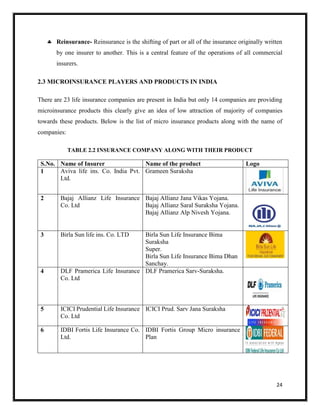

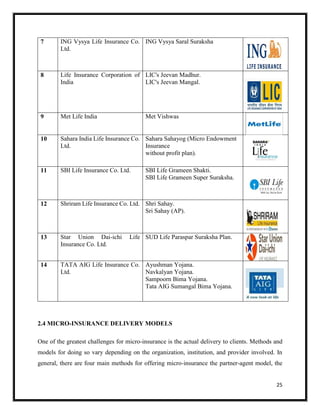

Microinsurance provides insurance protection to low-income individuals in India against risks such as death, illness, asset damage, and natural disasters. It began in India through non-profit organizations and hospitals but has expanded due to regulations requiring insurers to offer rural and social policies. While uptake is still limited, the potential market size is large as 90% of Indians lack insurance. Common microinsurance products in India include life, health, property, crop and disaster policies. These are offered through various models including partner-agent, full-service, provider-driven and community-based. Recently, IRDA proposed expanding microinsurance by allowing more agent types and diversifying products with savings and health features to better serve low-income communities.