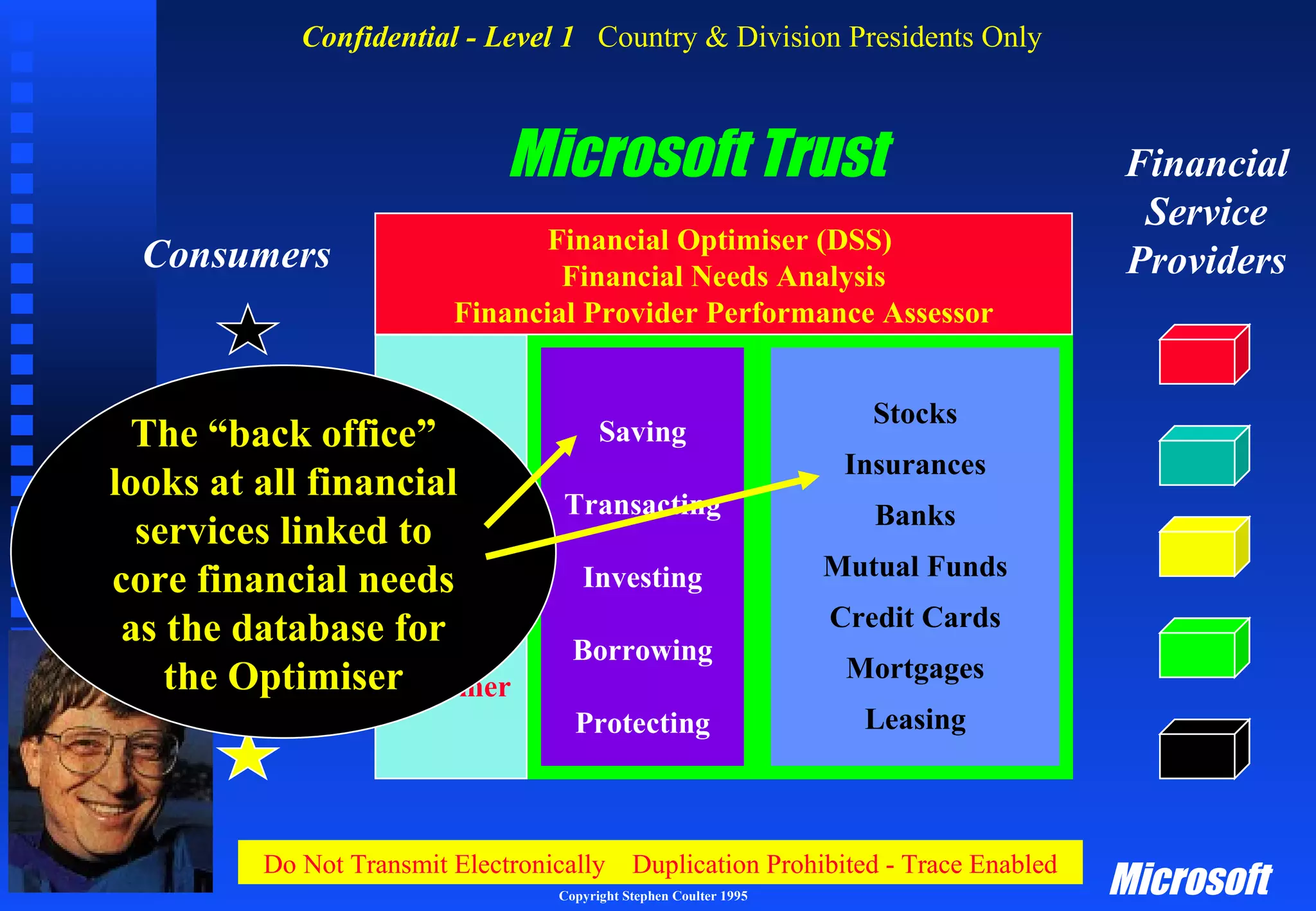

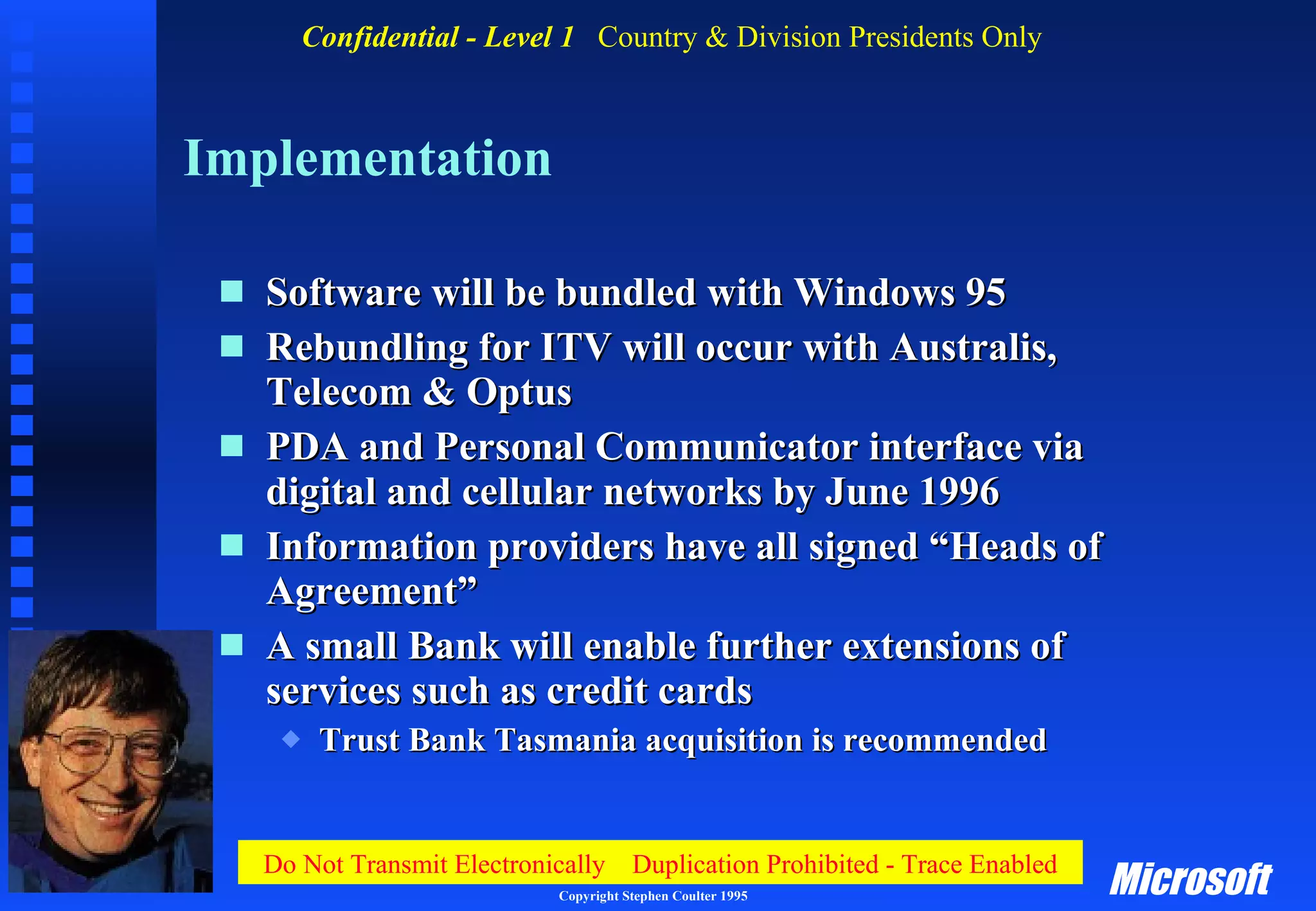

The document outlines Microsoft's global strategic plan for 1994-1998, focusing on seizing opportunities in the financial services sector by disintermediating traditional financial service providers. It proposes a network that enables consumers to access various financial services online, utilizing a financial optimiser tool that matches customers with the best financial solutions based on their needs. The plan includes piloting in Australia and recommendations for strategic acquisitions and partnerships in the telecommunications and financial information sectors.